For anybody thinking seriously about building up their savings, it is essential to begin with a plan. Having a financial plan will not only help you better manage your money to set aside funds for savings, it will also give you guidance for what will be a long-term action plan.

Financial planning need not be too intimidating. By following these three simple steps, you can start off on your financial planning journey.

1. Examine your finances and set your goals

Start out by writing a list of your current monthly expenses in terms of housing costs, transport costs, food, entertainment, clothing, education and all your essential spending. Then deduct this from your income – this tells you how much you are able to save.

Once you have this, write down your life goals – what do you want to achieve? Are you saving for a car? Your wedding? Your children’s education? Or maybe you want to save for your retirement? Set a financial target for each one of just how much you will need to save to reach each goal.

2. Organise your budget

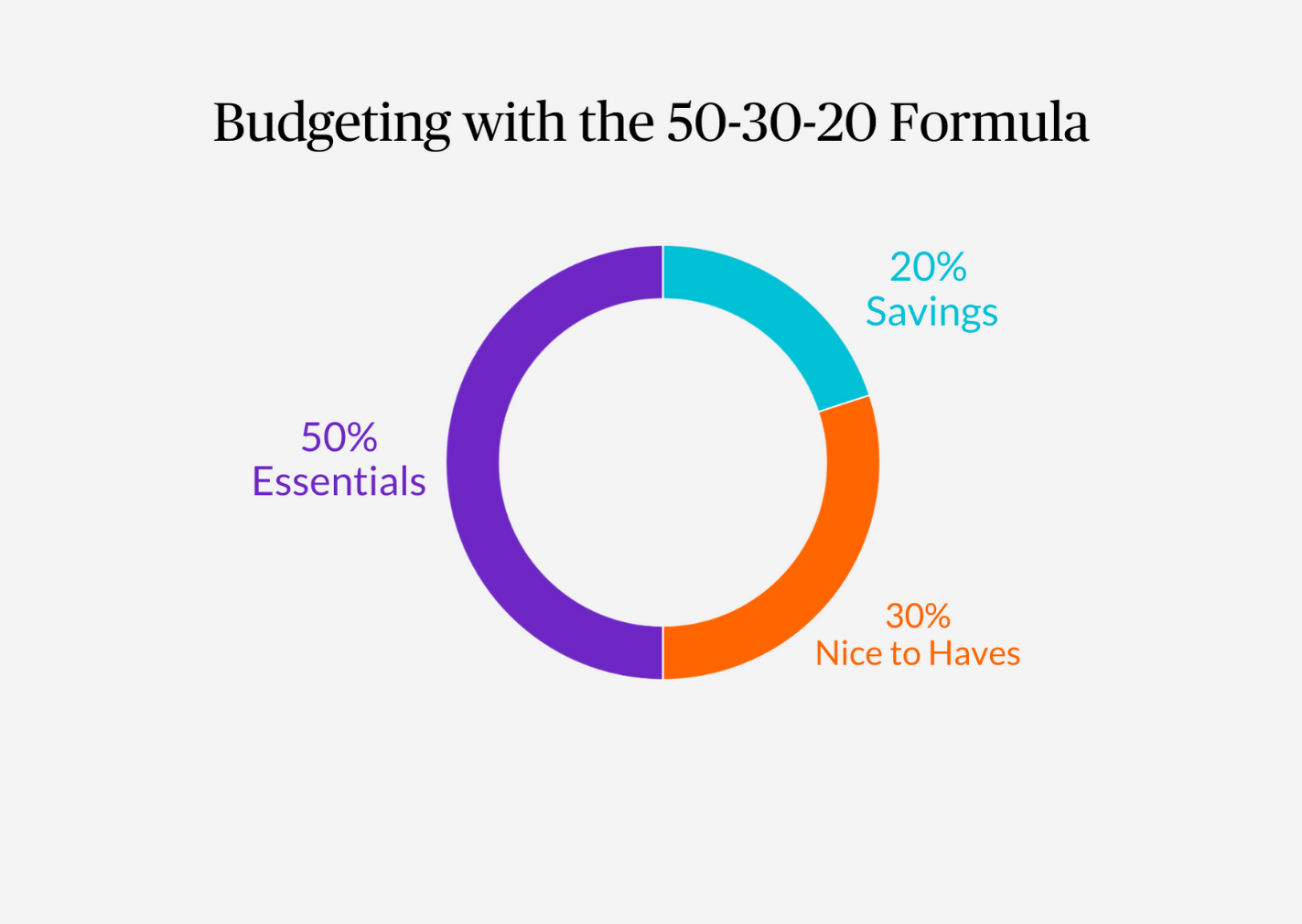

Before you can think about how to save for the future, you need to first organise your income. Start by dividing your income into what you want to spend and what you want to save. A useful rule of thumb is the 50-30-20 formula, which breaks your down into three categories:

- 50% - the things you need. half your income for the essentials you cannot do without – for example costs for housing, healthcare, transport, groceries and utilities. Here you can also include your minimum debt payments – for example credit card fees.

- 30% - the things you want. 30% of your income for things that are nice to have, but not essential. This can include dining out, entertainment, hobbies, fancy clothes, holidays and shopping.

- 20% - savings. Finally, the remaining 20% can be for savings. This includes bank savings of course, but can also cover investments and insurance premiums.

Remember, you can increase the amount you save by thinking about reducing spending on the things that you want. Another great tip save your pay rises rather than spending more on a more expense house, car, holidays, clothes. By keeping your living standards modest, you can save more for your future and not fall into the trap of increasing expenses.

3. Have a savings strategy

Once you have set your financial goals and organized your, you need to make sure you are planning your savings. It helps to prioritise your savings according to needs. Depending on the amount you have to save, these can be done one at a time or all at once.

- Emergency money – save enough money to support you and your family for three months in case of emergencies such as loss of a job or if you fall ill. You should remember that emergency savings cannot always pay for serious health issues and accidents. Therefore you should consider supplementing your emergency money with protection in the form of life insurance.

- Debt repayment – once you have emergency savings, or even as you are building it, think about paying off your debts. High interest rates can very quickly reduce your savings.

- Short term savings – once you can afford to, start putting money aside for those short- to medium-term goals, as set out earlier.

- Retirement – even if retirement is not your primary goal today, always try to save and invest a portion of your savings for retirement needs. The earlier you start saving for your retirement, the better will be your lifestyle later in life.

One more thing…protect your finances

Insurance is an essential part of your financial planning. Protect yourself and your family against the financial damage that can be brought about by unforeseen events and circumstances. As a minimum, you should consider life and health insurance options. Speak with a Chubb Life Vietnam who can create the right insurance solution y for your needs.

With all these elements in place, you are set to begin your savings journey, safe in the knowledge that you have a plan in place to guide you. A financial plan needn’t take too long to create, but its value will stay with you for many years.

Life protection for Invidiuals & Families: https://www.chubb.com/vn-en/personal/life-protection.html

or contact Chubb Life Vietnam to find out information about insurance packages specifically for you at:

Hotline: *8123 or (84 28) 3827 8123

Website: https://life.chubb.com/vn

Email: chubblife.vietnam@chubb.com

Fanpage: Chubb Life Viet Nam