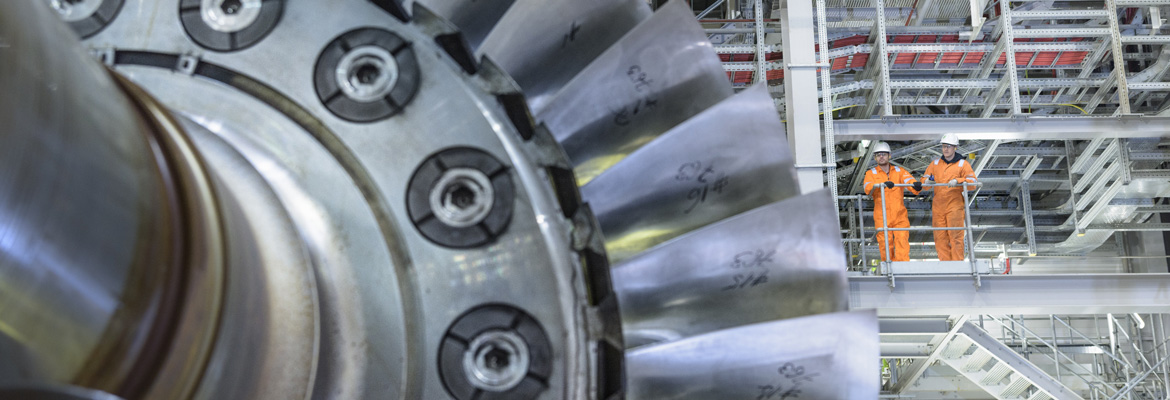

As digital and physical processes continue to converge, manufacturers are modernizing their production methods, enhancing their products, and changing the way they service and support their customers.

These changes present an array of new risks that manufacturers may not be adequately protected against through a traditional General Liability policy.

Coverage Highlights

- Dedicated limit of insurance for E&O, available from as low as RM250,000

- Encompass the full scope of insured Products and Services

- Claims Made coverage trigger

- Insurance written specifically with the needs of Manufacturing companies in mind

- Pays on behalf of the policyholder (vs reimbursing)

- Deductibles available as low as RM20,000

- Protects against legal liability and expenses incurred as a result of acts such as a failure of network security or unauthorized access or disclosure.

- Generally not meant to provide coverage for economic injuries arising out of products and services.

- Costs associated with the recall of products that are defective, dangerous, harmful or adulterated pose a substantial risk that can expose a manufacturer’s balance sheet.

- These are costs that are not typically addressed on a GL, E&O, or Cyber policy.

Claims Scenarios

A claim was made by a shipping company against a manufacturer of an integrated temperature monitoring “solution” used to monitor the temperature of cargo while in-transit. The shipper alleged that the in-transit temperature monitoring “solution” did not accurately record temperatures at established intervals, thereby leading to a wholesale grocery distributor rejecting a load of perishable goods.

A claim was made by retailers against a costume jewelry manufacturer that failed to comply with labeling requirements of consumer product safety laws. The retailers incurred costs to remove the non-compliant product from their shelves, and also lost revenues.

Several large distributors filed claims against a manufacturer of conveyor systems, alleging that such systems were defective, resulting in additional costs, late deliveries and lost income.

In an initial effort to capitalize on the “Internet of Things,” an advanced manufacturer embedded sensors into automated processes that provided real-time data on production output. Unfortunately, a flaw in the software controlling the sensors enabled an unauthorized user to access the data. Several end users of the sensors filed a lawsuit against the manufacturer for damages sustained from the unauthorized access.

A claim for compensation is made against a manufacturer of custom bolts by a farm equipment manufacturer for their failure to fulfil a client’s contract. A raw material supplied to the bolt manufacturer by a third party was found to be defective, rendering the bolts unsafe. The farm equipment manufacturer couldn’t use the bolts and terminated the supply contract with the bolt manufacturer.

A claim is made against a machinery manufacturer for loss of production time during a processing line outage. The machinery manufacturer was performing a routine maintenance visit for a product sold to their client. Whilst modifying the equipment, it resulted in slower than expected production speeds and subsequently lower output capacity.

Please refer to the policy contract for the full details of benefits, terms and exclusions that are applicable. The information provided here is a brief summary for quick and easy reference. The exact terms and conditions that apply are stated in the policy contract.

Downloads

Related Products

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks