MyHomeGuard is more than just household insurance. It provides cover for ATM assault, injuries resulting from theft, and personal accidents that occur outside your home.

Chubb leverages superior underwriting expertise and world renowned claims, account services, and financial strength to offer solutions for small and medium businesses.

Today’s multinational organizations face complex and interconnected risks. We offer insurance solutions that are tailored to global needs as well as local requirements, helping them address their risk management challenges.

Our partners’ contributions to our success are undeniable. As one of the world’s largest and strongest insurers, we offer a range of products and services capabilities through our distribution channels to ensure yours, too.

Chubb has a proven track record of maximising ancillary revenue for more than 120 business partners across Asia Pacific.

Protect your travel adventures, home, and everyday moments with Chubb’s General Insurance. Enjoy flexible coverage from a global insurance leader and buy online in minutes—peace of mind is just a click away.

Buy life insurance online for all your needs—critical illness, accidents, and term life. Enjoy comprehensive protection, health and wellness benefits, and flexible coverage options with easy online purchase.

In a buoyant economy, employee turnover is usually high as jobs are more easily available. Depending on the country, the cost of replacing a mid-level executive is about 20% of their annual salary while replacing a senior level executive can range from 213% to 400%* of annual salary.

Investing in policies that support employee retention has become essential as companies recognize the high cost of rehiring and training. Policies such as paid sick leave, childcare leave, health and personal accident insurance also demonstrate an employer’s commitment to their Duty of Care obligations and the general well-being of their employees. Let’s see how a simple Group Personal Accident insurance plan provides a strong safety net for employees and employers in the following scenarios. Cover was utilized under their Group insurance coverage provided by Chubb.

Scenario 1

The insured, a videographer working for a film production house, was knocked down by an e-scooter on his way home. He fractured his arm.

Fortunately, the film production house has a Group Personal Accident Policy that covers employees for loss of income and other benefits.

Scenario 2

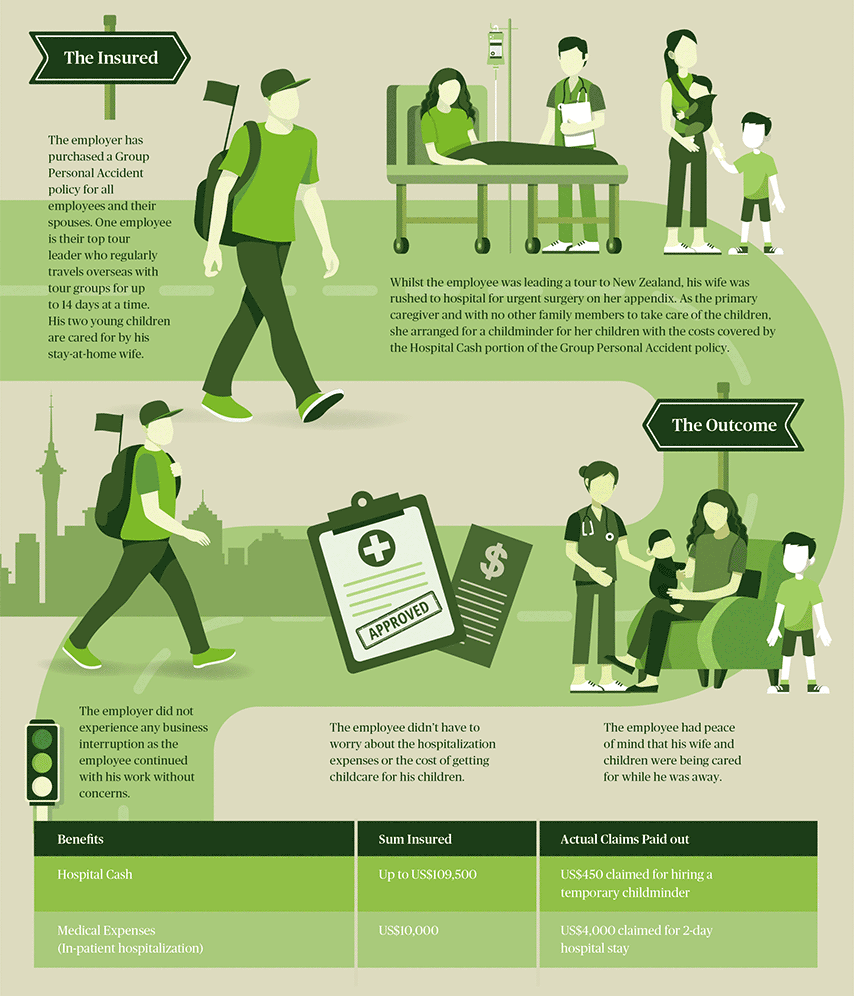

An employee insured by his employer’s Group Personal Accident also covered his spouse. While leading a tour overseas, his wife had to be hospitalized. Using the policy benefits, he claimed for a childminder to look after his young children without having to return home.

