MyHomeGuard is more than just household insurance. It provides cover for ATM assault, injuries resulting from theft, and personal accidents that occur outside your home.

Life has so much to offer. To ensure that you live yours to the fullest, our life protection insurance provides comprehensive solutions to grow your wealth and to protect your health according to your changing needs and goals.

Chubb leverages superior underwriting expertise and world renowned claims, account services, and financial strength to offer solutions for small and medium businesses.

Today’s multinational organizations face complex and interconnected risks. We offer insurance solutions that are tailored to global needs as well as local requirements, helping them address their risk management challenges.

Our partners’ contributions to our success are undeniable. As one of the world’s largest and strongest insurers, we offer a range of products and services capabilities through our distribution channels to ensure yours, too.

Chubb has a proven track record of maximising ancillary revenue for more than 120 business partners across Asia Pacific.

Protect your travel adventures, home, and everyday moments with Chubb’s General Insurance. Enjoy flexible coverage from a global insurance leader and buy online in minutes—peace of mind is just a click away.

Buy life insurance online for all your needs—critical illness, accidents, and term life. Enjoy comprehensive protection, health and wellness benefits, and flexible coverage options with easy online purchase.

When it comes to planning for your future, information is power. We’ve compiled some of the latest data from leading Hong Kong health organisations and our last year’s most common insurance claims at Chubb Life Hong Kong, so you can stay informed – and make the best decisions for yourself and your family’s future.

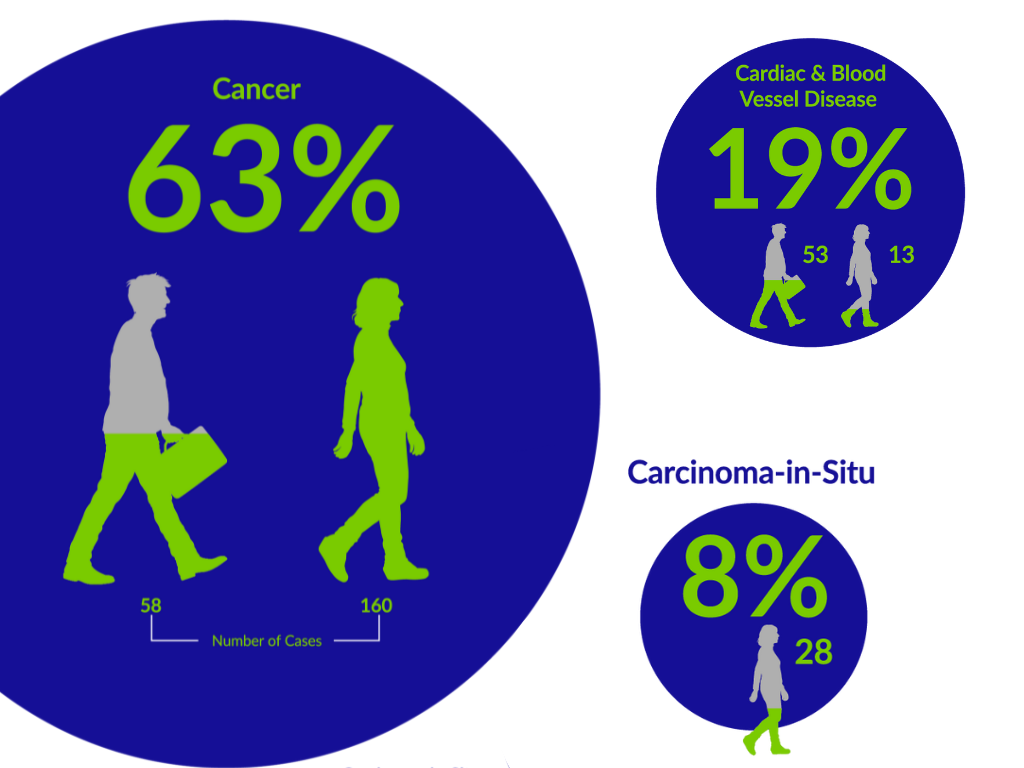

Did you know? According to the data of Hospital Authority in 2020, Lung, colorectal and breast cancer are the top 3 most common cancers in Hong Kong. Around 1 in 14 women will be diagnosed with breast cancer in their lifetime. Cancers of all kinds were responsible for 63% of the total number of our critical illness claims in 2022; the number of cases for women (160 cases) is twice that of men (58 cases).

