- Individuals & Families

- Businesses

- Agents & Brokers

- Embedded Insurance

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Because pets are family, Chubb now offers pet insurance with top-rated coverage from Healthy Paws.

Chubb offers the insurance protection you need for travel’s many “what ifs”.

Chubb protects small businesses at every stage – from newly formed start-ups to long-time anchors of the community.

Stay ahead of cyber threats with our free Cyber Claims Landscape Report.

Learn more about our dedicated learning paths, Online Learning Center, and more.

Many digital-savvy consumers look for it as a core or add-on option.

Many digital-savvy consumers look for it as a core or add-on option.

Many digital-savvy consumers look for it as a core or add-on option.

Chubb’s in-house technology makes it easy to integrate what we do into your customer experience.

-

About

-

Claims

-

Login & Pay Bill

For Agents & BrokersFor Travel Advisors

-

Back

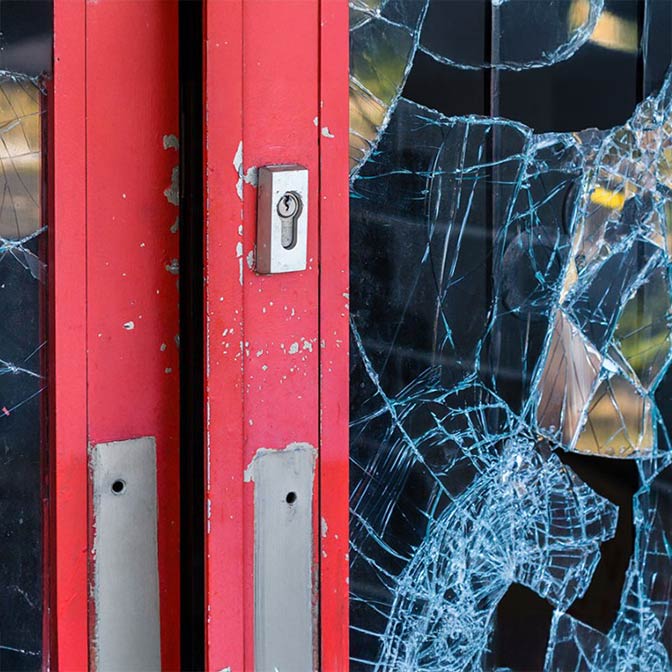

Business Interruption Coverage

What you need to know

Business interruption coverage is often included in a property insurance policy. It generally covers losses to business income caused by property damage.

Chubb offers a variety of insurance policies, and evaluates each claim by looking at the facts of the claim and the language of the relevant Chubb policy. That analysis is what matters for any specific claim. But in general, the vast majority of Chubb’s business interruption policies require direct physical loss or damage to property, such as that caused by a fire or flood or other peril that damages the property and prevents the business from operating while repairs are being made. Each policy describes the events that trigger business interruption coverage.

Again, coverage depends on the policy language and specific facts of the claim. For most policies, if businesses are closed by government actions, the policies still require direct physical loss or damage to the property or adjacent properties. With COVID-19, governments ordered shutdowns to keep people socially distant from each other, not because of dangerous conditions at any specific properties.

For over 200 years, Chubb has done our job to pay claims promptly and fairly while providing outstanding client service – it’s in our DNA.

We are currently paying claims for pandemic-related losses in workers compensation, travel insurance, credit-related products as well as business interruption where direct physical loss or damage to property is not required, such as event cancellation. We thoroughly review each and every claim submitted based on the facts and the policy.

In 2019, we received 3.6 million new claims and made more than $18.3 billion in claim payments

Chubb has taken a number of measures to help policyholders affected by the pandemic. We are temporarily suspending cancellation and non-renewal of coverage for non-payment in accordance with guidance from state regulators. We also introduced auto credits and exposure reductions for clients. In addition, Chubb is proud to take a lead role in insuring nearly 100 businesses that have quickly retooled their operations to assist in pandemic response efforts.

Additionally, we are supporting our small business clients by providing healthcare workers and first responders with $1 million in gift cards redeemable at our policyholders’ businesses.

Finally, we are contributing to immediate emergency response with a commitment of $10 million to pandemic relief efforts globally.

Please contact your agent to discuss your specific policy and circumstances.

Additional Resources

-

How does business interruption insurance work?

From Insurance Information Institute

Read More -

Understanding Business Interruption Insurance and Pandemics

From Insurance Information Institute

Read More -

Business interruption claims related to COVID-19Read More

-

COVID-19 and Business InterruptionWatch the Video