Cyber incidents by the numbers

An insight into Chubb's cyber claims experience over the past decade

Chubb has been providing cyber risk solutions since the launch of our first product in 1998. As a result of these decades of experience, we have gained meaningful insights into the various perils and average costs associated with cyber incidents in direct relation to the many industries affected.

By sharing our industry-specific experience, our aim is to increase awareness of cyber exposures for our insureds and broker partners. This information may aid executives, risk managers and information technology professionals in crafting their overall enterprise risk management framework including proactive loss mitigation as well as cyber insurance tailored for the organisation.

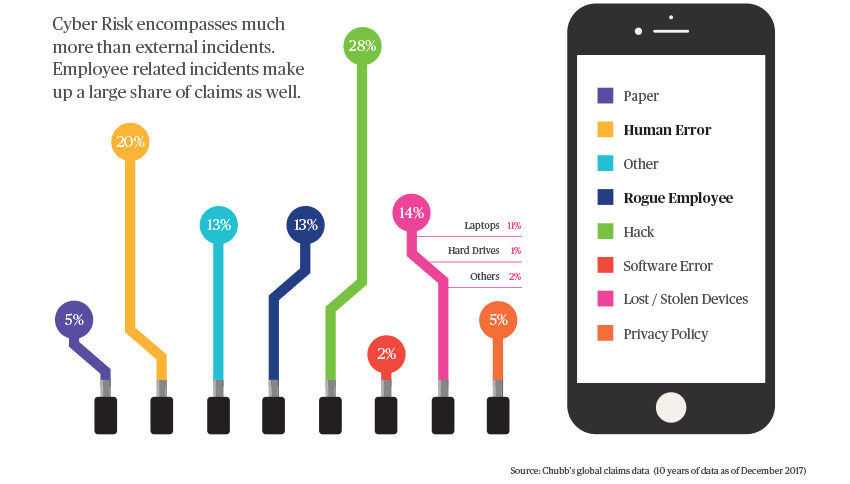

Triggers of cyber incidents

Our past decade of claims experience helps to dispel the notion that cyber insurance only responds to hacking and that these technology driven incidents only target organisations which handle a significant amount of data. In fact, all companies may face cyber exposures far beyond the sophisticated incidents which occupy the news headlines.

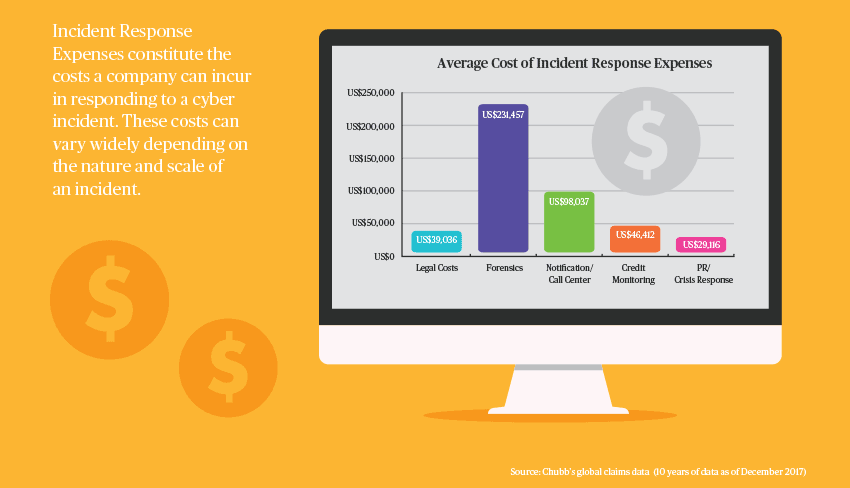

Cost of cyber incidents

The following are average costs our insureds have incurred in responding to cyber incidents before any follow on liabilities like regulatory proceedings or other litigation. While liability issues can’t always be mitigated, the majority of claims costs result from direct crisis costs incurred to contain and remediate the incident.

