Embedding insurance protection into consumer products has been an effective way to provide added relevant value while offering a simple, high-value customer experience in the past. With the emergence of the digital economy, changing demographics and strong economic development in the Asia Pacific Region, the demand for embedded insurance has taken a different form. I would like to share the 6 things I have learned about embedded insurance based on today’s context in this blog.

Here are 6 things you need to know about embedded insurance.

What is embedded insurance?

Embedded Insurance is offering more affordable, relevant and personalised insurance to people when and where they need it most, according to Simon Torrance, author of New Growth Playbook.

How is embedded insurance offered to consumers?

By abstracting insurance functionality into technology, embedded insurance enables any third-party provider/developer to integrate innovative insurance products into its customers’ purchase journeys seamlessly, rapidly and at a low cost. The end benefit is a stronger value proposition for the customers, thereby building brand preference and ultimately, customer loyalty.

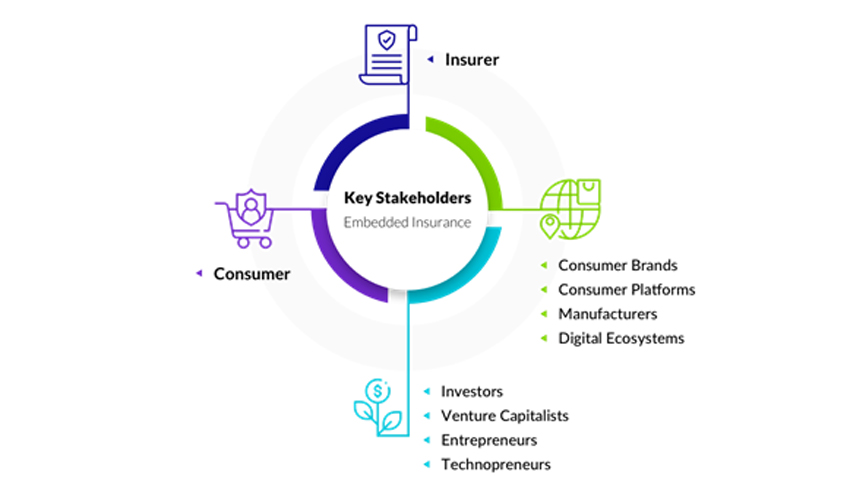

Who are the key stakeholders?

What is the embedded insurance market size?

US$3 trillion in total in 20201. US$700 billion in GWP for P&C by 2030.

Why is there an interest in embedded insurance?

Besides the market size, the need for insurance is greater than ever as the protection gap has widened. From 2000 to 2020, the gap has doubled largely due to digitisation, urbanisation, climate change and a lack of effective innovation2.

According to a study by Swiss Re, the global protection gap reached US$1.2 trillion in 20193. Natural catastrophe, mortality and health care are the top three factors contributing to the widening gap. The biggest gaps are in emerging Asia and Latin America.

How can every company become a part of embedded insurance?

In 2020, Chubb released a global platform called Chubb StudioSM that simplifies and streamlines the distribution of the company's insurance products through its partners' digital channels around the world. The platform enables Chubb's partners in e-commerce, banking, fintech, airline, telecommunications, retail and other industries to add digital insurance inside their ecosystem in an easy, frictionless manner.

Chubb Studio allows partner companies to embed Chubb's extensive range of consumer insurance products, including personal accident, supplemental health and life, residential and contents, mobile phone and travel as well as small business insurance, customer services and claims capabilities.

The capabilities of Chubb Studio were built on the company’s ability to successfully forge distribution partnerships with leading brands globally. Chubb has more than 150 distribution partners globally, of which five partnerships alone have given the company access to more than 100 million customers in Asia and Latin America.

If you are keen to learn how Chubb can collaborate with you, please connect with Gabriel Lazaro, Senior Vice President Head of Digital, Chubb Overseas General, on LinkedIn or email Gabriel.Lazaro@chubb.com.

1 https://www.linkedin.com/pulse/embedded-insurance-3-trillion-market-opportunity-could-simon-torrance/?trackingId=URCJGoln8ZVEQtHYxt4AkQ%3D%3D

2 https://www.linkedin.com/pulse/embedded-insurance-3-trillion-market-opportunity-could-simon-torrance/?trackingId=URCJGoln8ZVEQtHYxt4AkQ%3D%3D

3 https://riskandinsurance.com/global-protection-gap-reached-trillions-but-might-be-good-news/#:~:text=There's%20a%20global%20insurance%20protection,of%20these%20risks%20are%20insured.

Insights and Expertise

No part of this article may be reproduced in any written, electronic, recording, or printed form without written permission of Chubb.

Disclaimer - All contents of this article are intended for general information/guidance purposes only and not intended to be an offer or solicitation of insurance products or personal advice or a recommendation to any individual or business of any product or service. This article should not be relied on for legal advice or policy coverage and cannot be viewed as a substitute to obtaining proper legal or other professional advice, or for reading the policy documents. You should read the policy documents to determine whether any of the insurance product(s) discussed are right for you or your business, noting different limits, exclusions, terms and conditions apply in each country or territory, and not all cover is available in all countries or territories.