After 15 years in Singapore, I returned to Vietnam as country head for Chubb’s general insurance business. Before coming back, I kept hearing about the digital transformation in Vietnam with high penetration of internet and smartphones, but nothing beats living in the middle of the transformation. Every day, I pass by this fruit juice pushcart on my way home from work: the men sell fruit juices at $1 a cup and they offer free Wifi to attract customers. This is so affirmative of Vietnam as a "mobile-first market" with "over 51 million smartphones, representing over 80% of the population aged 15-years and older[1]."

Since being back, I have had several discussions with business leaders about the current state of digital partnerships. I sensed scepticism as to whether they work. Some said, “People simply don’t buy insurance here and we see no traction”, while others said, “Insurance needs face-to-face sales, so “digital” doesn’t work here.”

Chubb, with a track record of more than 150 successful partnerships globally, believes that we know how to make partnerships work. Therefore, when I was invited by Future Finance Live to speak at their ‘Digital Transformation for Insurance’ webinar, I proposed ‘Digital Ecosystems & Insurance: A Winning Partnership and is Vietnam ready to ride the wave?’ as my topic, to share with the industry some of our experience.

Impact of technology on Vietnam’s economy and society

It is a known fact that technology has changed consumer behavior and influenced the way the Vietnamese live and do business in Vietnam. Technology has shaped the way they conduct business, manufacture goods, seek a certain lifestyle, make purchases, choose investment products, buy insurance and communicate.

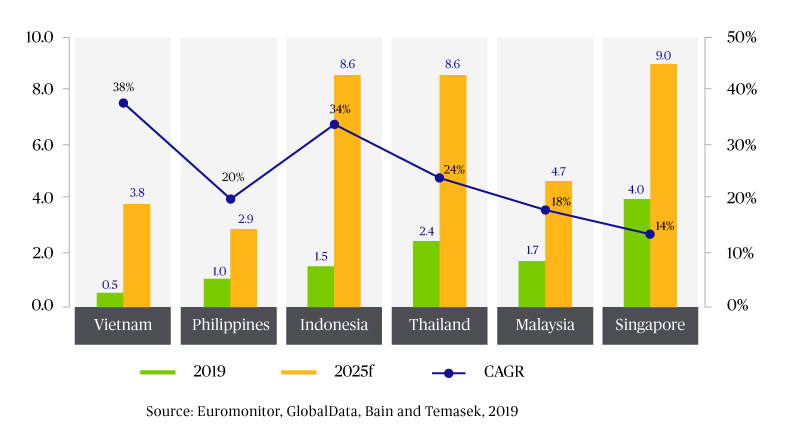

I have mentioned the 51 million smartphones, but do you know there are 68 million internet users in a country of 98 million people²? Google’s search report³ shows that the year-on-year growth for retail and online search in Vietnam is 100%. This can translate into huge potential in the digital banking and e-wallet space. With only 30.8% of Vietnamese having bank accounts according to Global Findex Index⁴, there is a big gap in financial inclusion. Take a look at the forecast for digital financial service revenue growth in Southeast Asian countries below, where Vietnam leads in terms of Compound Annual Growth Rate (CAGR) –

Insurance Distribution and Digital Ecosystems

Insurance Distribution and Digital Ecosystems

Growing digital financial services goes hand in hand with offering affordable, simple and accessible insurance products to the Vietnamese consumers and Small & Mid-sized Enterprises (SMEs). This gives rise to partnerships beyond the traditional bancassurance distribution model. Non-traditional partnerships are expanding rapidly as leading brand names move beyond their core business to meet new business opportunities and consumer demands, while expanding their value chains along the way. This new business model requires building partnerships powered by technology, which then gives rise to the creation of digital ecosystems. Several of these ecosystems have sprouted in Vietnam, both indigenous and foreign.

With digital ecosystems building platforms to create one-stop shopping and hyper-relevant experiences, new risks have emerged. This is where insurance comes in to manage these risks, e.g., with more consumers transacting online, cyber purchase protection is emerging as a very strong need.

Insurance products offered on these platforms for personal accident, mobile devices, purchase protection and SMEs, among others, are simple and easy to purchase. All you need is a smartphone, an app and an e-wallet. Let’s take a look at our partnership with Grab.

Chubb x Grab Partnership

This partnership has been instrumental in creating innovative and contextual offerings for its delivery partners and passengers since 2018. Grab has recently announced that its financial arm has sold 100 million insurance policies in less than two years in Southeast Asia.

Our star product - Ride Cover – covers death and disability if the passenger is involved in an accident during the ride. For as little as USD0.10 per ride, the end-to-end process is powered by technology within the app.

The winning formula

Through our partnership with Grab, one of 150 brands that we collaborate with globally, we are confident of our winning formula that’s been proven to maximize the opportunities from digital ecosystems.

The formula lies in defining the brands’ expectations from their insurers in these four areas:

- Brands must assess their insurance partner carefully in terms of system integration, best practices and the competence of the team resources.

- Brands must also check the financial strength of the insurers as their ability to pay claims efficiently and promptly can enhance their brand reputation.

- Brands operating in multiple markets need to ensure they select an insurer which can support them in all markets to enable efficient scaling of the solutions in all their markets.

- Brands need to demand a long-term investment commitment (both financial and people resources) from their insurers as five to 10 year roadmaps become the norm.

Chubb’s commitment to Digital Ecosystems

Chubb started building its digital capabilities several years ago, culminating in a full solution suite with the launch of Chubb Studio® in 2020 as a long-term investment in growing digital ecosystems. Chubb Studio simplifies and streamlines the distribution of our insurance products through our partners' digital channels around the world. It enables our partners in e-commerce, banking, fintech, airline, telecommunications and other industries to promote or sell insurance inside their ecosystems in an easy, frictionless manner.

Chubb Studio also provides our partners with digital access to our extensive range of consumer insurance products, including personal accident, supplemental health and life, residential and contents, mobile phone and travel as well as small business insurance.

As I have started a new chapter in my career, I am looking forward to connecting with more brands in Vietnam. Please connect with me on LinkedIn or email: khue.dinh@chubb.com

References:

[1] How new technology is transforming Vietnam's economy by Sarah Lazarus, CNN,

https://edition.cnn.com/2020/04/06/asia/vietnam-tech-economy-intl-hnk-spc/index.html

[2] Vietnam Population 2022 (Live),

https://worldpopulationreview.com/countries/vietnam-population

[3] Vietnam's Search For Tomorrow by Think with Google, https://www.thinkwithgoogle.com/_qs/documents/10586/Vietnam_-_Search_for_tomorrow_EN_version.pdf

[4] Account ownership at a financial institution or with a mobile-money service provider (% of population ages 15+) - Vietnam by Demirguc-Kunt et.al.,2018, Global Financial Inclusion Database, World Bank,

https://data.worldbank.org/indicator/FX.OWN.TOTL.ZS?locations=VN

Tips and Resources

We help you stay ahead and informed with these helpful tips and tricks

Partner with us

If you are keen to learn how Chubb can collaborate with you, get in touch with:

Pham Thu Huong

Head of Accident & Health

Chubb Vietnam

Thuhuong.Pham@chubb.com