Featured /

Entdecken Sie unsere Branchenlösungen

Erfahren Sie mehr

Chubb feiert 20-jährige Präsenz in der Schweiz

Erfahren Sie mehr

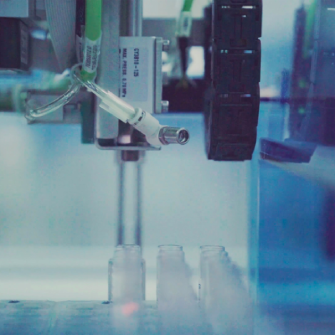

Chubb Schweiz ist Mitglied von BioAlps und bietet auf Life Science-Unternehmen zugeschnittene Versicherungslösungen an.

Erfahren Sie mehr

Ein Oldtimer ist mehr als nur ein Auto. Lernen Sie unser Spezialprodukt Masterpiece Motor für einzigartige Fahrzeuge kennen.

Erfahren Sie mehr

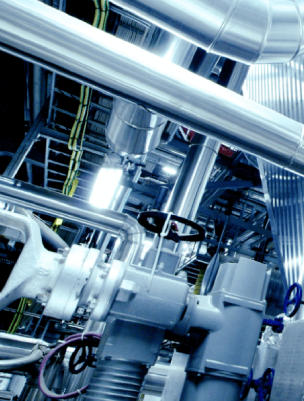

Wie Sie Betriebsunterbrechungen durch robustes Risikomanagement reduzieren

Erfahren Sie mehr

ICT-Branche: Lernen Sie die Risiken und Herausforderungen kennen, mit denen ICT-Unternehmen heute konfrontiert sind.

Lesen Sie den neusten Risikobericht

Zivile Unruhen nehmen weltweit zu. Seien Sie vorbereitet und lesen Sie unseren neuesten Bericht zu Terrorismus und politisch motivierter Gewalt.

Erfahren Sie mehrProdukte

Featured /

All-In-One Geschäftsreiseversicherung: Schnell und effizient abgeschlossen mit Chubb Easy Solutions

Erfahren Sie mehr

Chubb Masterpiece® Signature - eine Versicherung für vermögende Privatkunden

Erfahren Sie mehr

Chubb feiert 20-jährige Präsenz in der Schweiz

Erfahren Sie mehr

Ein Oldtimer ist mehr als nur ein Auto. Lernen Sie unser Spezialprodukt Masterpiece Motor für einzigartige Fahrzeuge kennen.

Erfahren Sie mehr

Chubb Easy Solutions wurde speziell für unsere Geschäftspartner entwickelt, um Industrieversicherungen online abzuschliessen und zu verwalten.

Online-Lösung Easy Solutions

ICT-Branche: Lernen Sie die Risiken und Herausforderungen kennen, mit denen ICT-Unternehmen im heutigen Umfeld konfrontiert sind.

Lesen Sie den neusten Risikobericht

Covid-19 hat die Risikolandschaft für Life Science-Unternehmen verändert. Chubbs Berichtsreihe gibt Einblick in diese Veränderungen.

MehrProdukte

Featured /

Chubb feiert 20-jährige Präsenz in der Schweiz

Erfahren Sie mehr