Group personal accident for SME's

People are your client's most important asset

Many New Zealand small businesses fail due to the loss of key employees.

Despite this fact 32% of Company Directors have indicated they do not have plans in place to manage this risk.*

When you consider that New Zealand faces increasing labour shortages and businesses struggle to attract and retain talent this is a concerning exposure for your SME clients.

One method of mitigating key person risk is Group Personal Accident Insurance (GPA). It offers lump sum benefits for death or serious injury to employees while also covering the expense of replacement staff costs.

Chubb is now providing insurance brokers with the ability to bind their own GPA policies for SME clients.

GPA benefits

Chubb GPA can be used as a contractual benefit to staff, or the client can receive the benefits and then provide a range of payments and assistance in the event that an employee accidentally dies or suffers a serious injury.

Policy benefits:

- Lump sum benefits for Accidental Death or Disablement through injury

- Lump sum benefits for broken bones

- Benefits for injuries resulting from events such as terrorism or workplace trauma

- Funeral expenses

- Return to work assistance

- Replacement staff /recruitment costs

- Company image protection

- Home and car modification costs

- Car-jacking benefit

- Air or road rage benefit

- Public transport ticket benefit

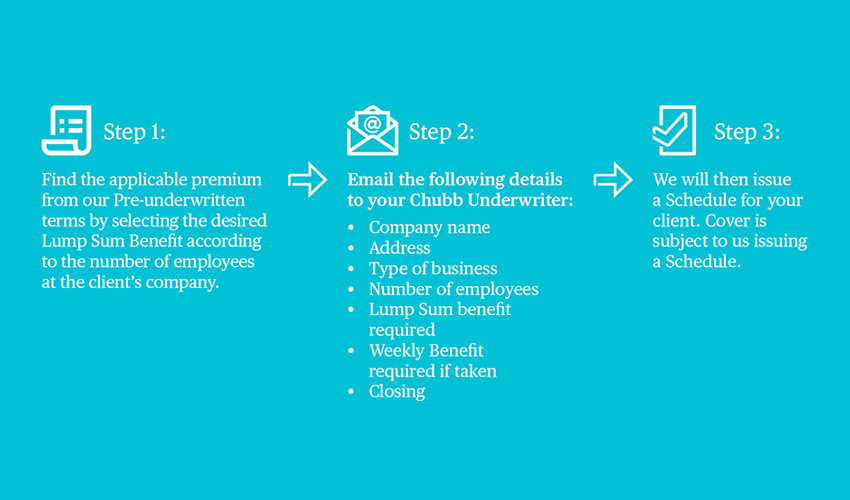

Bind in 3 easy steps

Our terms can be offered to qualifying mutual clients with no application form required!

Quote and bind policies directly with your clients in 3 easy steps:

Terms and Conditions apply

Why Chubb?

- Marketing leading policies with broad coverage and a host of additional benefits included as an exclusive endorsement suite for this offer

- Expert knowledge and service from local underwriters

- A dedicated claims team with escalations points based in Auckland that is focused on swift and satisfactory outcomes

- A truly global network of expertise and servicing capability

This content is brought to you by Chubb Insurance New Zealand Limited (“Chubb”) as a convenience to readers and is not intended to constitute advice (professional, financial or otherwise) or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/nz-en through your broker or by contacting any of the Chubb offices. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of the content. Readers relying on any content do so at their own risk. It is the responsibility of the reader to evaluate the quality and accuracy of the content. Reference in this content (if any) to any specific commercial product, process, or service, and links from this content to other third party websites, do not constitute or imply an endorsement or recommendation by Chubb and shall not be used for advertising or service/product endorsement purposes. ©2020 Chubb Insurance New Zealand Limited Company No. 104656 FSP No. 35924. Chubb®, its logos, and Chubb.Insured.SM are protected trademarks of Chubb.

Do you want to know more?

Contact us to find out how we can help protect your SME clients against key person risk.