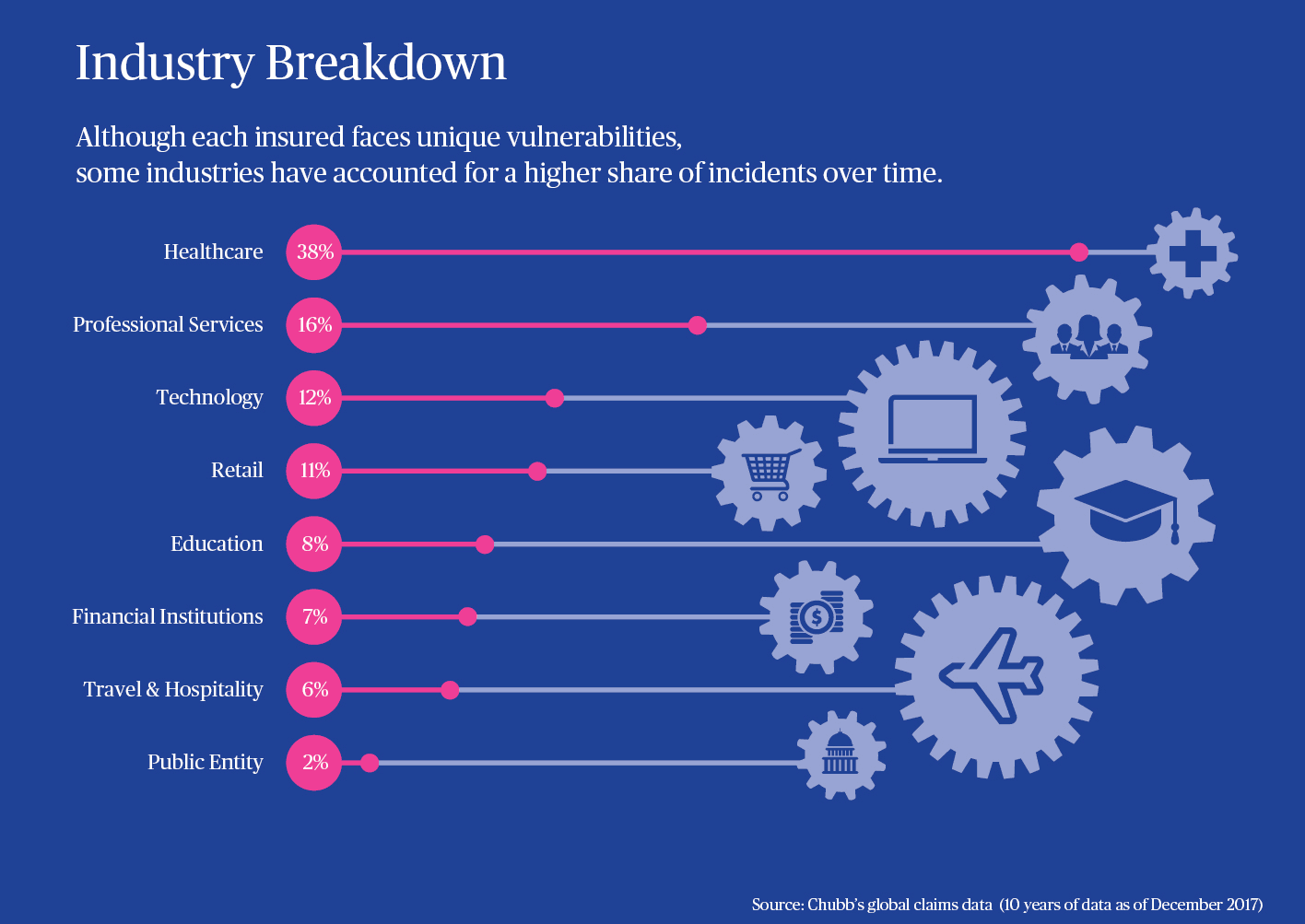

Industry breakdown

While the healthcare industry has made up the largest share of our cyber claims, the distribution of claims across all industries continues to widen.

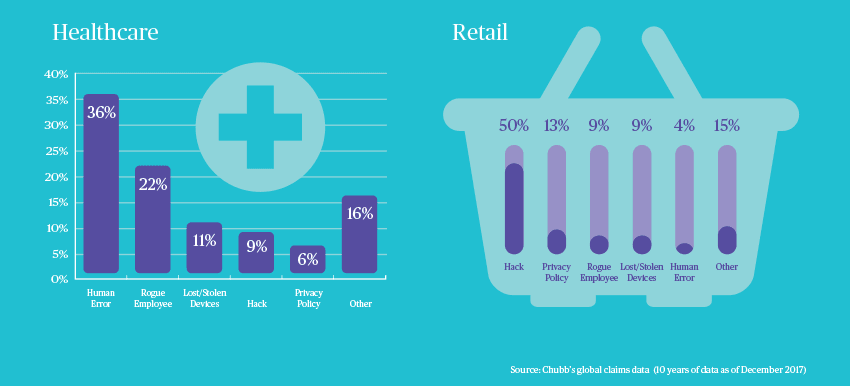

Claim triggers by industry segment

While hacking has represented a majority of cyber incidents for some industries like Retail, a large share of the incidents we handle stem from other scenarios like rogue employees or simple human errors. For example, healthcare organisations have faced a vast majority of human related issues as opposed to malicious hacks.