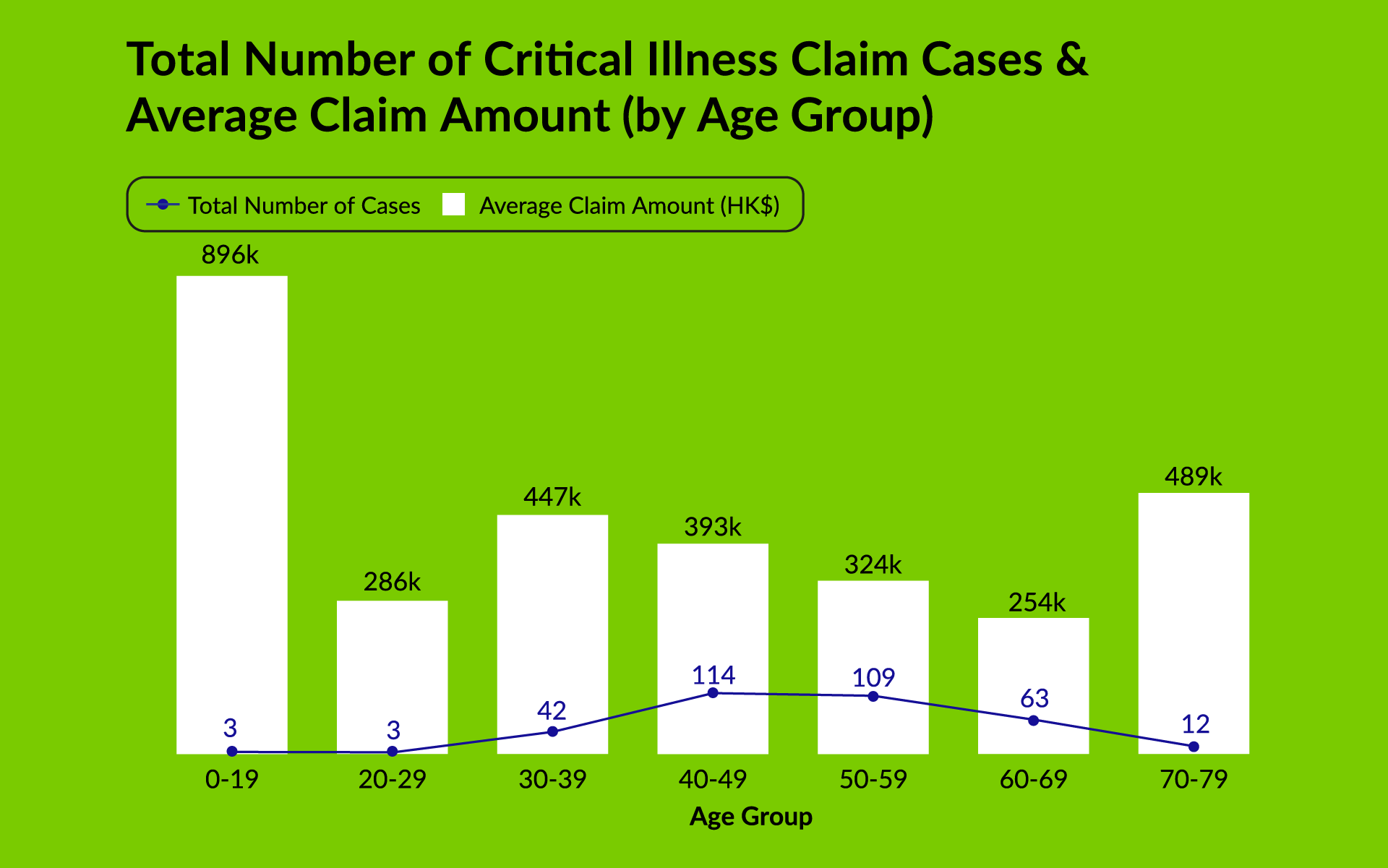

We often associate critical illness with seniors, but it may be more common among middle-aged people than we think. Overall, the largest number of 2022 Chubb Life Hong Kong critical illness claim cases came from claimants ages 40-49, representing 33% of the total.

