Banks and the Digital Wallet Race: The Embedded Insurance Strategy

By the Numbers

- Introduction

- Executive Summary

- Section 1: Going Mainstream

- 1.1 Embedded Leaders

- 1.2 Global View: A Tale of Two Worlds, Converging

- Section 2: What do Customers Want — and Need?

- 2.1 The Omnichannel Journey

- Section 3: Partnering for the Future

- 3.1 Wanted (In an Insurance Partner)

- Conclusion: Getting to the Next Level

A Global Survey of Established Banks, Fintechs & Consumers

The banking industry is in a period of digital disruption as customers increasingly demand a digital experience and access to more value-added products and services. Banking also faces competition from non-traditional players where technology has fueled the creation of digital platforms, where the offer of financial services to their extensive customer base is increasingly important. As examples, we can see the rapid rise of “super apps” in Asia that offer multiple services in an integrated customer experience and the creation of digital wallets for customers to make and receive payments. These themes have led established banks and fintechs to look for ways to broaden their digital product portfolio and provide greater value to their customers.

One way to enhance a digital product portfolio is by making insurance available to customers through contextual offers that are integrated into the banking customer’s journey e.g. when taking out a loan or making a bill payment — presenting the relevant insurance proposition at just the right time to create a seamless customer experience. By the nature of the offer, these products need to be simple, affordable, and clearly relevant to the customer’s needs. Banks are increasingly adopting this approach, but is it working? And if so, how well?

With this survey, Chubb — a world leader in insurance — wanted to gauge perceptions of banks and fintechs that have explored or implemented digital insurance offerings for their customers. What are the expectations and main drivers of motivation — increase customer trust, higher revenue, improved customer retention? Is this a long-term, sustainable solution or a more short-term view?

Chubb also wanted to better understand how consumers around the world feel about buying insurance digitally. Are certain products more conducive to buying digitally? What about generational or regional buying preferences? Answers to these and many other questions will enable financial institutions to make data-driven decisions as they consider the expansion of core offerings to include insurance protection.

Embedded insurance is a strategic growth opportunity for both established and digitally native companies. The findings from the Chubb survey provide valuable insights on the key themes of embedded insurance — consumer expectations, the drivers of value creation for banks and fintechs, insurance needs and challenges for banks and fintechs — and helps inform the banking sector. Chubb is an embedded insurance market leader and well-positioned to assist banks and fintechs as they look to capitalize on this strategic growth opportunity.

Sean Ringsted

Chief Digital Business Officer, Chubb

Executive Summary

The survey demonstrated that fintechs and established banks around the world overwhelmingly agree that including digital insurance as part of their portfolio of products and services is becoming a must-have to compete in today’s global financial services market.

Financial organizations have answered the call of the consumer for an intuitive experience for their financial products. Digital transformations within established banking organizations, and innovation by digitally native financial firms — or fintechs — has led to many cutting-edge payment solutions from digital wallets to contextual payments embedded in social media.

Leadership voices

Gabriel Lazaro | Head of Digital, Chubb Overseas General Insurance

“Their next logical step is bringing insurance to the level that their customers expect. And that means providing a seamless, user-friendly experience that addresses all aspects of the customer journey, including enrollment, claims, and beyond.”

Amy McNeece | Senior Vice President of Digital Consumer Partnerships, North America, Chubb

“A modern-day, intuitive experience comes with embedded offers for financial protection and must be a frictionless stage of the customer journey. For example, when a consumer is offered a relevant insurance product such travel insurance with a plane ticket.”

Financial organizations offer insurance tied to different financial products or as a standalone offering to bolster their customer base, increase consumer trust in financial products, and create additional revenue streams.

A survey of financial executives worldwide involved in making decisions about embedded insurance products — whether they currently offer embedded insurance or not — reveals that 81% of them believe that embedded insurance will turn from a nice-to-have to a must-have.

This report, based on a survey of 2,000 consumers worldwide and 200 executives from financial organizations, including established firms and fintechs — as well as interviews with Chubb’s executives — will address:

- The state of play of embedded insurance: The revenues that financial organizations currently derive from insurance and how they expect it to grow over the next three years; the key benefits of embedded insurance for those who offer it; and which financial organizations, established banks or fintechs, are leaders in embedded insurance.

- How consumers around the world feel about buying insurance: Consumers’ needs and expectations in terms of insurance coverage, main areas of underinsurance, consumers’ attitudes toward buying insurance via digital channels, and the omnichannel approach to embedded insurance.

- The partnerships between financial organizations and insurance companies: The most important characteristics that financial firms are looking for in their insurance partners (and the ones they ignore), challenges with forming partnerships and how to overcome them.

Methodology

Findings are based on a survey of 2,000 consumers worldwide and 200 financial organizations’ executives, conducted by iResearch Services in the second quarter of 2023.

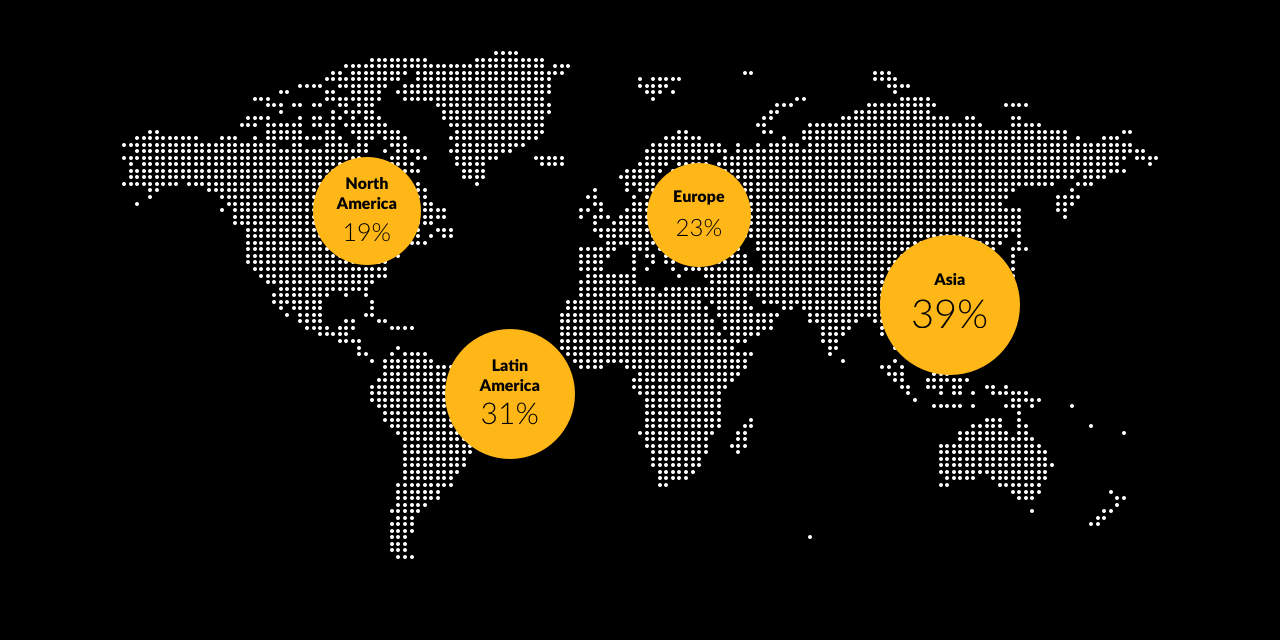

Consumers were evenly split among four regions: North America (500), Latin America (500), Asia Pacific (500) and Europe (500). They represented all age groups, levels of education, and professional status. For brevity, in the text of the report, the sample of 2,000 global consumers is referred to as “consumers.”

Financial executives represented established banking organizations (52%) and fintechs (48%). They were evenly split among four regions: North America (50), Latin America (50), Asia Pacific (50), and Europe (50). The majority of fintechs (84%) had revenues of $10 million to $500 million ($250 million in some Asian markets); most established banking organizations (89%) had AUM (assets under management) of at least $1 billion. All executives surveyed engaged in decision-making about insurance products, such as embedded insurance.

For both consumers and financial executives, the regions included the following countries:

North America: U.S. and Canada; Latin America: Brazil, Mexico, and Chile; Asia Pacific: South Korea, Singapore, Thailand, The Philippines, and Vietnam; Europe: United Kingdom, France, and Spain.

A Global Survey of Established Banks, Fintechs & Consumers

The banking industry is in a period of digital disruption as customers increasingly demand a digital experience and access to more value-added products and services. Banking also faces competition from non-traditional players where technology has fueled the creation of digital platforms, where the offer of financial services to their extensive customer base is increasingly important. As examples, we can see the rapid rise of “super apps” in Asia that offer multiple services in an integrated customer experience and the creation of digital wallets for customers to make and receive payments. These themes have led established banks and fintechs to look for ways to broaden their digital product portfolio and provide greater value to their customers.

One way to enhance a digital product portfolio is by making insurance available to customers through contextual offers that are integrated into the banking customer’s journey e.g. when taking out a loan or making a bill payment — presenting the relevant insurance proposition at just the right time to create a seamless customer experience. By the nature of the offer, these products need to be simple, affordable, and clearly relevant to the customer’s needs. Banks are increasingly adopting this approach, but is it working? And if so, how well?

With this survey, Chubb — a world leader in insurance — wanted to gauge perceptions of banks and fintechs that have explored or implemented digital insurance offerings for their customers. What are the expectations and main drivers of motivation — increase customer trust, higher revenue, improved customer retention? Is this a long-term, sustainable solution or a more short-term view?

Chubb also wanted to better understand how consumers around the world feel about buying insurance digitally. Are certain products more conducive to buying digitally? What about generational or regional buying preferences? Answers to these and many other questions will enable financial institutions to make data-driven decisions as they consider the expansion of core offerings to include insurance protection.

Embedded insurance is a strategic growth opportunity for both established and digitally native companies. The findings from the Chubb survey provide valuable insights on the key themes of embedded insurance — consumer expectations, the drivers of value creation for banks and fintechs, insurance needs and challenges for banks and fintechs — and helps inform the banking sector. Chubb is an embedded insurance market leader and well-positioned to assist banks and fintechs as they look to capitalize on this strategic growth opportunity.

Sean Ringsted

Chief Digital Business Officer, Chubb

Executive Summary

The survey demonstrated that fintechs and established banks around the world overwhelmingly agree that including digital insurance as part of their portfolio of products and services is becoming a must-have to compete in today’s global financial services market.

Financial organizations have answered the call of the consumer for an intuitive experience for their financial products. Digital transformations within established banking organizations, and innovation by digitally native financial firms — or fintechs — has led to many cutting-edge payment solutions from digital wallets to contextual payments embedded in social media.

Leadership voices

Gabriel Lazaro | Head of Digital, Chubb Overseas General Insurance

“Their next logical step is bringing insurance to the level that their customers expect. And that means providing a seamless, user-friendly experience that addresses all aspects of the customer journey, including enrollment, claims, and beyond.”

Amy McNeece | Senior Vice President of Digital Consumer Partnerships, North America, Chubb

“A modern-day, intuitive experience comes with embedded offers for financial protection and must be a frictionless stage of the customer journey. For example, when a consumer is offered a relevant insurance product such travel insurance with a plane ticket.”

Financial organizations offer insurance tied to different financial products or as a standalone offering to bolster their customer base, increase consumer trust in financial products, and create additional revenue streams.

A survey of financial executives worldwide involved in making decisions about embedded insurance products — whether they currently offer embedded insurance or not — reveals that 81% of them believe that embedded insurance will turn from a nice-to-have to a must-have.

This report, based on a survey of 2,000 consumers worldwide and 200 executives from financial organizations, including established firms and fintechs — as well as interviews with Chubb’s executives — will address:

- The state of play of embedded insurance: The revenues that financial organizations currently derive from insurance and how they expect it to grow over the next three years; the key benefits of embedded insurance for those who offer it; and which financial organizations, established banks or fintechs, are leaders in embedded insurance.

- How consumers around the world feel about buying insurance: Consumers’ needs and expectations in terms of insurance coverage, main areas of underinsurance, consumers’ attitudes toward buying insurance via digital channels, and the omnichannel approach to embedded insurance.

- The partnerships between financial organizations and insurance companies: The most important characteristics that financial firms are looking for in their insurance partners (and the ones they ignore), challenges with forming partnerships and how to overcome them.

Methodology

Findings are based on a survey of 2,000 consumers worldwide and 200 financial organizations’ executives, conducted by iResearch Services in the second quarter of 2023.

Consumers were evenly split among four regions: North America (500), Latin America (500), Asia Pacific (500) and Europe (500). They represented all age groups, levels of education, and professional status. For brevity, in the text of the report, the sample of 2,000 global consumers is referred to as “consumers.”

Financial executives represented established banking organizations (52%) and fintechs (48%). They were evenly split among four regions: North America (50), Latin America (50), Asia Pacific (50), and Europe (50). The majority of fintechs (84%) had revenues of $10 million to $500 million ($250 million in some Asian markets); most established banking organizations (89%) had AUM (assets under management) of at least $1 billion. All executives surveyed engaged in decision-making about insurance products, such as embedded insurance.

For both consumers and financial executives, the regions included the following countries:

North America: U.S. and Canada; Latin America: Brazil, Mexico, and Chile; Asia Pacific: South Korea, Singapore, Thailand, The Philippines, and Vietnam; Europe: United Kingdom, France, and Spain.

Executive Summary

The survey demonstrated that fintechs and established banks around the world overwhelmingly agree that including digital insurance as part of their portfolio of products and services is becoming a must-have to compete in today’s global financial services market.

Financial organizations have answered the call of the consumer for an intuitive experience for their financial products. Digital transformations within established banking organizations, and innovation by digitally native financial firms — or fintechs — has led to many cutting-edge payment solutions from digital wallets to contextual payments embedded in social media.

Leadership voices

Gabriel Lazaro | Head of Digital, Chubb Overseas General Insurance

“Their next logical step is bringing insurance to the level that their customers expect. And that means providing a seamless, user-friendly experience that addresses all aspects of the customer journey, including enrollment, claims, and beyond.”

Amy McNeece | Senior Vice President of Digital Consumer Partnerships, North America, Chubb

“A modern-day, intuitive experience comes with embedded offers for financial protection and must be a frictionless stage of the customer journey. For example, when a consumer is offered a relevant insurance product such travel insurance with a plane ticket.”

Financial organizations offer insurance tied to different financial products or as a standalone offering to bolster their customer base, increase consumer trust in financial products, and create additional revenue streams.

A survey of financial executives worldwide involved in making decisions about embedded insurance products — whether they currently offer embedded insurance or not — reveals that 81% of them believe that embedded insurance will turn from a nice-to-have to a must-have.

This report, based on a survey of 2,000 consumers worldwide and 200 executives from financial organizations, including established firms and fintechs — as well as interviews with Chubb’s executives — will address:

- The state of play of embedded insurance: The revenues that financial organizations currently derive from insurance and how they expect it to grow over the next three years; the key benefits of embedded insurance for those who offer it; and which financial organizations, established banks or fintechs, are leaders in embedded insurance.

- How consumers around the world feel about buying insurance: Consumers’ needs and expectations in terms of insurance coverage, main areas of underinsurance, consumers’ attitudes toward buying insurance via digital channels, and the omnichannel approach to embedded insurance.

- The partnerships between financial organizations and insurance companies: The most important characteristics that financial firms are looking for in their insurance partners (and the ones they ignore), challenges with forming partnerships and how to overcome them.

Methodology

Findings are based on a survey of 2,000 consumers worldwide and 200 financial organizations’ executives, conducted by iResearch Services in the second quarter of 2023.

Consumers were evenly split among four regions: North America (500), Latin America (500), Asia Pacific (500) and Europe (500). They represented all age groups, levels of education, and professional status. For brevity, in the text of the report, the sample of 2,000 global consumers is referred to as “consumers.”

Financial executives represented established banking organizations (52%) and fintechs (48%). They were evenly split among four regions: North America (50), Latin America (50), Asia Pacific (50), and Europe (50). The majority of fintechs (84%) had revenues of $10 million to $500 million ($250 million in some Asian markets); most established banking organizations (89%) had AUM (assets under management) of at least $1 billion. All executives surveyed engaged in decision-making about insurance products, such as embedded insurance.

For both consumers and financial executives, the regions included the following countries:

North America: U.S. and Canada; Latin America: Brazil, Mexico, and Chile; Asia Pacific: South Korea, Singapore, Thailand, The Philippines, and Vietnam; Europe: United Kingdom, France, and Spain.