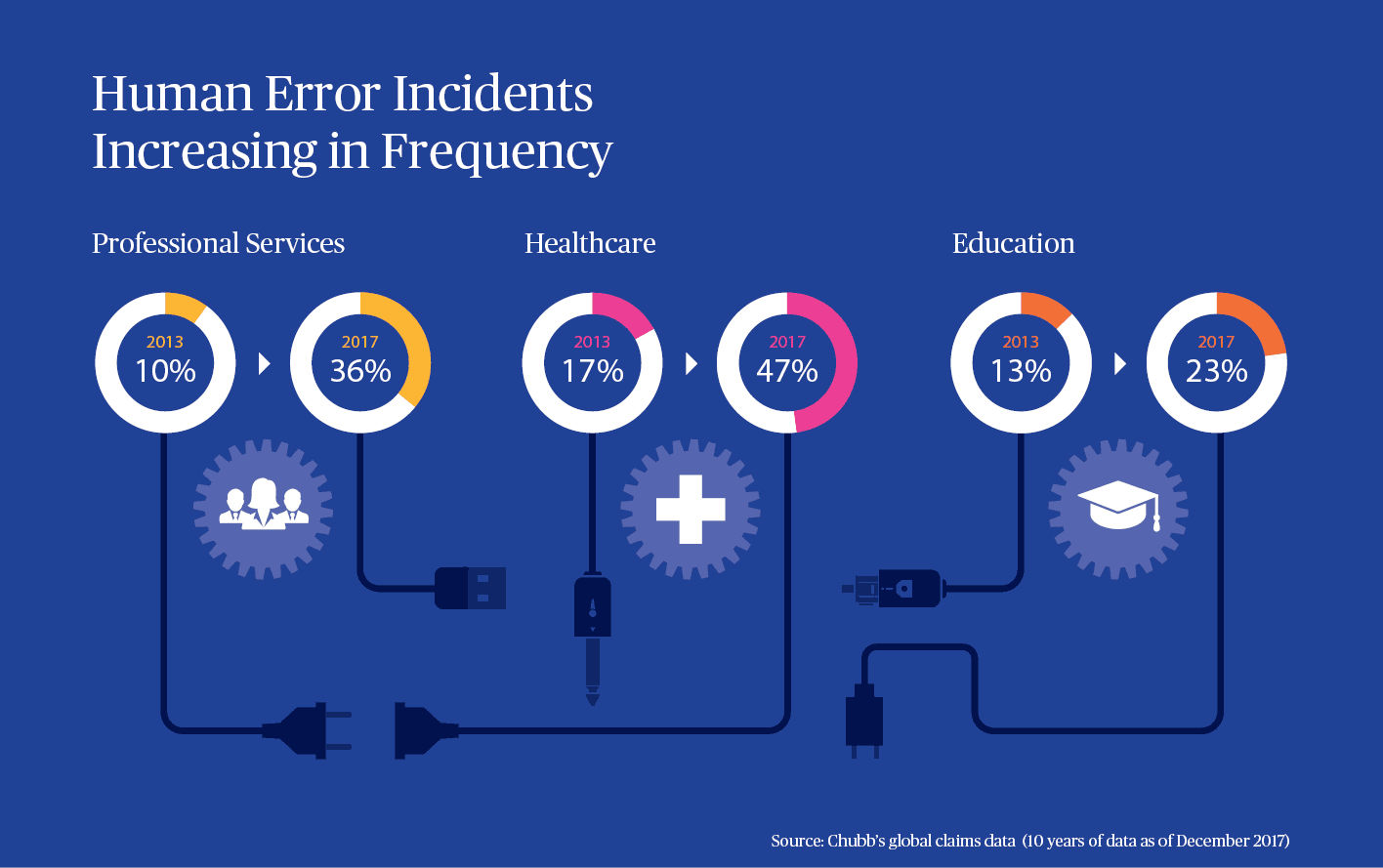

Incidents caused by human error are increasing in frequency

All industries share one common denominator of rising claims from human-related errors, with the increase more pronounced in some industries than others. These trends may provide important insights for organisations as they identify their vulnerabilities and areas to allocate proactive risk mitigation resources.

Cyber related exposures will continue to evolve and therefore demand innovative coverage and risk mitigation solutions. Chubb’s information sharing and experience based approach to cyber risk aim s to support this ever important process.

This content is brought to you by Chubb Insurance Australia Limited (“Chubb”) as a convenience to readers and is not intended to constitute advice (professional or otherwise) or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/au, through your broker or by contacting any of the Chubb offices. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of the content. Readers relying on any content do so at their own risk. It is the responsibility of the reader to evaluate the quality and accuracy of the content. Reference in this content (if any) to any specific commercial product, process, or service, and links from this content to other third party websites, do not constitute or imply an endorsement or recommendation by Chubb and shall not be used for advertising or service/product endorsement purposes. ©2020 Chubb Insurance Australia Limited ABN: 23 001 642 020 AFSL: 239687. Chubb®, its logos, and Chubb.Insured.SM are protected trademarks of Chubb.

Have questions?

Contact a broker today.