1. The Covid-19 Effect

Resources for Brokers

Driving up costs

As borders across the globe reopen, the long-term impacts of a global pandemic have led to a number of factors driving up medical and travel costs. The insurance industry as a whole has been faced with a significant surge in medical claims in the past year and has seen a rapid increase in the cost of medical treatment worldwide, a trend we expect to continue in 2022 and beyond.

1. The Covid-19 Effect

2. Higher Travel Costs

3. Medical Costs

|

|

|

|

|

|

|

|

|

|

|

|

*Source: WTW 2022 Global Medical Trends Survey Report. Download full report

|

Does Chubb BTI cover COVID-19 related medical expenses for an overseas business trip? |

|

Does Chubb BTI cover COVID-19 related medical expenses for a directors’/executives’ private overseas travel? |

|

|

Does Chubb BTI provide cover if a person contracts COVID-19 and needs to change or cancel their travel plans?

|

||

| Is cover provided if a person needs to quarantine whilst travelling? Cover may be provided up to the amount shown in the Schedule, under Section 6 – Cancelation and Disruption, if the covered individual is directed by a health authority to quarantine after contracting COVID-19 whilst traveling.* |

||

| Does a person need to be vaccinated against COVID-19 to be covered? No, this is not a condition of the policy. However, the Covered Person must abide by travel vaccination requirements set out by a country, territory, accommodation and transport providers etc. |

*A loss which is a result of Incidental Private Travel or Directors and Executives Private Travel shall be limited to a maximum of $20,000 per Covered Person per event.

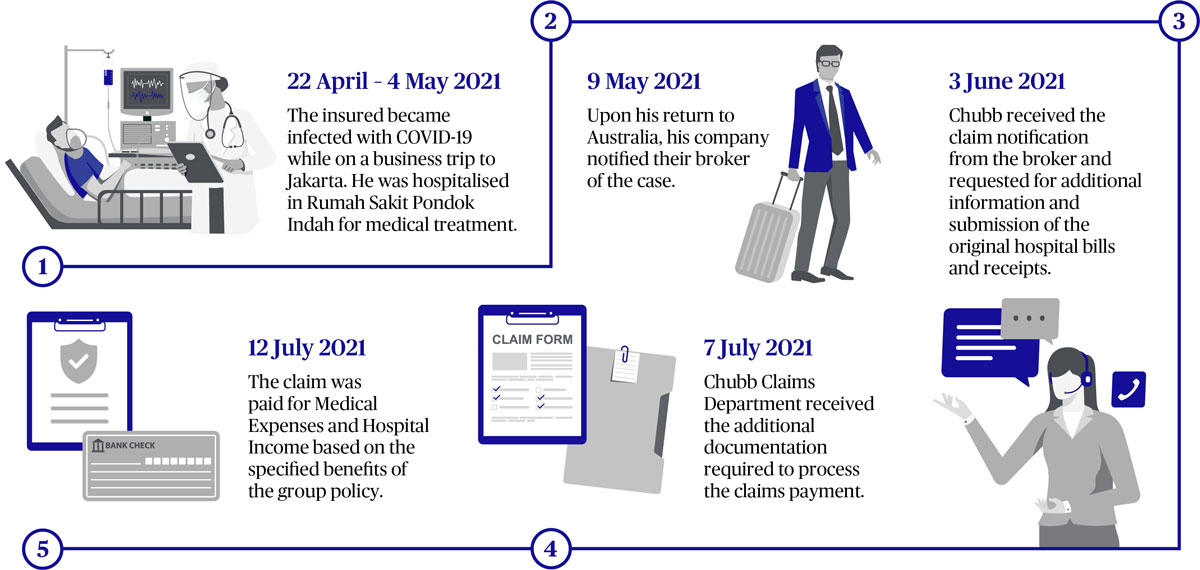

Example of a COVID-19 related business travel claim

Additional resources for brokers

A number of factors have led to general instability and uncertainty in today’s market, and we know these are challenging times for our brokers. Chubb is here to support you and your business, and equip you with the insights and tools to be able to demonstrate your value, and the value of adequate insurance coverage, to your clients.

Chubb Return to Travel Survey

In 2021 Chubb conducted a global survey to find out the concerns of business travellers today.

Contact us to find out how we can help you get covered against potential risks