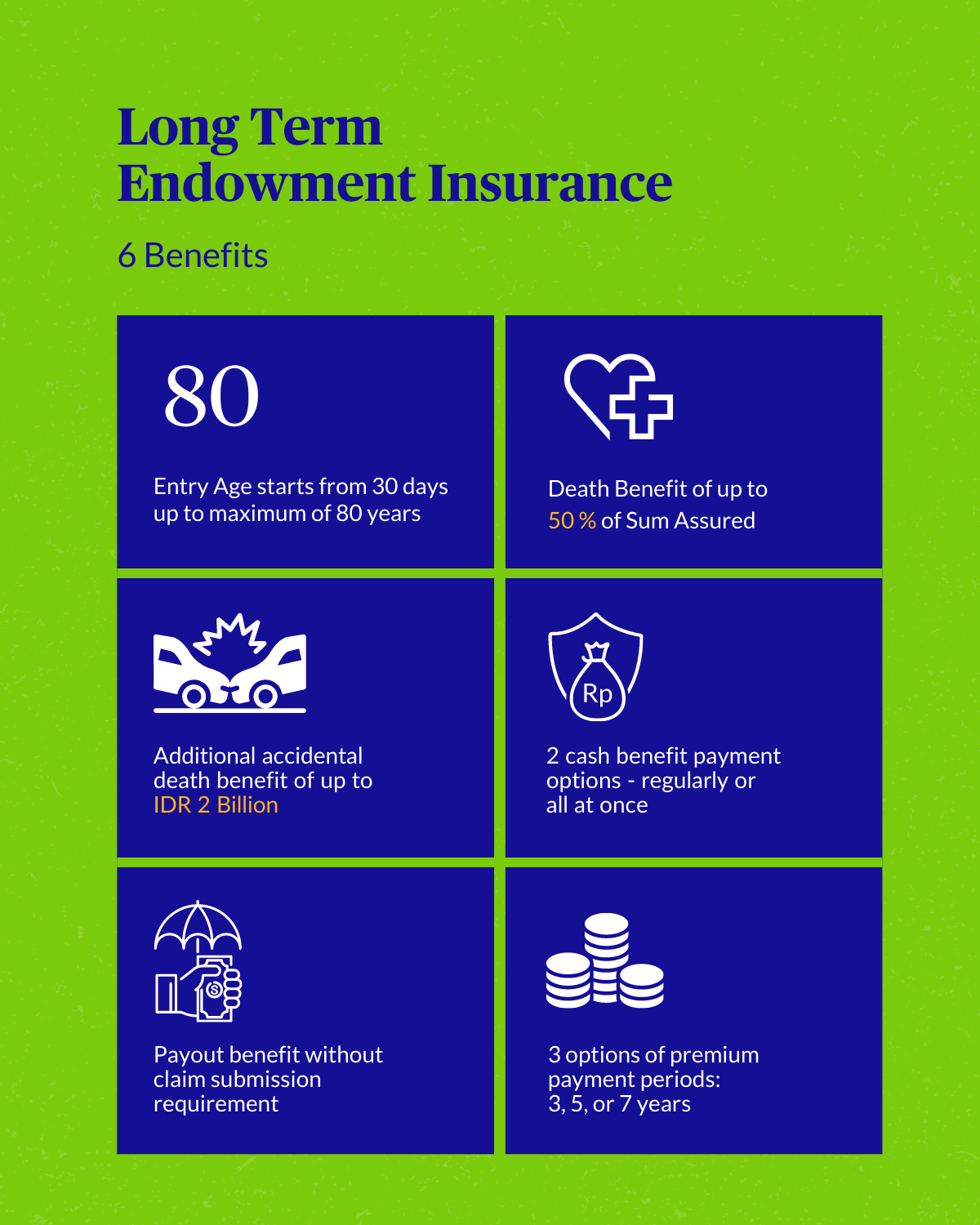

With the rising healthcare and educational costs, it’s essential to plan ahead and protect your family’s long term financial needs. Chubb Life’s Long Term Endowment Insurance is a traditional life insurance product that is specially crafted to help protect you and your family against future uncertainties. With a long protection period for up to 20 years, you have the flexibility to choose your cash benefit payment to be made gradually or all at once.

Product Highlights

Product Highlights

Death Benefit and Extra Accidental Death Benefit

Extra Accidental Death Benefit will be paid if the insured had an accident in the age not more than 60 years and within 90 days since the accident occurred and caused the death, maximum IDR 2,000,000,000

Selectable Benefit

A guaranteed amount of cash is payable upon the due date according to the benefit selected by the Policyholder:

- Regular Payout Benefit

If the insured remains alive on the due date of Regular Payout Benefit, the amount payable is as follows:

- Maturity Payout Benefit

In case of survival of the insured person upon maturity of the Policy contract, 250% of Sum Assured is payable. Otherwise, 250% of Sum Assured will be deducted by any Death Benefit claim payment that has been made prior to maturity of the Policy contract.

Content Download

.

Interested in this Chubb policy?

Have a question or need more information? Contact us to find out how we can help you get covered against potential risks.