Hospitalisation and Surgery Rider (HSR) is an insurance rider that provides reimbursement of the hospital cost, if the insured hospitalised due to illness or accident, and insurance benefits for accidental death, as charged, by overall annual limit.

Coverage Highlights

Best Protection Solution

- Cashless in hospital provider, in which area of Indonesia, Malaysia and Singapore

- Benefits:

- Various hospital’s miscellaneous cost, including doctor visits, and surgical fees, will be covered, as charged

- Day surgery will be covered, as charged

- Medical consultation, diagnostic check-up and laboratory before inpatient treatment will be covered, as charged

- Post hospitalisation cost will be covered, as charged

- Additional benefits of dialysis, cancer, and physiotherapy will be covered, as charged

- Yearly limit can be increased up to 7 times if the insured adds Major Medical Rider (MMR)

- Entry age starts from 30 days up to 65 years*

- Provides protection to the insured until 88 years old

- Cardiac operation, as charged*

- Additional benefits of evacuation and repatriation at the time when travelling local or abroad

- Protection from all hospitals around the world – with the appropriate standard costs of hospitals in Singapore

*) In accordance with the provisions written in the policy.

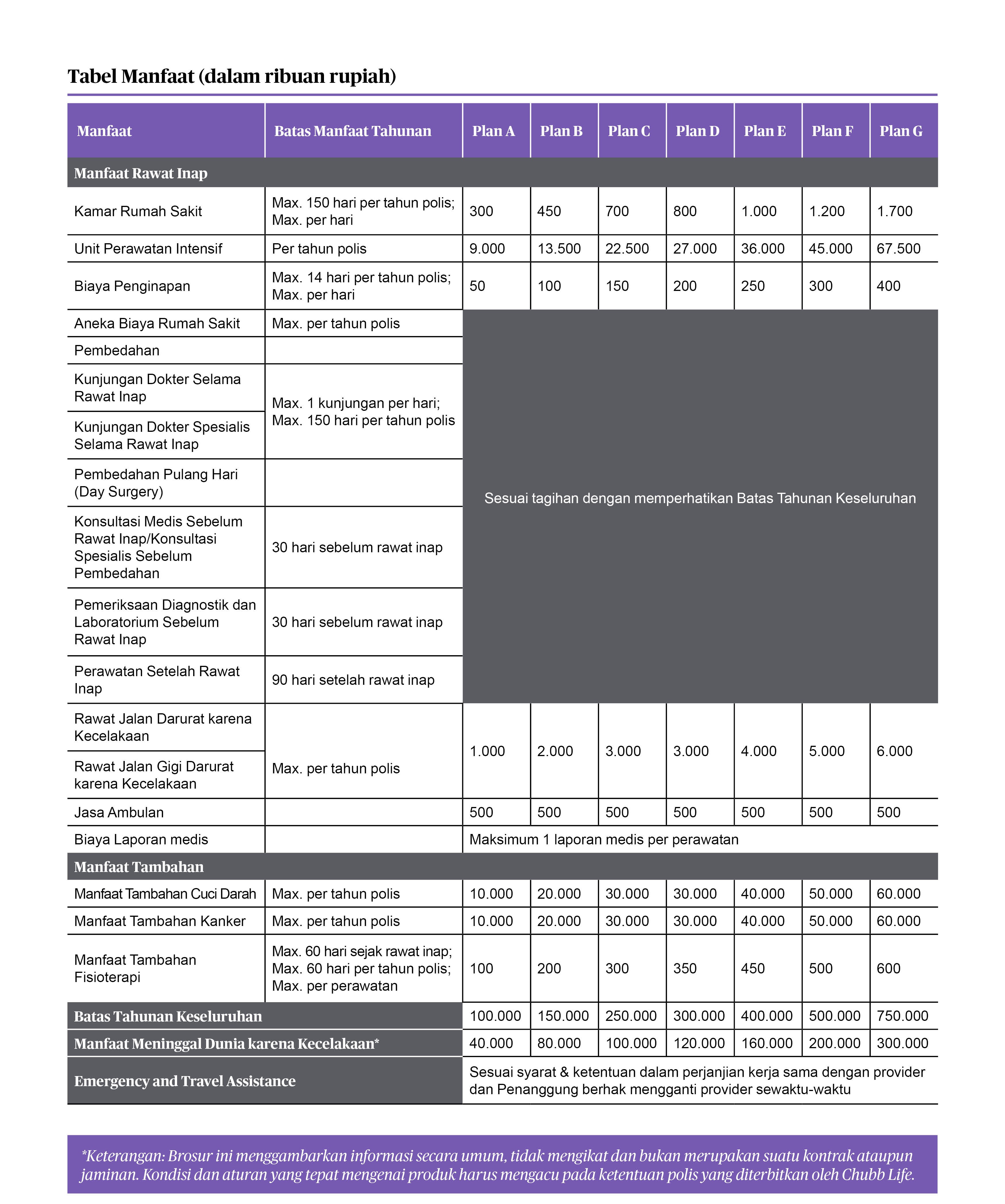

Table of Benefit (In Thousand Rupiah)

*) Up to age of 88 years old

*) Table of Benefits above is not intended to be binding

Information presented is not intended to be binding. Please always refer to terms and conditions in the policy.

Content Download

Interested in this Chubb policy?

Have a question or need more information? Contact us to find out how we can help you get covered against potential risks