Your insurance is underwritten by Chubb Life Insurance New Zealand Limited (Chubb Life).

Chubb Life has an A (Excellent) financial strength rating given by A.M. Best Company Inc.

A summary of the rating scale is: A++, A+ Superior | A, A- Excellent | B++, B+ Good | B, B- Fair | C++, C+ Marginal | C, C- Weak | D Poor | E Under Regulatory Supervision | F In Liquidation | S Suspended. For the full rating scale and more rating information visit www.ambest.com/ratings/guide.pdf

Secure |

|

|

Vulnerable |

|

|

A++ |

A+ |

Superior |

B |

B- |

Fair |

A |

A- |

Excellent |

C++ |

C+ |

Marginal |

B++ |

B+ |

Good |

C |

C- |

Weak |

|

|

|

D |

|

Poor |

|

|

|

E |

|

Under regulatory Supervision |

|

|

|

F |

|

In Liquidation |

|

|

|

S |

|

Suspended |

All licensed insurance companies must meet the requirements of the solvency standards for insurance business as set by the Reserve Bank of New Zealand. These solvency standards state that we must hold a minimum amount of solvency capital, so that we are in a position to pay claims to our customers during unexpected events (such as earthquakes or pandemics).

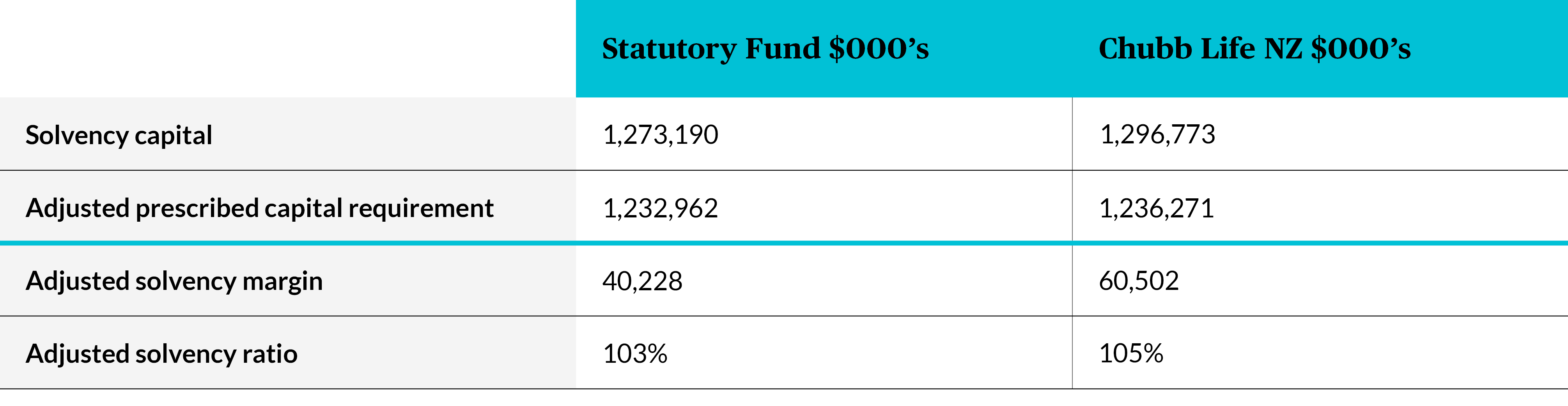

The adjusted solvency margin of Chubb Life NZ as at 30 September 2025 is $60.5m, of which $40.2m was the adjusted solvency margin of the Statutory Fund. The table below shows how the adjusted solvency margins are determined:

We calculate our capital according to the Reserve Bank standard. That’s our solvency capital. Then we compare that to the minimum amount of capital that the Reserve Bank requires us to hold (the adjusted prescribed capital requirement).

The adjusted solvency margin tells you how much more capital we hold, above the minimum set by the Reserve Bank, and the solvency ratio shows you that as a percentage. Generally speaking, a large margin helps to protect policyholders by making sure we can absorb losses before you are impacted.

Chubb Life NZ is required under the Insurance (Prudential Supervision) Act 2010 to establish a Statutory Fund. For all Chubb Life NZ's life insurance policyholders, we advise that the Statutory Fund relevant to your policies is Chubb Life NZ's Statutory Fund Number One.