Scenario 3

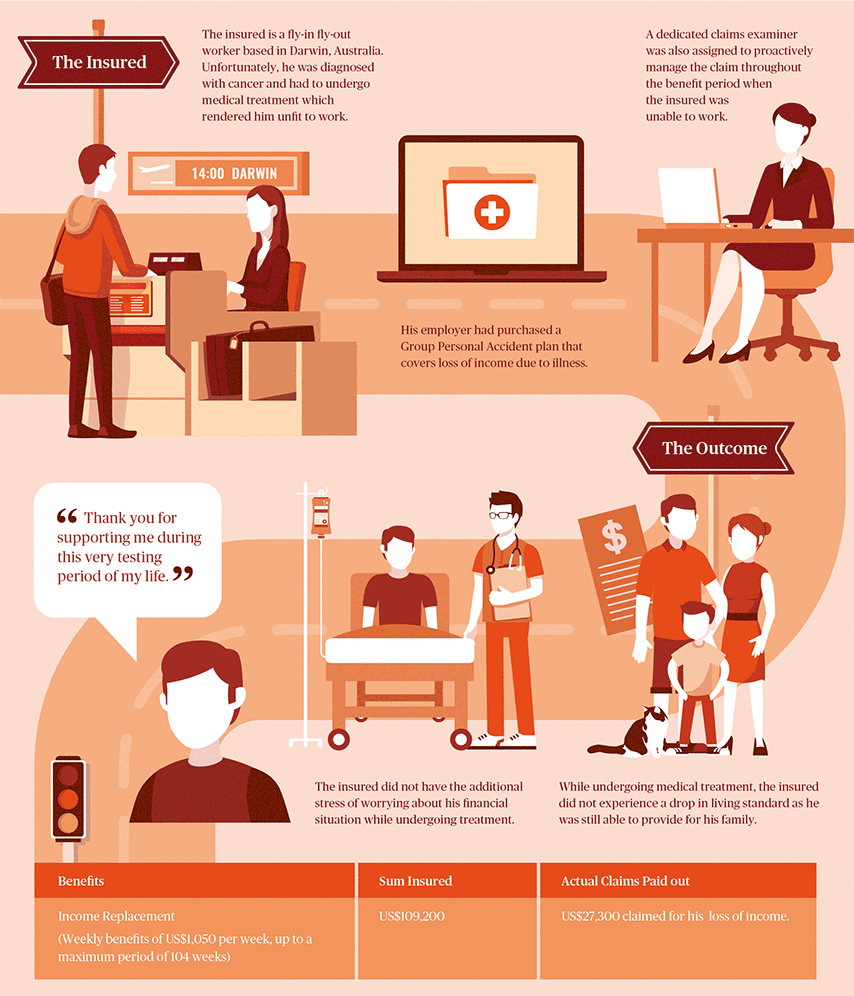

The insured is a fly-in fly-out worker based in Darwin, Australia. Unfortunately, he was diagnosed with cancer and had to undergo medical treatment. His company’s Group Personal Accident covers loss of income due to illness. As such, he was able to continue providing for his family and did not suffer a drop in his living standard.

