MyHomeGuard is more than just household insurance. It provides cover for ATM assault, injuries resulting from theft, and personal accidents that occur outside your home.

Chubb leverages superior underwriting expertise and world renowned claims, account services, and financial strength to offer solutions for small and medium businesses.

Today’s multinational organizations face complex and interconnected risks. We offer insurance solutions that are tailored to global needs as well as local requirements, helping them address their risk management challenges.

Our partners’ contributions to our success are undeniable. As one of the world’s largest and strongest insurers, we offer a range of products and services capabilities through our distribution channels to ensure yours, too.

Chubb has a proven track record of maximising ancillary revenue for more than 120 business partners across Asia Pacific.

Protect your travel adventures, home, and everyday moments with Chubb’s General Insurance. Enjoy flexible coverage from a global insurance leader and buy online in minutes—peace of mind is just a click away.

Buy life insurance online for all your needs—critical illness, accidents, and term life. Enjoy comprehensive protection, health and wellness benefits, and flexible coverage options with easy online purchase.

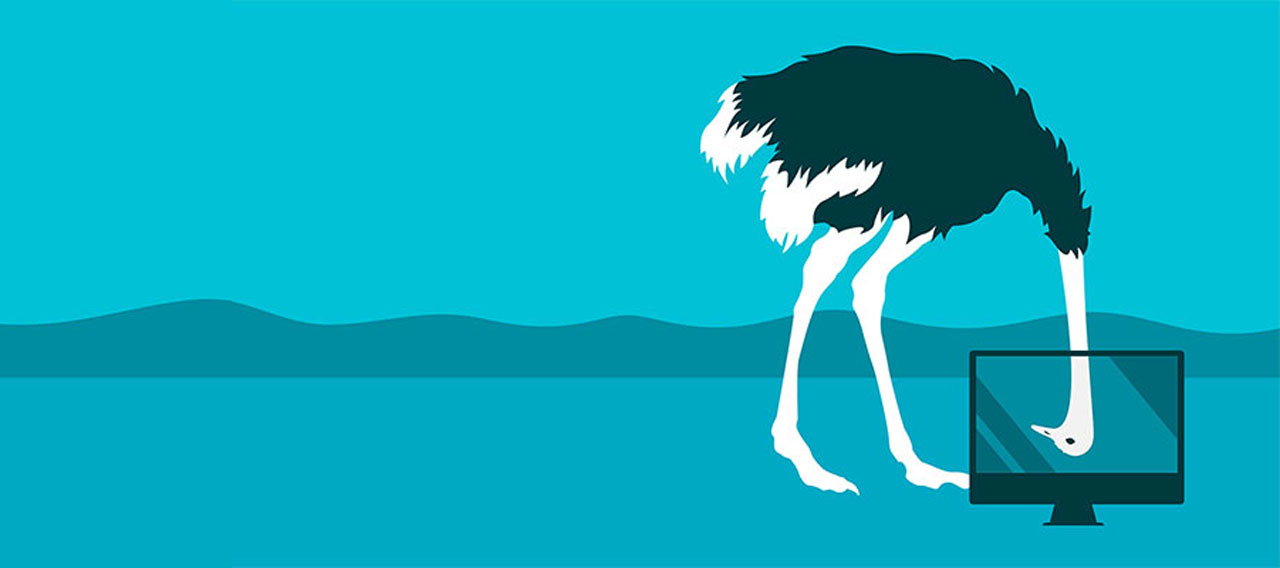

All businesses with an online presence face a range of cyber risks. Prominent among them are data breaches, which constitute a class of vulnerability that the public is particularly concerned about, especially in light of recent high-profile data breaches like that which affected Facebook in September 2018. There’s no way to eliminate cyber risks like data breaches but there’re a variety of measures that can help businesses manage and mitigate risks.

Reducing the risk

As with so many other risks, the best way to manage cyber risks like data breaches is to reduce the risk and exposure as much as possible. Reducing the risk protects a business and its customers and clients from having their data compromised while reducing the exposure protects a business from the consequences of data breaches.

Reducing exposure is best accomplished by purchasing cyber liability insurance. Reducing the risk is best accomplished by implementing the security measures that best suit the business and the type of data being held. Unfortunately, there isn’t a global standard or a solution that suits all organisations.

Regardless of which security measures are chosen, it’s vital that security products and services be continuously monitored and kept up to date. Businesses must also take steps to ensure basic cyber safety practices are implemented. This includes measures like good password practices and employing data encryption where relevant. This won’t create a foolproof system that eliminates the risk of a data breach occurring but it will significantly reduce the risk.

Responding to a data breach

In addition to implementing practices and procedures that prevent data breaches, a good data breach risk management strategy will include guidelines that should be followed in the event a breach does occur. Such guidelines should specify whether IT, PR, legal etc. professionals need to be engaged and should also cover protocols for:

- Containing a breach and limiting further damage including protocols for shutting down and preventing further access to a system that has been breached

- Assessing the risks associated with and impacts of a breach including the impacts on the business, such as whether compromised data will affect other business processes or relationships with third parties, and the impacts on the business’s customers, such as the number of people affected and the nature of the data that was compromised

- Reporting a breach who needs to be notified, when and how they should be notified and what information they need to be given

- Rectifying a breach including procedures for attempting to recover lost data and restarting compromised systems

- Assessing the effectiveness of the response and preventing future breaches including protocols for: determining whether criminal activity, human error or inadequate procedures contributed to the breach; evaluating any operational, policy, resource, employee or management issues that arose during the response to a breach; and modifying any procedures or behaviours that contributed to the breach

Summary

Managing cyber risks like data breaches requires an integrated approach designed to:

- prevent an attack

- limit the exposure

- respond to an incident in the event prevention fails

Watch the webinar, Getting your brain around cyber: A multi-faceted risk, for more tips on improving an organisation’s cyber resilience and insights into cyber trends.

Insights and Expertise

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks.

No part of this article may be reproduced in any written, electronic, recording, or printed form without written permission of Chubb.

Disclaimer - All contents of this article are intended for general information/guidance purposes only and not intended to be an offer or solicitation of insurance products or personal advice or a recommendation to any individual or business of any product or service. This article should not be relied on for legal advice or policy coverage and cannot be viewed as a substitute to obtaining proper legal or other professional advice, or for reading the policy documents. You should read the policy documents to determine whether any of the insurance product(s) discussed are right for you or your business, noting different limits, exclusions, terms and conditions apply in each country or territory, and not all cover is available in all countries or territories.