- Individuals & Families

- Businesses

- Agents & Brokers

- Embedded Insurance

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Because pets are family, Chubb now offers pet insurance with top-rated coverage from Healthy Paws.

Chubb offers the insurance protection you need for travel’s many “what ifs”.

Chubb protects small businesses at every stage – from newly formed start-ups to long-time anchors of the community.

Stay ahead of cyber threats with our free Cyber Claims Landscape Report.

Learn more about our dedicated learning paths, Online Learning Center, and more.

Many digital-savvy consumers look for it as a core or add-on option.

Many digital-savvy consumers look for it as a core or add-on option.

Many digital-savvy consumers look for it as a core or add-on option.

Chubb’s in-house technology makes it easy to integrate what we do into your customer experience.

-

About

-

Claims

-

Login & Pay Bill

For Agents & BrokersFor Travel Advisors

-

Back

Senior Care Facilities Insurance

What we cover

Senior Care Facilities Insurance Coverage Highlights

- Primary Healthcare Professional Liability (claims made) and General Liability (occurrence or claims made) with various deductible options, depending on venue

- Excess Liability coverage available with varying limits available based on venue and account characteristics

- Minimum premium varies by characteristics of the account.

Excess Coverage (where offered):

- Limits available up to $10 million each claim; $10 million aggregate

(Not available on all accounts. Limits available are based upon underwriting guidelines and account characteristics.)

Primary Coverage (where offered):

- Limits available up to $1 million each claim; $3 million aggregate

- Claims Made Professional Liability and Occurrence or Claims Made General Liability

- Separate limits for Professional Liability and General Liability may be available for additional premium

Senior Care Facilities Insurance

Who we cover

Chubb provides insurance coverage for the following senior care facilities as well as for both for-profit and non-profit entities.

- Skilled nursing facilities

- Assisted living facilities

- Memory care

- Continuing care retirement communities

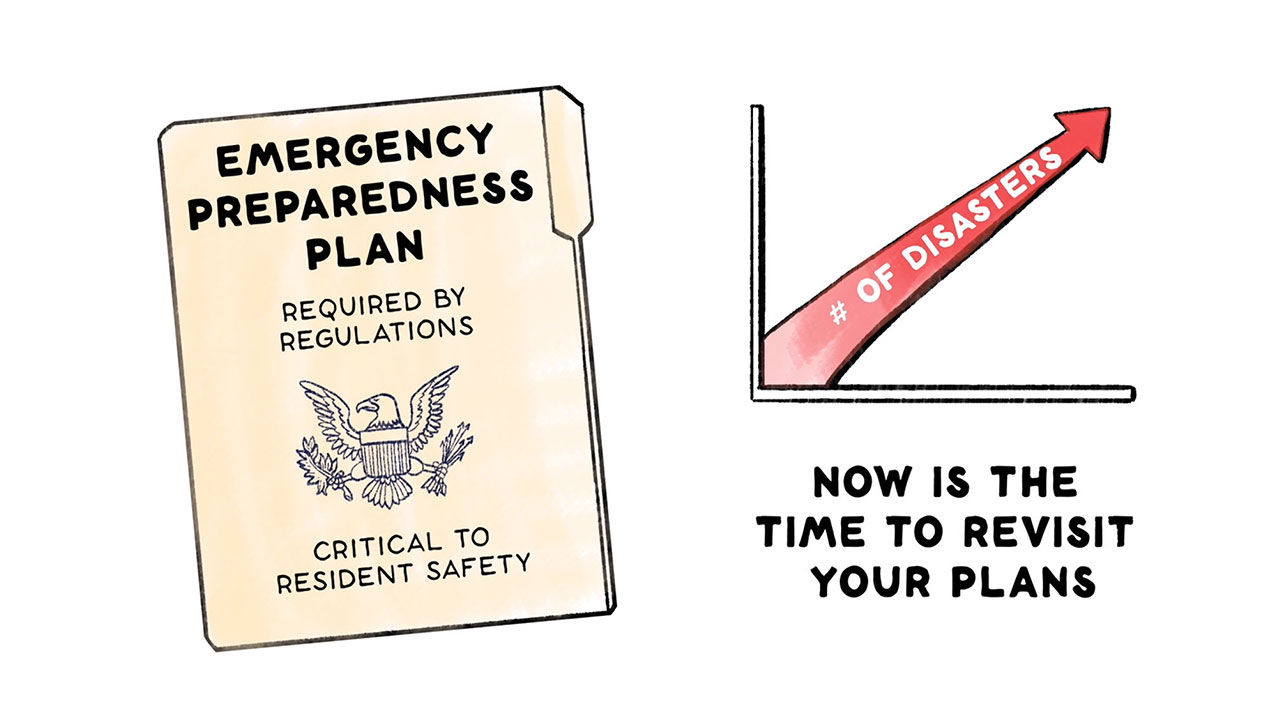

Senior care facilities useful resources

Information to help healthcare providers manage their risk profile.

Download more information about Chubb Medical Risk Senior Care Facilities coverage.

Chubb Healthcare partners with you to meet risk management challenges

Chubb’s Healthcare customers have exclusive access to our Healthcare Risk Management Portal, which puts the latest tools, resources, assessments, and risk management strategies at your fingertips. Our toolkit includes, but is not limited to, the following:

- Assisted Living Assessment Tool

- Integrated Memory Care Checklist

- Senior Care Violence Assessment

To learn more about our portal, including how to gain access, contact us:

Diane Doherty

Senior Vice President, Healthcare Risk Management

E Diane.Doherty@chubb.com

Terry Hopper

Vice President, Healthcare Risk Management

E Terese.Hopper@chubb.com