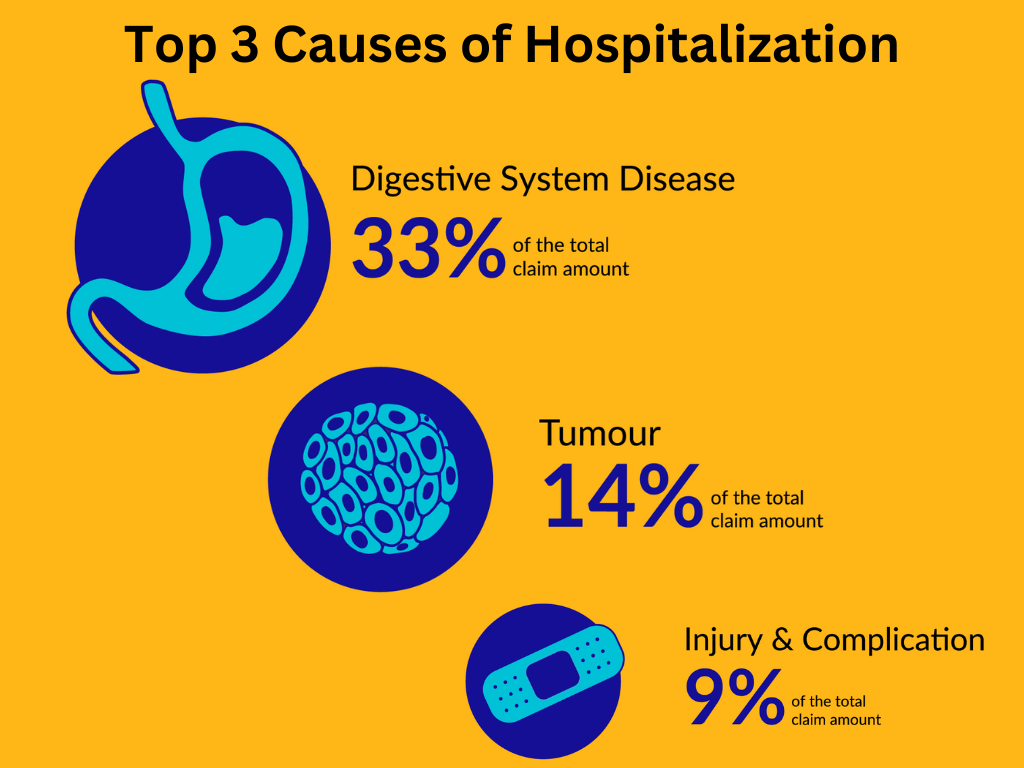

According to the data of National Cancer Institute in 2020, young adults around the world are facing an increase in colorectal cancer. Overall, the largest number of 2022 Chubb Life Hong Kong hopsitalization claim cases came from Digestive System Diseases, recording 33%.

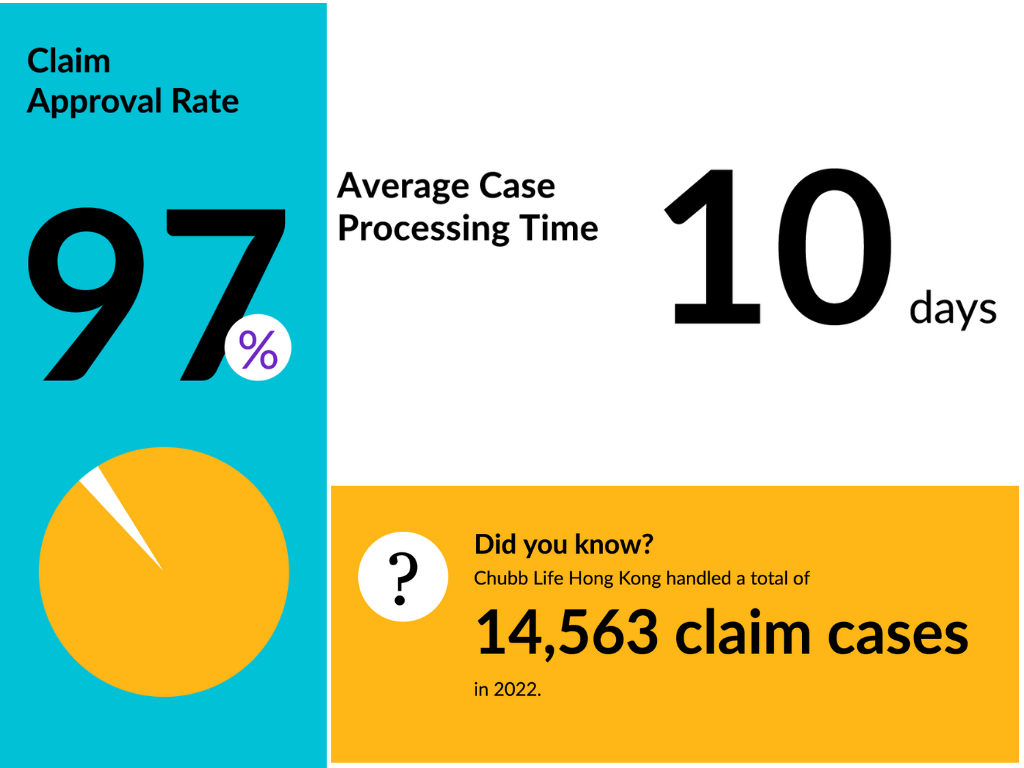

With reference, you will naturally know how to choose! Chubb Life Hong Kong had a 97% claim approval rate and an average case processing time of just 10 days, handling of 14,563 claims cases.

Stay informed and in control of your health. Click here to download the 2022 Chubb Life Hong Kong Claims Report now.

Insights and Expertise

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks.

No part of this article may be reproduced in any written, electronic, recording, or printed form without written permission of Chubb.

Disclaimer - All contents of this article are intended for general information/guidance purposes only and not intended to be an offer or solicitation of insurance products or personal advice or a recommendation to any individual or business of any product or service. This article should not be relied on for legal advice or policy coverage and cannot be viewed as a substitute to obtaining proper legal or other professional advice, or for reading the policy documents. You should read the policy documents to determine whether any of the insurance product(s) discussed are right for you or your business, noting different limits, exclusions, terms and conditions apply in each country or territory, and not all cover is available in all countries or territories.