skip to main content

- Business

- Individuals & Families

- Partnerships

Quick links

Back

Industries

Climate+

Chubb Climate+ spans major industries, with a goal of enabling climate change progress in a meaningful way.

Quick links

Back

Products

Personal Accident Insurance

Chubb’s Personal Accident cover is designed to respond swiftly and effectively in the event of an accident, and offers a lump sum payment.

Back

Partnerships

Partnerships Home

Build your business by providing the protection your customers need – it’s insurance for the new possible.

Back

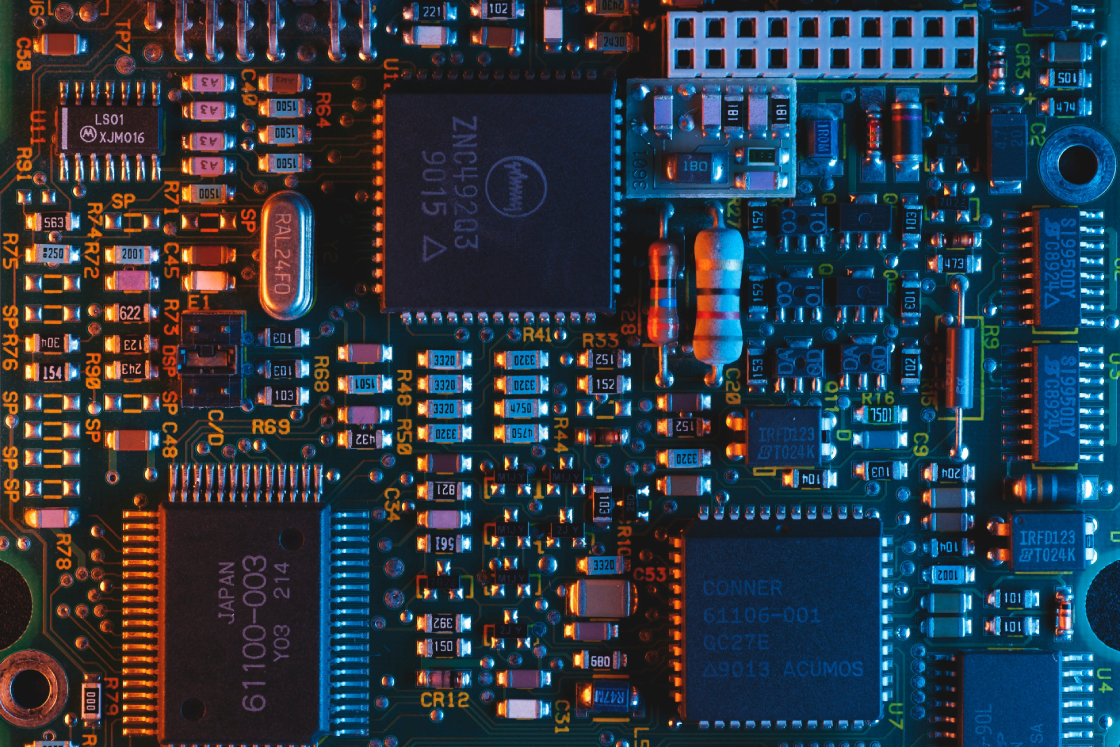

Technology

Technology

The seamless, secure, and scalable engine behind new possibilities for your company and customers.

Back

Case Studies

Chubb for Business

A broad range of tailored insurance products and services helping your business operate with confidence

BUSINESS INSURANCE

A leader in specialist business insurance. We work with you to provide the right cover to protect your business as it grows.

Our broad range of products and services includes traditional business insurance, specialty solutions, risk mitigation capabilities, and industry expertise to help companies and organisations navigate emerging risks.

Industries

Supporting a diverse range of industries with products and services that protect against specific risks

Products

Choose from a wide range of innovative products that offer the right protection for your business

Insights and expertise

We keep your business informed and protected with these helpful articles.

NIS2 and DORA: What technology companies need to know

T and tech companies could face liability risk following NIS2 and DORA legislation. Learn about technology risk management and improve customer relationships.

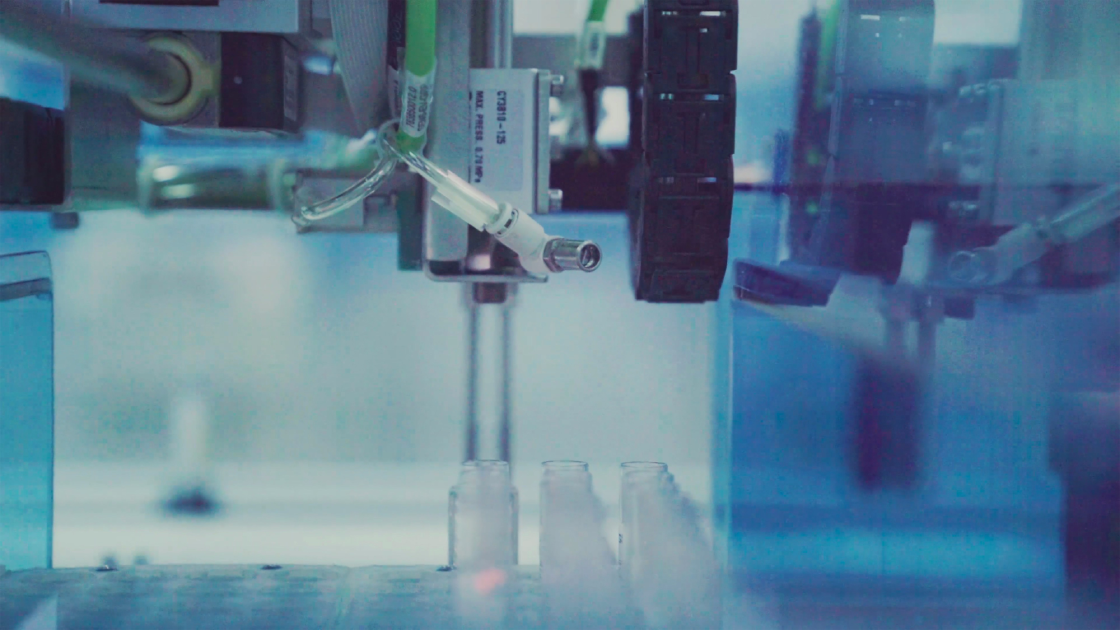

Current Challenges in European Clinical Trials: CTIS and Ethics Committees

The CTIS system, introduced in 2022, has been challenging for clinical trials insurers. In this article, Chubb’s Alex Forrest, Head of Industry Practices and Life Sciences, explains why.

Cybersecurity tips for Life Science companies

Life sciences companies across the UK and Europe are exposed to cyber threats. In this article, we discuss the most common risks and how businesses can help to protect themselves.