Why you need a valuation for your collectibles — and how to get one

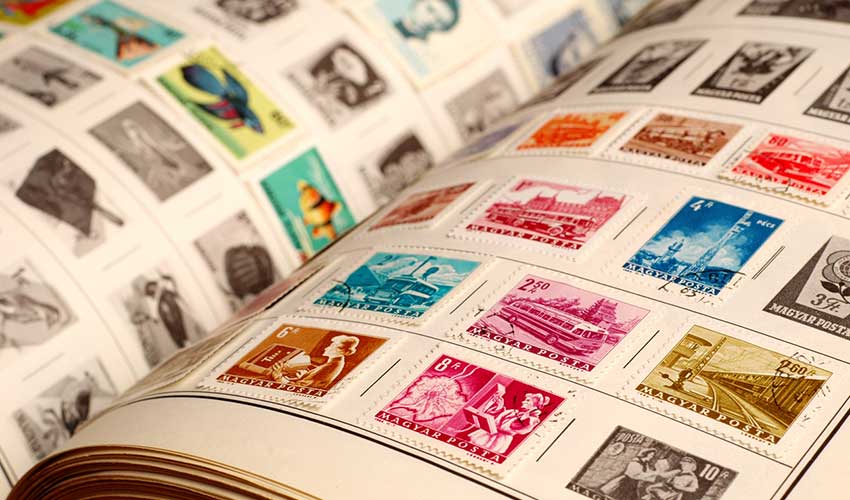

Whether you’ve inherited a few pieces of jewellery, are starting to collect sports memorabilia, or have invested in wine or fine art over the years, your collectibles are a part of your history and your story. They may even be worth a substantial amount of money.

Any time you own a collection, consider getting the items valued. Here’s why:

- You’ll probably want to protect them. To get insurance on valuable collectibles, you may need to know how much they’re worth. A valuation will let the insurance company know the appropriate compensation amount if your pieces are lost, stolen or damaged. Keep in mind that most standard homeowner’s policies will provide limited coverage for valuables. To fully protect your collectibles, you may need a premium policy.

- You may want to sell them. If you’re looking to sell your valuables, you’ll need to know how much to charge, and potential buyers will probably want to know the process by which the item’s value was determined. A professional valuation is the way to go.

- You may have inherited them. If you inherited collectibles, you may need to have them valued to accurately calculate any applicable taxes if you later decide to sell them. You should seek specialist tax advice in this regard.

You may be surprised to know that there are different values for the same item. Depending on the purpose of the valuation, the same item can have more than one type of value. The two most common are fair market value and retail replacement value.

- Fair market value is the price at which property would change hands between a willing buyer and a willing seller. This value is typically used for tax purposes or to inform a sale.

- Retail replacement value is the highest amount that would be required to replace a piece with another of similar age, quality, origin, appearance provenance, and condition. This value is typically used for insurance purposes.

How do you go about getting a professional valuation?

People often think that the way to get a valuation is to go to the place where that type of valuable is sold. For example, if you inherited an antique collection, you might think it wise to go to an antique shop for a valuation.

Actually, the opposite is true!

Make sure you seek out an expert who does not have an active interest in purchasing your item.

To find a registered valuer:

- Consult a reputable valuer association. Search for a member of the National Council of Jewellery Valuers or the Auctioneers and Valuers Association of Australia. To obtain and maintain membership in these organisations, valuers must complete courses and exams, demonstrate years of experience, and adhere to a set of strict ethical standards.

- Look for someone who has expertise in what you have. Not all valuers have knowledge of all types of valuables, so find someone who really knows the type of item you have.

- Avoid valuers who charge a fee based on a percentage of the item’s value. This is a conflict of interest. Instead, your valuer should charge a flat fee or hourly rate.

This content is brought to you by Chubb Insurance Australia Limited (“Chubb”) as a convenience to readers and is not intended to constitute advice (professional or otherwise) or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/au, through your broker or by contacting any of the Chubb offices. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of the content. Readers relying on any content do so at their own risk. It is the responsibility of the reader to evaluate the quality and accuracy of the content. Reference in this content (if any) to any specific commercial product, process, or service, and links from this content to other third party websites, do not constitute or imply an endorsement or recommendation by Chubb and shall not be used for advertising or service/product endorsement purposes. ©2024 Chubb Insurance Australia Limited ABN: 23 001 642 020 AFSL: 239687. Chubb®, its logos, and Chubb.Insured.SM are protected trademarks of Chubb.

Have questions?

Contact a broker today.