Gold Fortune Deferred Annuity Plan

MyHomeGuard is more than just household insurance. It provides cover for ATM assault, injuries resulting from theft, and personal accidents that occur outside your home.

Chubb leverages superior underwriting expertise and world renowned claims, account services, and financial strength to offer solutions for small and medium businesses.

Today’s multinational organizations face complex and interconnected risks. We offer insurance solutions that are tailored to global needs as well as local requirements, helping them address their risk management challenges.

Our partners’ contributions to our success are undeniable. As one of the world’s largest and strongest insurers, we offer a range of products and services capabilities through our distribution channels to ensure yours, too.

Chubb has a proven track record of maximising ancillary revenue for more than 120 business partners across Asia Pacific.

Protect your travel adventures, home, and everyday moments with Chubb’s General Insurance. Enjoy flexible coverage from a global insurance leader and buy online in minutes—peace of mind is just a click away.

Buy life insurance online for all your needs—critical illness, accidents, and term life. Enjoy comprehensive protection, health and wellness benefits, and flexible coverage options with easy online purchase.

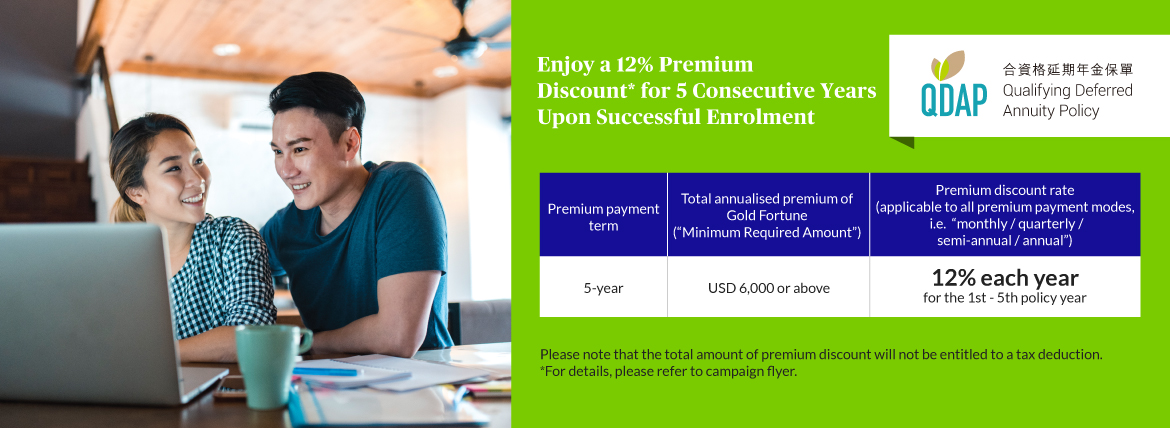

Gold Fortune Deferred Annuity Plan

Plan Highlights

- Monthly Annuity Income, including Guaranteed Monthly Annuity Income and Non-Guaranteed Monthly Annuity Income, payable for 10 years

- A lump sum of Maturity Dividend, including Guaranteed Maturity Dividend and Non-Guaranteed Maturity Dividend, for potentially higher return

- Choose for the Annuitant being the Insured to start receiving Monthly Annuity Income at Age 55 or 65

- 2 options of premium payment term available: 5 / 10 years

- Maximum 2 years of Premium Holiday is allowed after the 2nd Policy Anniversary

- Enjoy tax deduction for the qualifying deferred annuity premiums paid

- Additional 10% Guaranteed Monthly Annuity Income payout throughout the Annuity Period if the Annuitant being the Insured diagnosed with Total and Permanent Disability before the Annuity Period starts

- Application for this plan is simple and no medical examination is required

FAQ

The tax deduction limit for Voluntary Contributions (TVC) and Qualifying Deferred Annuities (QDAP) in the MPF system is a total of $60,000.

You can use annuities for tax deductions, but only Qualifying Deferred Annuities (QDAP) that are certified by the Insurance Authority and meet its criteria are eligible for deductions. Insurance companies provide policyholders with an annual policy summary each year, which helps you fill in the qualified annuity premiums for you or your spouse, as annuity beneficiaries, in Part 10 of your tax return.

Purchasing a deferred annuity allows you to prepare for retirement early by making regular contributions, providing income after retirement. Qualifying Deferred Annuities also offer tax deductions, giving you higher returns.

Interested in this Chubb policy?

Have a question or need more information? Contact us to find out how we can help you get covered against potential risks.

This webpage is for general reference only and should not be regarded as professional advice, recommendation and it is not part of the policy. It provides an overview of the key features of the product and should be read along with other materials which cover additional information about the product. Such materials include, but not limited to, product brochure that contains key product risks, policy provisions that contain exact terms and conditions, benefit illustrations (if any) and other policy documents and other relevant marketing materials, which are all available upon request. You might also consider seeking independent professional advice if needed.

The above information shall not be construed as an offer to sell, solicitation or persuasion to buy or provision of any of our products outside Hong Kong. For further information, please contact your Chubb Life Hong Kong Insurance Consultant or call our Customer Service Center Hotline at (852) 2894 9833.

The “Chubb Life Hong Kong”, “Company”, “we”, or “our” herein refers to Chubb Life Insurance Hong Kong Limited.