Chubb to join the Cyclone Reinsurance Pool

- Chubb will join the Cyclone Reinsurance Pool on 1 January 2024.

- Policies will be progressively transferred into the pool by Chubb and its underwriting agencies from 1 January 2024 onwards.

- By 31 December 2024 all eligible policies will be covered by the Cyclone Reinsurance Pool.

- The underwriting appetite across home, strata and small business policies remains unchanged.

What is the Cyclone Reinsurance Pool about?

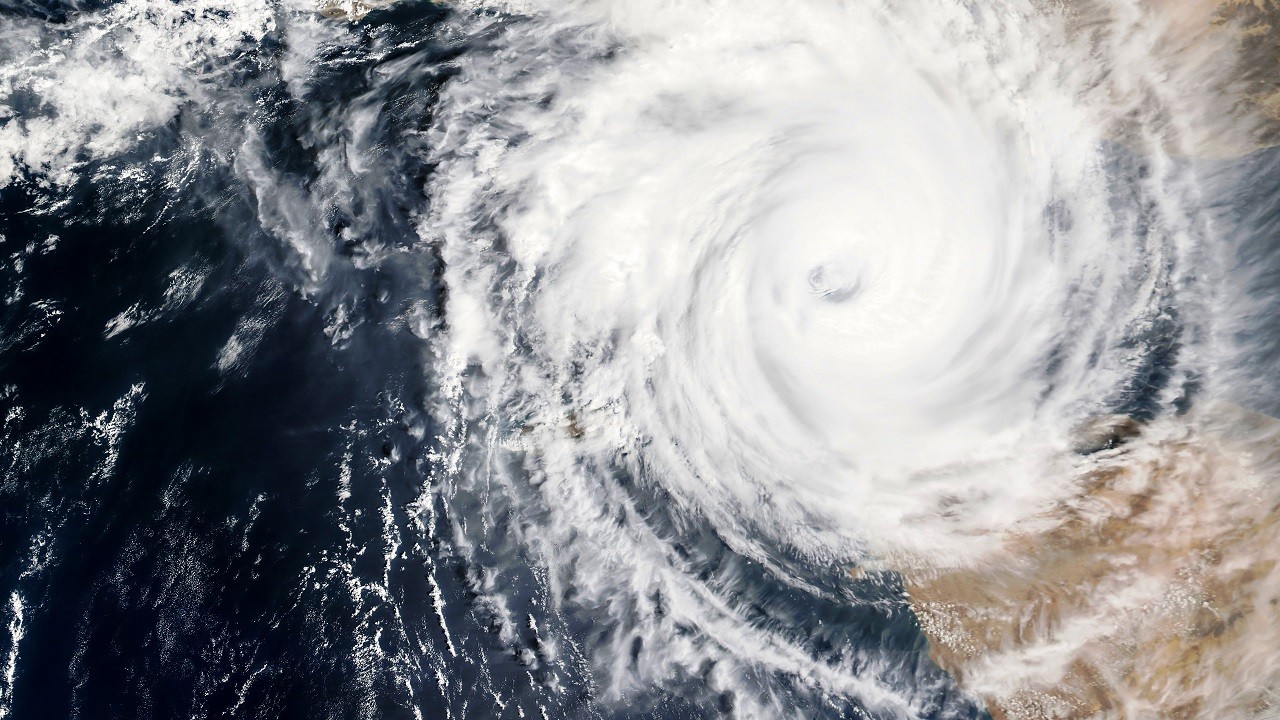

The Cyclone Reinsurance Pool provides reinsurance to insurers in Australia so that they can transfer their risk for cyclones and cyclone-related flood damage. This reinsurance arrangement between insurers and the Australian Reinsurance Pool Corporation (ARPC) is backed by a $10 billion Government guarantee1 and aims to improve insurance affordability for northern Australia. Household, strata, and small commercial property insurance policies are covered by the Cyclone Reinsurance Pool. It provides Australia wide reinsurance for insurers but targets support to cyclone-prone areas such as northern Australia.

What does the Cyclone Reinsurance Pool cover?

The Cyclone Reinsurance Pool covers home, strata, and small business policies including 2 :

- residential home and contents, including landlord insurance and farm residential cover, residential fine art collections

- residential strata, including mixed-use strata schemes (where 50 per cent or more of floor space is used mainly for residential purposes)

- commercial property policies with less than $5 million total sum insured across risks covered by the pool (property, contents, and business interruption) marine stock with less than $5 million total sum insured, commercial fine art collections with less than $5 million total sum insured

For more information about the Cyclone Reinsurance Pool, visit the Australian Reinsurance Pool Corporation website at www.arpc.gov.au/reinsurance-pools/cyclone.

From 1 January 2024 we will progressively transition our residential home and contents, strata and small business property policies.

The design of the cyclone reinsurance pool is intended to make insurance for cyclone exposed risks more affordable. As such, insureds in cyclone-prone areas may see a reduction in the cyclone and cyclone-related flood components of their premium. It is important to understand that a variety of other risk factors go into the calculation of an insurance premium and every risk will be considered on its own specifics.

No. The cyclone pool is a reinsurance arrangement between insurers and ARPC.

Yes. Participation is mandatory for Australian general insurers with eligible cyclone pool insurance contracts as per the Terrorism and Cyclone Insurance Act 2003 (Cth).