Scenario 4

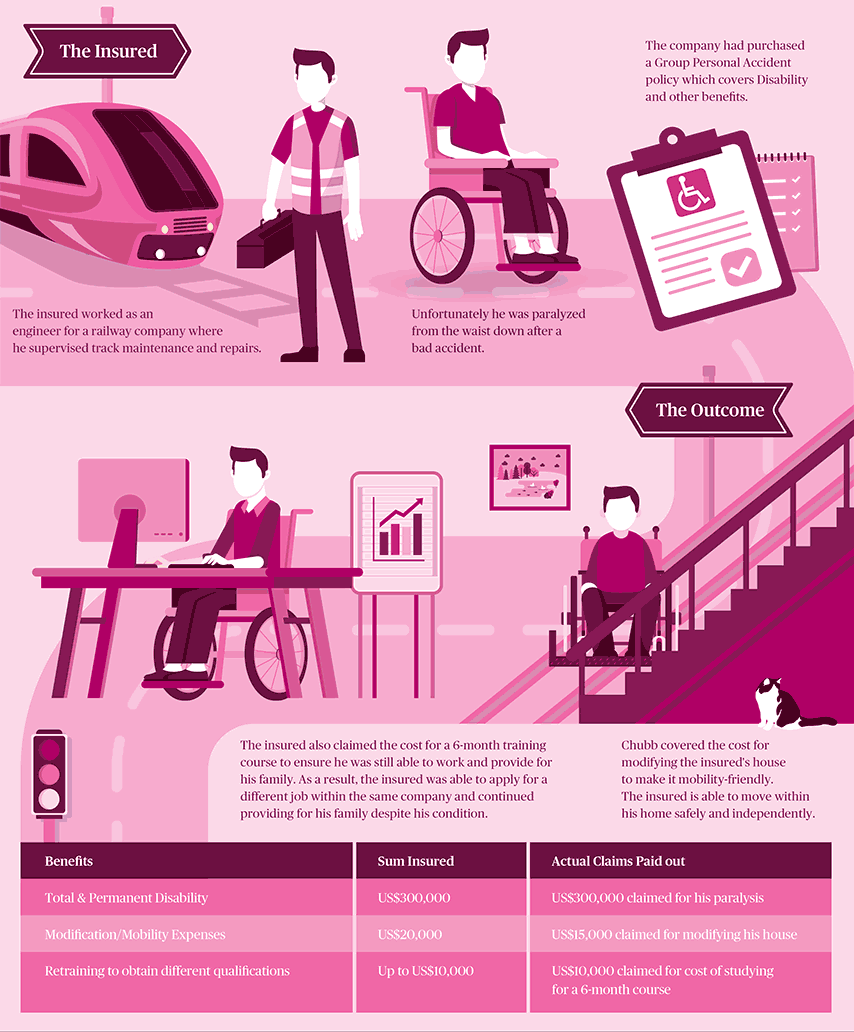

The insured received a lump sum payment when he was paralyzed from the waist as his company’s Group Personal Accident Policy covers Total & Permanent Disability. In addition, he was also able to claim for his home modification and retraining benefits so that he found a new job thereafter.

Scenario 5

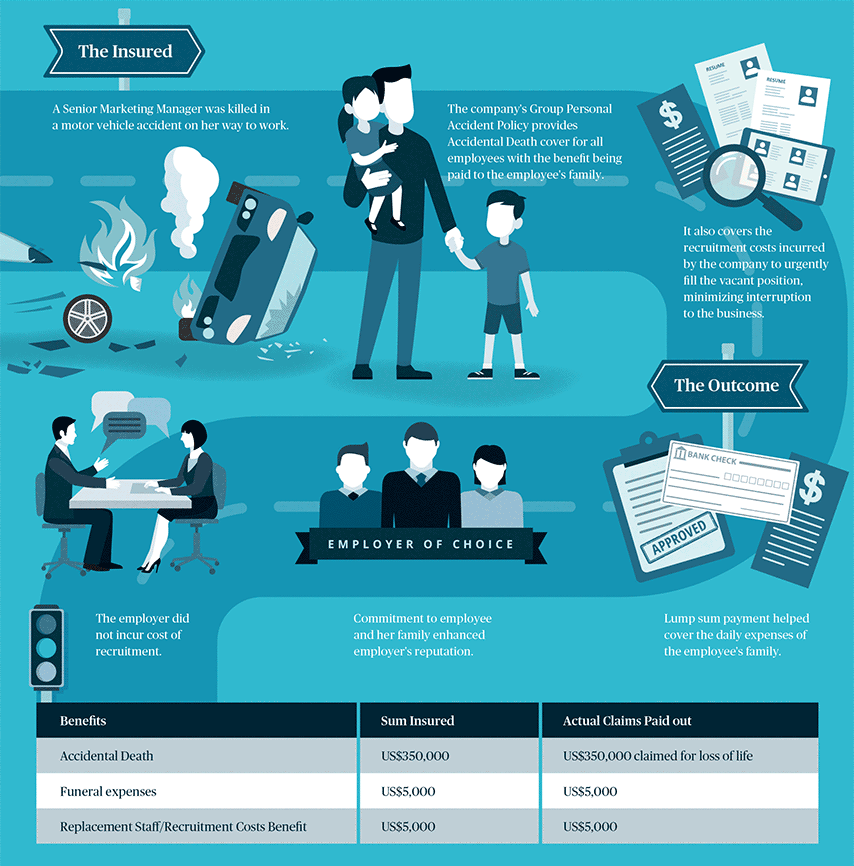

In this unfortunate case, the insured died from a road accident but his family received a lump sum payment from her company’s Group Personal Accident Policy.

Insights and Expertise

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks.

No part of this article may be reproduced in any written, electronic, recording, or printed form without written permission of Chubb.

Disclaimer - All contents of this article are intended for general information/guidance purposes only and not intended to be an offer or solicitation of insurance products or personal advice or a recommendation to any individual or business of any product or service. This article should not be relied on for legal advice or policy coverage and cannot be viewed as a substitute to obtaining proper legal or other professional advice, or for reading the policy documents. You should read the policy documents to determine whether any of the insurance product(s) discussed are right for you or your business, noting different limits, exclusions, terms and conditions apply in each country or territory, and not all cover is available in all countries or territories.