Section 1: Going Mainstream

Digital wallets, contactless payments, and embedded transactions are now part of everyday life. The era of cash, checks, or visits to an ATM has been supplanted by virtual payments. With many financial digital services already fully embraced by customers, financial institutions — be they well-established banks or digitally native fintechs — are looking for new types of offerings.

Many turn to insurance, and specifically embedded insurance — an innovative way to integrate relevant risk protection into customers’ purchase journeys without adding any friction to their experience.

Embedded insurance is relevant to a product and environment, like when a customer buys travel insurance while buying an airline ticket, anti-theft insurance when purchasing a diamond ring, or cyber insurance when signing up for a video gaming subscription.

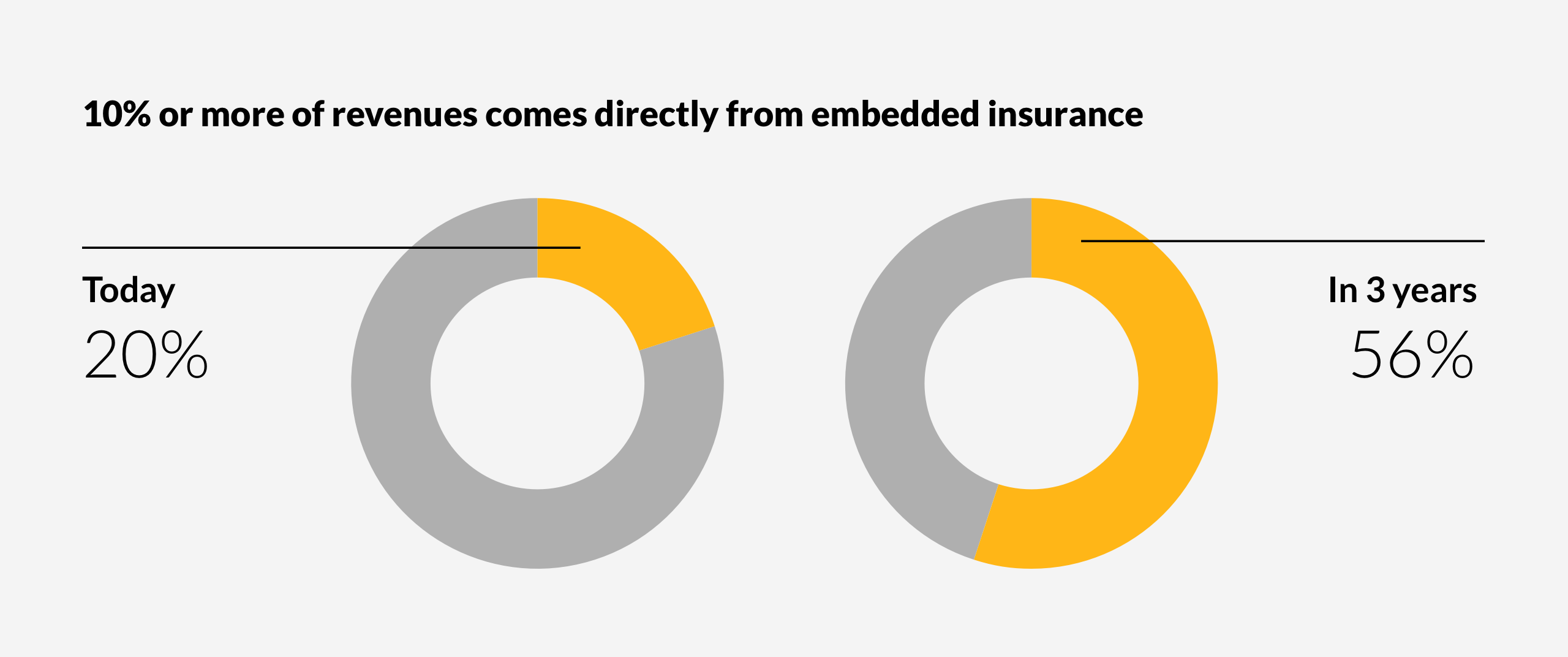

Financial organizations project significant growth in the revenues they derive from insurance. In three years, more than half of financial organizations surveyed expect to derive 10% or more revenues from insurance, versus a fifth who derive that much revenue from insurance today.

