Embedded insurance – 6 things you need to know and how to make it real

Embedding insurance protection into consumer products has been an effective way to provide added relevant value while offering a simple, high-value customer experience in the past. With the emergence of the digital economy, changing demographics and strong economic development in the Asia Pacific Region, the demand for embedded insurance has taken a different form.

-

What is embedded insurance?

Embedded Insurance is offering more affordable, relevant and personalised insurance to people when and where they need it most, according to Simon Torrance, author of New Growth Playbook.

-

How is embedded insurance offered to consumers?

By abstracting insurance functionality into technology, embedded insurance enables any third-party provider/developer to integrate innovative insurance products into its customers’ purchase journeys seamlessly, rapidly and at a low cost. The end benefit is a stronger value proposition for the customers, thereby building brand preference and ultimately, customer loyalty.

-

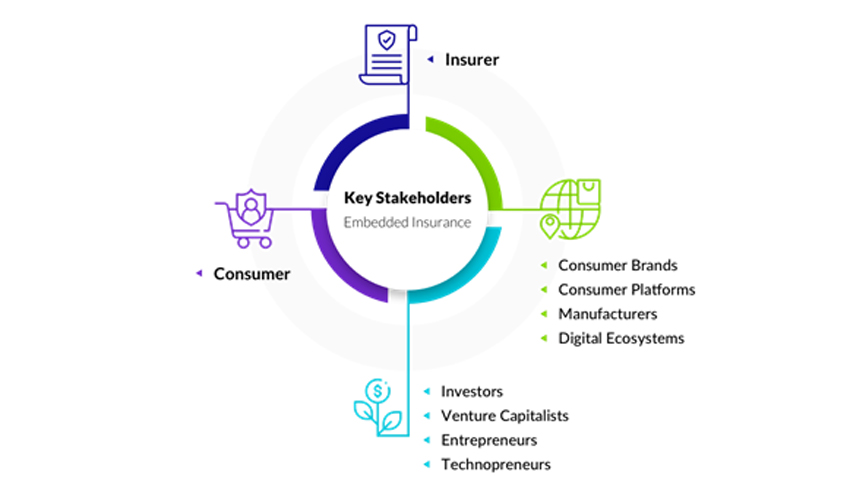

Who are the key stakeholders?

-

What is the embedded insurance market size?

US$3 trillion in total in 20201. US$700 billion in GWP for P&C by 2030.

-

Why is there an interest in embedded insurance?

Besides the market size, the need for insurance is greater than ever as the protection gap has widened. From 2000 to 2020, the gap has doubled largely due to digitisation, urbanisation, climate change and a lack of effective innovation2.

According to a study by Swiss Re, the global protection gap reached US$1.2 trillion in 20193. Natural catastrophe, mortality and health care are the top three factors contributing to the widening gap. The biggest gaps are in emerging Asia and Latin America. -

How can every company become a part of embedded insurance?

In 2020, Chubb released a global platform called Chubb StudioSM that simplifies and streamlines the distribution of the company's insurance products through its partners' digital channels around the world. The platform enables Chubb's partners in e-commerce, banking, fintech, airline, telecommunications, retail and other industries to add digital insurance inside their ecosystem in an easy, frictionless manner.

Chubb Studio provides partner companies with digital access to Chubb's extensive range of consumer insurance products, including personal accident, supplemental health and life, residential and contents, mobile phone and travel as well as small business insurance, customer services and claims capabilities.

The capabilities of Chubb Studio were built on the company’s ability to successfully forge distribution partnerships with leading brands globally. Prior to the launch of Chubb Studio, the company had more than 150 distribution partnerships globally. Five partnerships announced in the last three years alone have given the company access to more than 100 million customers in Asia and Latin America.

As you may have more insights on embedded insurance, please share them with me, If you are keen to learn how Chubb can collaborate with you, please contact Chubb at CustomerCare.MY@Chubb.com.

1 https://www.linkedin.com/pulse/embedded-insurance-3-trillion-market-opportunity-could-simon-torrance/?trackingId=URCJGoln8ZVEQtHYxt4AkQ%3D%3D

2 https://www.linkedin.com/pulse/embedded-insurance-3-trillion-market-opportunity-could-simon-torrance/?trackingId=URCJGoln8ZVEQtHYxt4AkQ%3D%3D

3 https://riskandinsurance.com/global-protection-gap-reached-trillions-but-might-be-good-news/#:~:text=There's%20a%20global%20insurance%20protection,of%20these%20risks%20are%20insured.

The benefit(s) payable under eligible certificate/policy/product is(are) protected by PIDM up to limits. Please refer to PIDM’s TIPS brochure or contact Chubb Insurance Malaysia Berhad or PIDM (visit www.pidm.gov.my)

This content is brought to you by Chubb Insurance Malaysia Berhad, Registration No. 197001000564 (9827-A) (“Chubb”) as a convenience to readers and is not intended to constitute advice or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/my, through your broker or by contacting any of the Chubb offices or Chubb agents. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of this content. It is the responsibility of the reader to evaluate the quality and accuracy of material herein.

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks