MyHomeGuard is more than just household insurance. It provides cover for ATM assault, injuries resulting from theft, and personal accidents that occur outside your home.

Life has so much to offer. To ensure that you live yours to the fullest, our life protection insurance provides comprehensive solutions to grow your wealth and to protect your health according to your changing needs and goals.

Chubb leverages superior underwriting expertise and world renowned claims, account services, and financial strength to offer solutions for small and medium businesses.

Today’s multinational organizations face complex and interconnected risks. We offer insurance solutions that are tailored to global needs as well as local requirements, helping them address their risk management challenges.

Our partners’ contributions to our success are undeniable. As one of the world’s largest and strongest insurers, we offer a range of products and services capabilities through our distribution channels to ensure yours, too.

Chubb has a proven track record of maximising ancillary revenue for more than 120 business partners across Asia Pacific.

Protect your travel adventures, home, and everyday moments with Chubb’s General Insurance. Enjoy flexible coverage from a global insurance leader and buy online in minutes—peace of mind is just a click away.

Buy life insurance online for all your needs—critical illness, accidents, and term life. Enjoy comprehensive protection, health and wellness benefits, and flexible coverage options with easy online purchase.

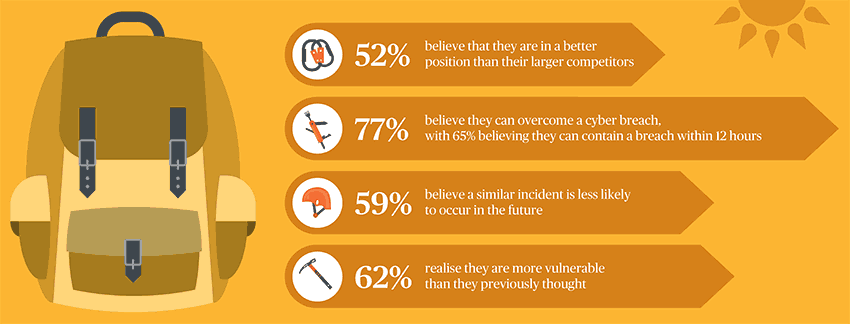

Small Medium Enterprises (SMEs) in Hong Kong believe that they are less vulnerable to cyber risks than their larger competitors. According to Chubb's SME Cyber Preparedness Report “Too Small to Fail?”, 52% of the 300 respondents agreed with that statement. They also think that they can overcome cyber breaches quickly and easily, with more than half (65%) believing that they can contain a breach within 12 hours.

However, nothing could be further from the truth.

- More than half (71%) experienced a cyber error or attack in the past 12 months.

- When probed, 45% of respondents are not confident that all their employees who have access to sensitive data are fully aware of their data privacy responsibilities.

- 52% believe they are not aware of all the cyber threats they face.

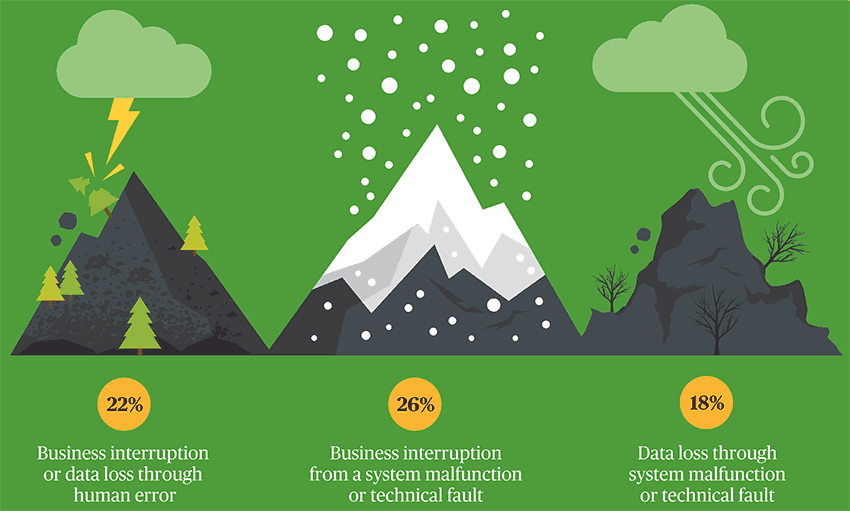

While SMEs may be at risk of external cyber attacks, our research shows that the majority of the cyber incidents are actually caused by internal factors. The top three incidents are business interruption or data loss through human error, system malfunction or technical fault.

Following a cyber incident:

- SMEs react differently with 46% stating that they increased their security, 36% notified affected parties, and 13% took no action at all.

- Their key concerns were relationship with customers (64%), profits (60%), cost of incident (60%) and public reputation (61%).

These statistics lead us to believe that there is a significant gap between the hard reality of cyber risk and how well small companies are prepared to deal with it. SMEs face a far bigger risk exposure as they face many of the same threats as larger companies do, yet most do not have the means to make as much investment required to implement comprehensive protection, or to recover from an attack.

Infographic

Are SMEs over confident about their ability to manage cyber risk?

These findings are based on a research done by Chubb, in collaboration with YouGov. Interested to find out more, download the full report – Too Small to Fail? Singapore SME Cyber Preparedness Report.

Insights and Expertise

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks.

No part of this article may be reproduced in any written, electronic, recording, or printed form without written permission of Chubb.

Disclaimer - All contents of this article are intended for general information/guidance purposes only and not intended to be an offer or solicitation of insurance products or personal advice or a recommendation to any individual or business of any product or service. This article should not be relied on for legal advice or policy coverage and cannot be viewed as a substitute to obtaining proper legal or other professional advice, or for reading the policy documents. You should read the policy documents to determine whether any of the insurance product(s) discussed are right for you or your business, noting different limits, exclusions, terms and conditions apply in each country or territory, and not all cover is available in all countries or territories.