[Infographic] Regional SME cyber preparedness report 2019

In the past 12 months, more than two-thirds (68%) of Small and Medium-sized Enterprises (SMEs) in Australia, Hong Kong, Singapore and Malaysia have experienced a cyber incident. Amid a rising digital economy globally, the number of businesses affected will only increase.

Despite this, many SMEs in the markets studied remain unconcerned by this clear and present danger to their business, choosing to gamble their business on what is – at best – a 50:50 chance of being involved in a cyber incident. The odds are only half the story here though.

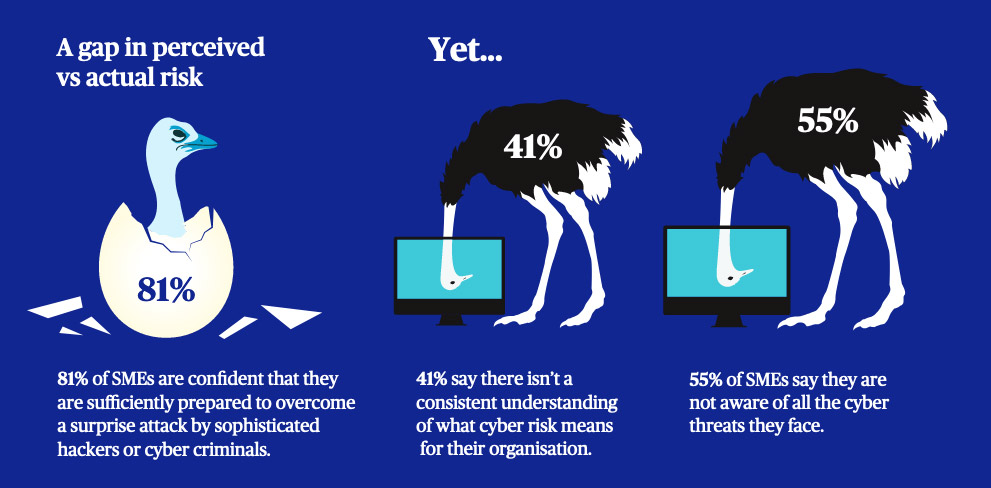

At the core of our survey results this year is that SMEs remain ignorant when it comes to cyber risk and are risking it all by not investing in improving their defences. A disconnect between perceived and actual risk was apparent in our 2018 report, and it continues to persist in 2019.

On one hand, 81% of SMEs are confident that they are sufficiently prepared to overcome a surprise attack by sophisticated hackers or cyber criminals.

On the other, more than half (55%) of SMEs concede they are not aware of all the cyber threats they face. 41% also agree that there isn’t a consistent understanding of what cyber risk means for their organisation.

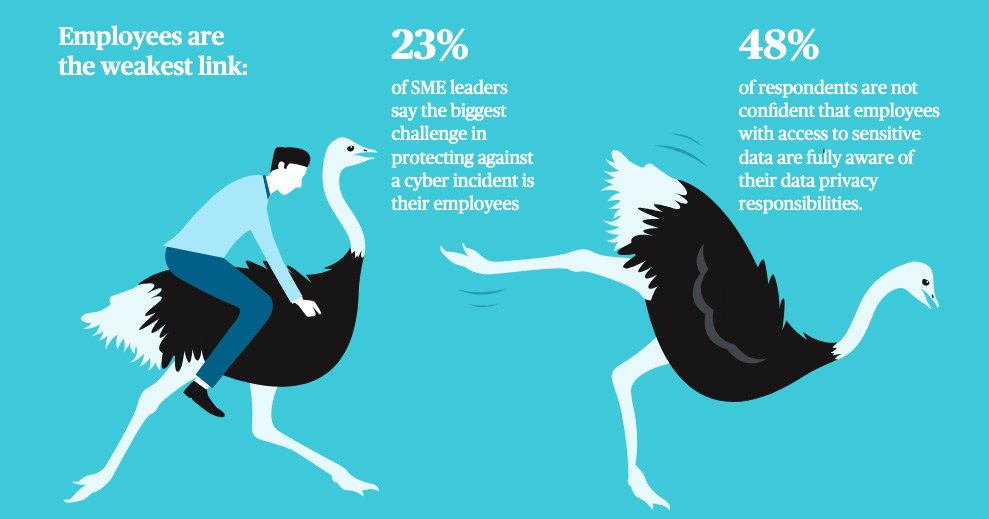

On average, 23% of SME leaders say the biggest challenge in protecting the organisation against a cyber incident is their employees. This is just one of the several data points in the survey suggesting that employees are widely regarded as the weakest link in managing cyber risks. Almost half (48%) of respondents are not confident that employees with access to sensitive data are fully aware of their data privacy responsibilities.

This content is brought to you by Chubb Insurance New Zealand Limited (“Chubb”) as a convenience to readers and is not intended to constitute advice (professional, financial or otherwise) or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/nz-en through your broker or by contacting any of the Chubb offices. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of the content. Readers relying on any content do so at their own risk. It is the responsibility of the reader to evaluate the quality and accuracy of the content. Reference in this content (if any) to any specific commercial product, process, or service, and links from this content to other third party websites, do not constitute or imply an endorsement or recommendation by Chubb and shall not be used for advertising or service/product endorsement purposes. ©2020 Chubb Insurance New Zealand Limited Company No. 104656 FSP No. 35924. Chubb®, its logos, and Chubb.Insured.SM are protected trademarks of Chubb.

Interested in this Chubb policy?

Have a question or need more information? Contact us to find out how we can help you get covered against potential risks