High risk vs low risk drivers: Which one are you?

What kind of driver are you? Do you typically speed up when the traffic light turns yellow? We Malaysians are generally seen as kiasu drivers, thanks to our notorious driving habits. Things like speeding, violating traffic rules and using our phones while driving are some of the common habits we’ll see on the road.

The Malaysian Institute of Road Safety Research reported that in 2016 alone, there was a total of 521,466 road accidents, 7,152 of which were fatal.

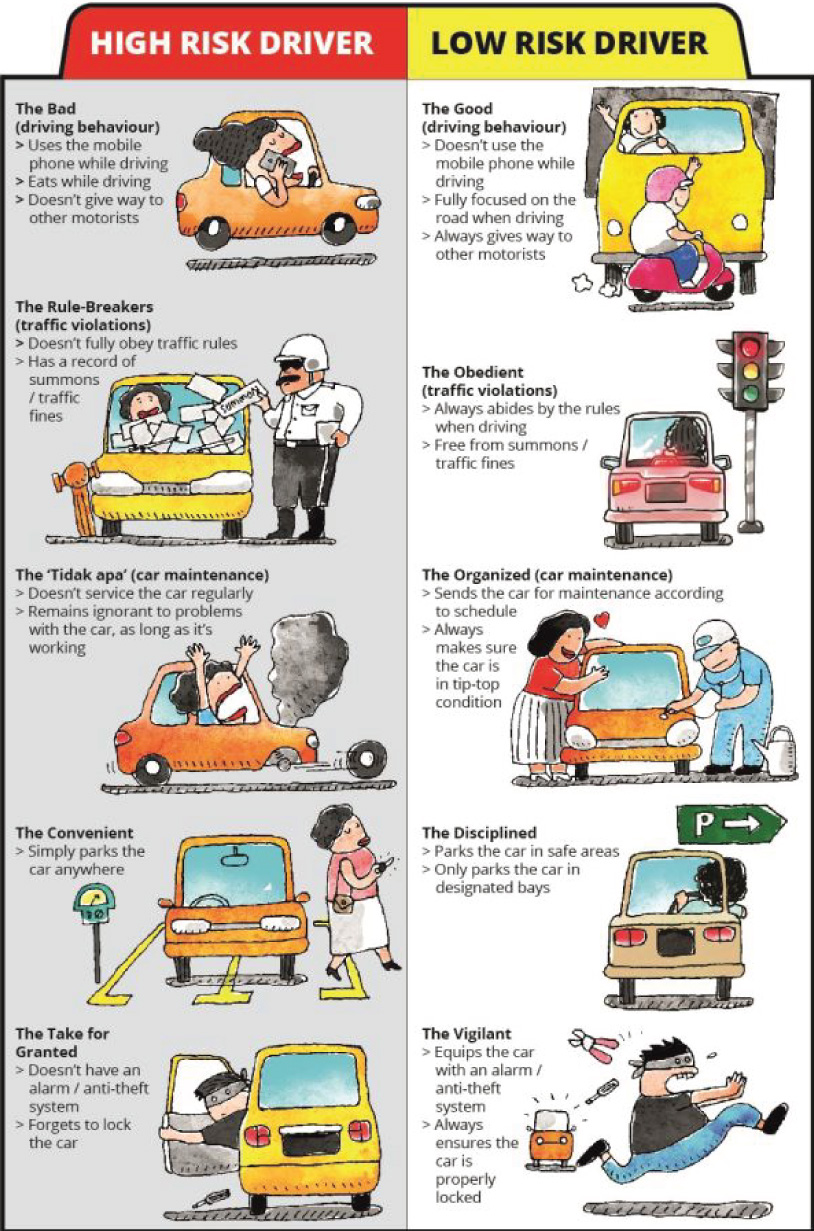

Drivers who are prone to reckless and dangerous behaviour on the road are categorised as high risk drivers. While we may come across these high risk drivers on the roads, there are many more Malaysians who are careful when they’re driving. They’re courteous to fellow drivers, always mindful about where they park and obediently follow traffic rules.

Based on your habits, which category do you belong to?

Your driver risk profile affects you more than you think. Effective July 1, 2017, the fixed premium rates for Comprehensive and Third Party Fire and Theft Motor products were liberalised, this means that drivers can now be charged different premium rates based on their driver risk profile.

Low risk drivers enjoy lower premiums compared to their riskier counterparts. Other than different premium rates, the liberalisation of motor insurance allows insurers to offer other benefits to customers.

Customers will now find a wider range of products in the motor insurance industry. Rather than the standard insurance plans, insurance companies are now competing to come up with new plans that best suits the needs of their customers.

With a reliable insurance plan, you can rest easy knowing that you’re protected while on the road.

Before you dive into signing up for new plans, look at the different features and consider which would best benefit you based on your lifestyle. If you’re prone to certain risks, like floods, it would be wise to invest in a plan that offers coverage for flood damage.

Pricing shouldn’t be the only factor to consider when choosing an insurance plan. Determine what kind of protection you require, whether the plan covers that, and if the price of the plan matches its value.

Having motor insurance is a huge relief during unexpected circumstances. In some cases, it can make or break a person’s bank balance. So when you’re deciding on an insurance plan, be sure that you understand its coverage.

Don’t be shy – ask questions and check out reviews. Don’t jump into a plan without fully understanding what it entails. It’s also comforting to hear feedback from someone who is currently covered by an insurance plan that you are looking to purchase.

Source: This article was first published in The Star Online on October 12, 2017

The benefit(s) payable under eligible certificate/policy/product is(are) protected by PIDM up to limits. Please refer to PIDM’s TIPS brochure or contact Chubb Insurance Malaysia Berhad or PIDM (visit www.pidm.gov.my)

This content is brought to you by Chubb Insurance Malaysia Berhad, Registration No. 197001000564 (9827-A) (“Chubb”) as a convenience to readers and is not intended to constitute advice or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/my, through your broker or by contacting any of the Chubb offices or Chubb agents. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of this content. It is the responsibility of the reader to evaluate the quality and accuracy of material herein.

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks