A safety net for the workforce

In a buoyant economy, employee turnover is usually high as jobs are more easily available. Depending on the country, the cost of replacing a mid-level executive is about 20% of their annual salary while replacing a senior level executive can range from 213% to 400%* of annual salary.

Investing in policies that support employee retention has become essential as companies recognise the high cost of rehiring and training. Policies such as paid sick leave, childcare leave, health and personal accident insurance also demonstrate an employer’s commitment to their Duty of Care obligations and the general well-being of their employees. Let’s see how a simple Group Personal Accident insurance plan provides a strong safety net for employees and employers in the following scenarios. Cover was utilized under their Group insurance coverage provided by Chubb.

Scenario 1

The insured, a videographer working for a film production house, was knocked down by an e-scooter on his way home. He fractured his arm.

Fortunately, the film production house has a Group Personal Accident Policy that covers employees for loss of income and other benefits.

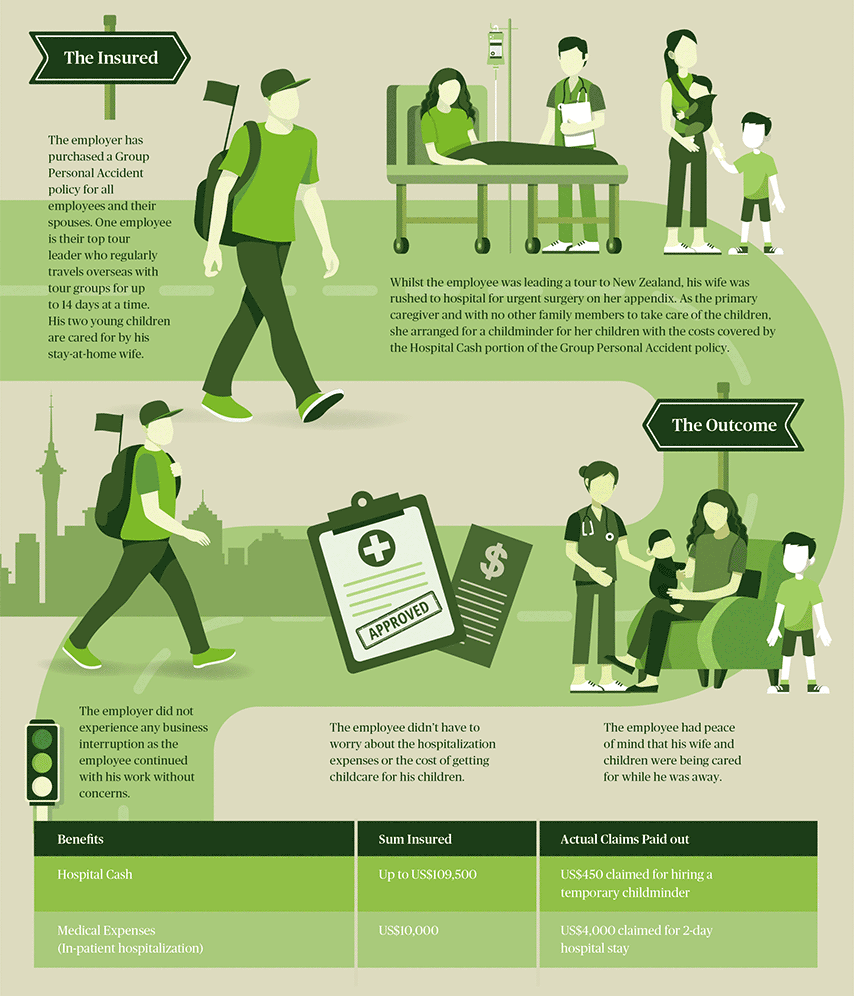

Scenario 2

An employee insured by his employer’s Group Personal Accident also covered his spouse. While leading a tour overseas, his wife had to be hospitalized. Using the policy benefits, he claimed for a childminder to look after his young children without having to return home.

Scenario 3

The insured is a fly-in fly-out worker based in Darwin, Australia. Unfortunately, he was diagnosed with cancer and had to undergo medical treatment. His company’s Group Personal Accident covers loss of income due to illness. As such, he was able to continue providing for his family and did not suffer a drop in his living standard.

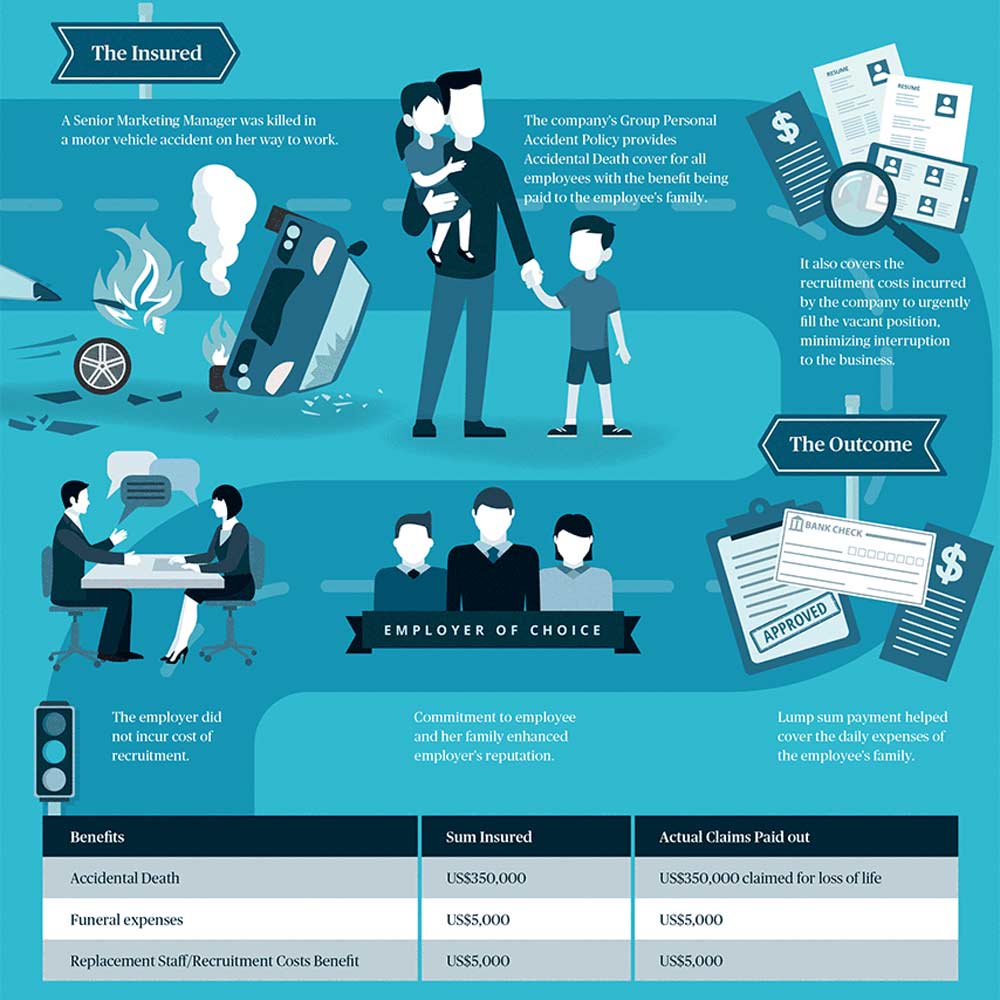

Scenario 4

In this unfortunate case, the insured died from a road accident but his family received a lump sum payment from her company’s Group Personal Accident Policy.

*Source: https://www.quill.com/blog/careers-advice/turning-the-tables-the-cost-of-employee-turnover.html?cm_mmc=NEW_Infographic

*Source: https://www.quill.com/blog/careers-advice/turning-the-tables-the-cost-of-employee-turnover.html?cm_mmc=NEW_Infographic

This content is brought to you by Chubb Insurance Australia Limited (“Chubb”) as a convenience to readers and is not intended to constitute advice (professional or otherwise) or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/au, through your broker or by contacting any of the Chubb offices. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of the content. Readers relying on any content do so at their own risk. It is the responsibility of the reader to evaluate the quality and accuracy of the content. Reference in this content (if any) to any specific commercial product, process, or service, and links from this content to other third party websites, do not constitute or imply an endorsement or recommendation by Chubb and shall not be used for advertising or service/product endorsement purposes. ©2020 Chubb Insurance Australia Limited ABN: 23 001 642 020 AFSL: 239687. Chubb®, its logos, and Chubb.Insured.SM are protected trademarks of Chubb.

Have questions?

Contact a broker today.