A safety net for the workforce

A safety net for the workforce

In a buoyant economy, employee turnover is usually high as jobs are more easily available. Depending on the country, the cost of replacing a mid-level executive is about 20% of their annual salary while replacing a senior level executive can range from 213% to 400%* of annual salary.

Investing in policies that support employee retention has become essential as companies recognize the high cost of rehiring and training. Policies such as paid sick leave, childcare leave, health and personal accident insurance also demonstrate an employer’s commitment to their Duty of Care obligations and the general well-being of their employees. Let’s see how a simple Group Personal Accident insurance plan provides a strong safety net for employees and employers in the following scenarios. Cover was utilised under their Group insurance coverage provided by Chubb.

Scenario 1

The insured, a videographer working for a film production house, was knocked down by an e-scooter on his way home. He fractured his arm.

Fortunately, the film production house has a Group Personal Accident Policy that covers employees for loss of income and other benefits.

Scenario 2

The insured is a fly-in fly-out worker based in Darwin, Australia. Unfortunately, he was diagnosed with cancer and had to undergo medical treatment. His company’s Group Personal Accident covers loss of income due to illness. As such, he was able to continue providing for his family and did not suffer a drop in his living standard.

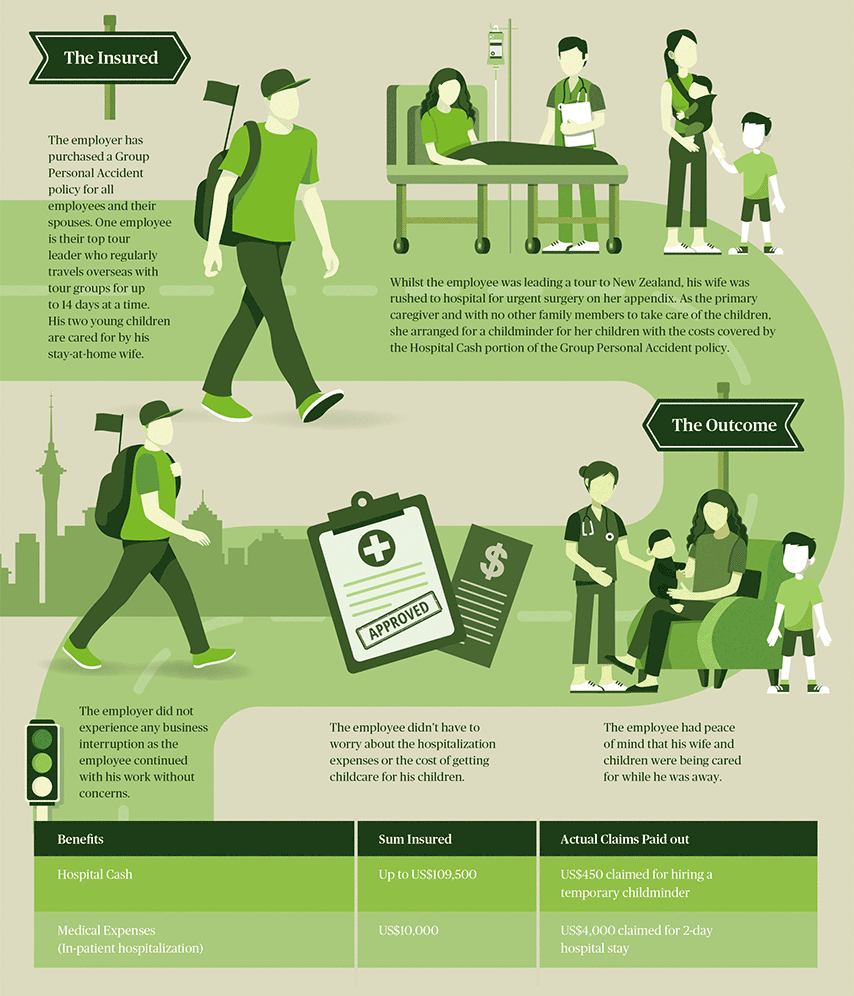

Scenario 3

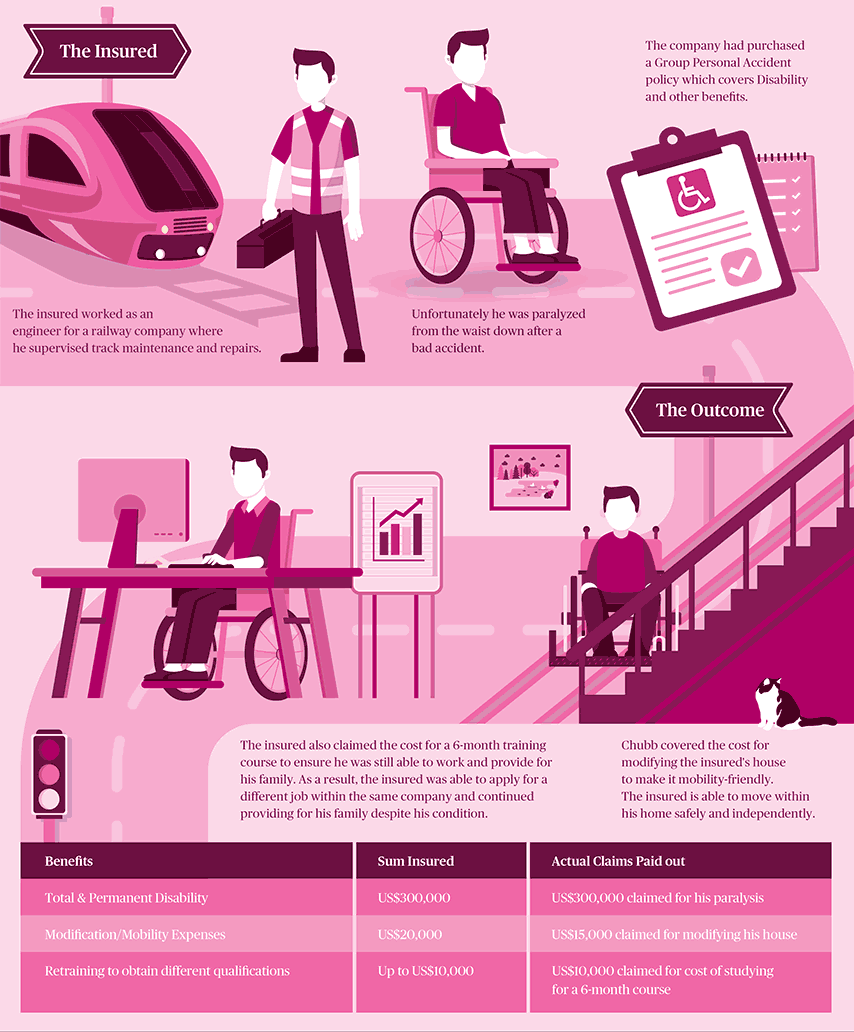

The insured received a lump sum payment when he was paralyzed from the waist as his company’s Group Personal Accident Policy covers Total & Permanent Disability. In addition, he was also able to claim for his home modification and retraining benefits so that he found a new job thereafter.

Scenario 4

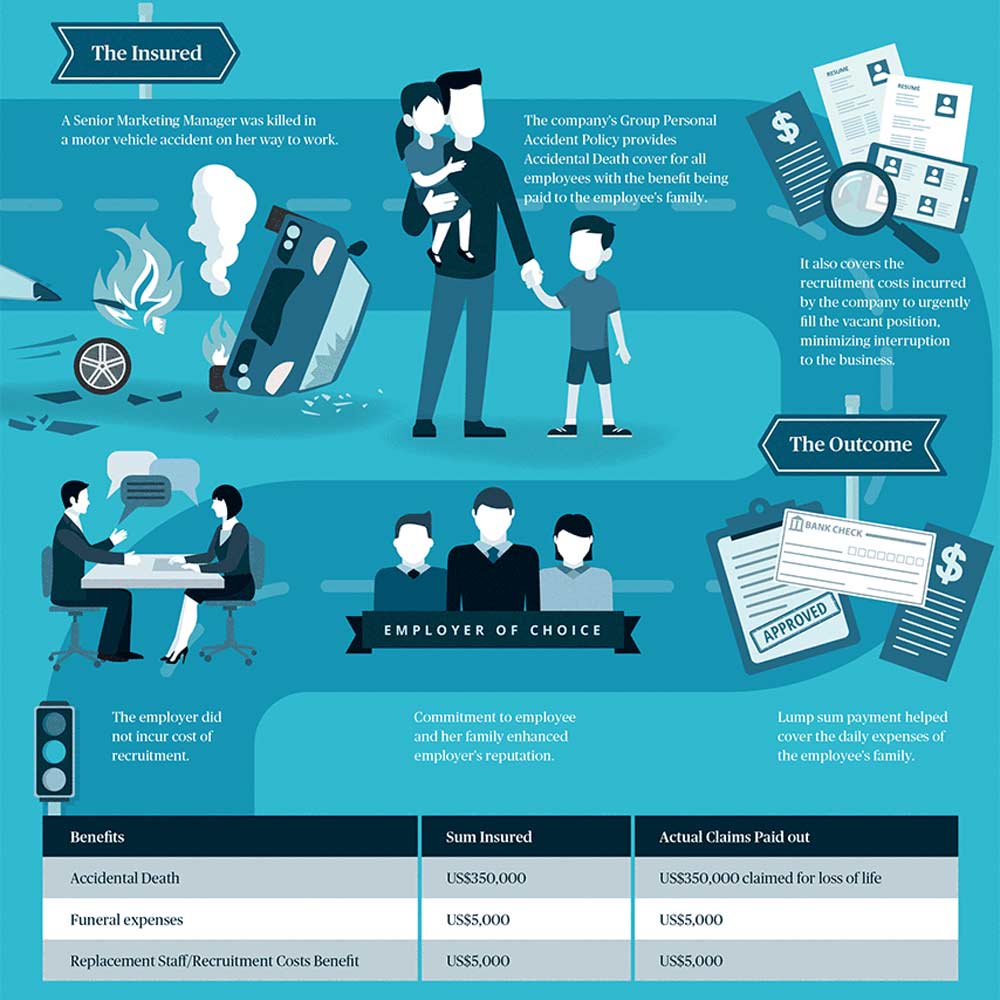

In this unfortunate case, the insured died from a road accident but his family received a lump sum payment from her company’s Group Personal Accident Policy.

No part of this article may be reproduced in any written, electronic, recording, or printed form without written permission of Chubb.

@2022 Chubb. The contents of this document are for informative purposes only and do not constitute advice. Please review the full terms, conditions and exclusions of our policies to consider whether they are right for you. Coverage may be underwritten by one or more Chubb companies or our network partners. Not all coverages and services are available in all countries and territories. Chubb® and its respective logos, and Chubb. Insured.SM are protected trademarks of Chubb.

Have a question or need more information?

Leave your contact details and our representatives will get in touch with you.