Ready for Takeoff

What percentage of your revenues are currently generated by embedded insurance, and what percentage of your revenues do you aim to directly generate from embedded insurance in the next 3 years?

Insurance offers to bank customers come in different forms: standalone cross-sells of insurance products (offered through digital and other distribution channels) that complement a bank’s core product offering; relevant insurance embedded at no additional charge such as travel insurance or purchase protection coverage on a credit card. Insurance offers to bank customers serve to enhance bank customer acquisition through new product benefits, deepen customer relationships to drive loyalty and stickiness, and support usage of bank products by creating recurring payment streams.

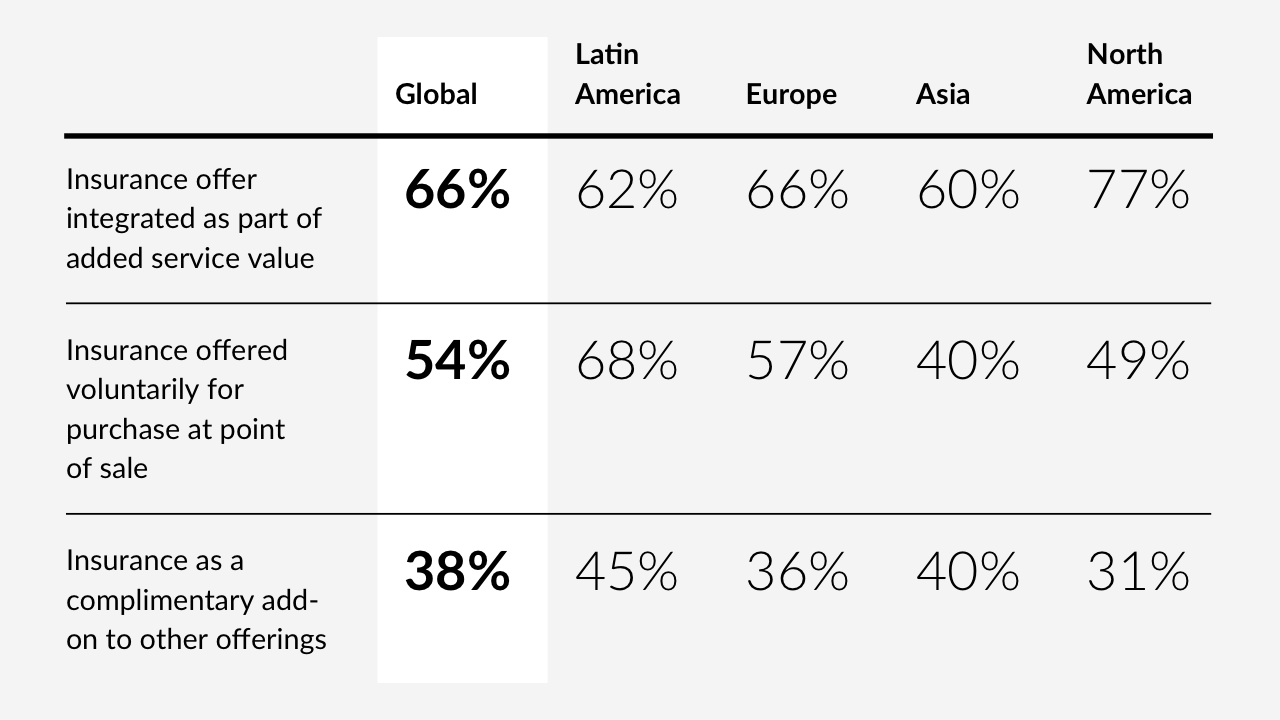

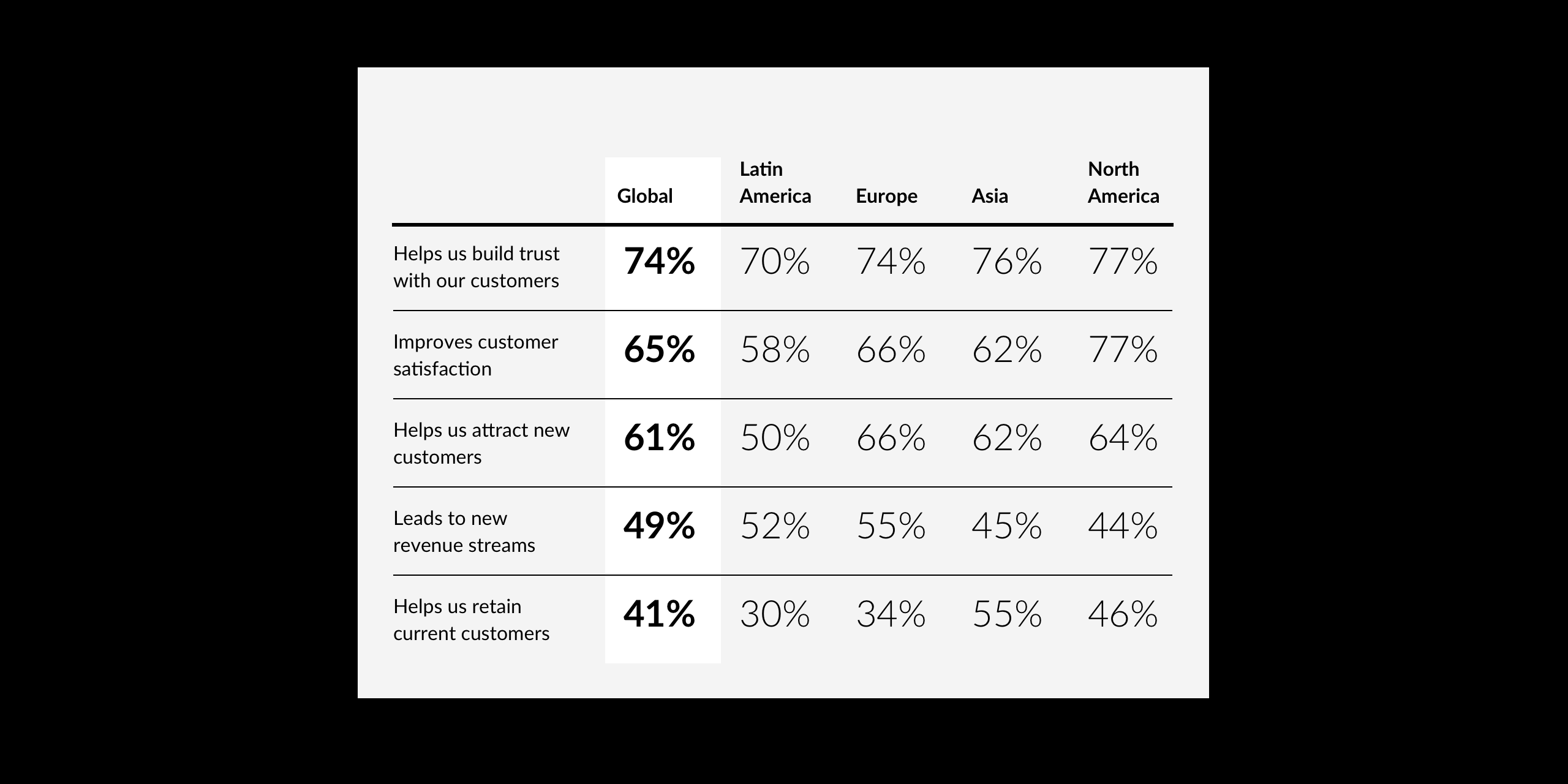

Most survey respondents, globally 66%, offer integrated insurance as part of added service value. That is one reason why financial executives globally ranked customer trust and satisfaction above direct revenue generation as the top benefits of embedded insurance. One of the reasons behind offering embedded insurance, especially for fintechs, is their desire to aggressively grow their customer base.

Focusing on Added Value

What type of embedded insurance do you offer?

Across all regions, offering insurance as an added value is the top choice for financial firms, led by North America and followed by Europe. For example, French travelers who carry Boursorama Banque’s premium card, Ultim, can plan their trips with greater peace of mind because the card offers comprehensive travel insurance, provided at no additional cost to consumers.

Bon Voyage!

French travelers who carry Boursorama Banque’s premium card, Ultim, can plan their trips with greater peace of mind because the card offers comprehensive travel insurance underwritten by Chubb.

The French-based online financial group created in 1995 by Société Générale, Boursorama boasts a rapidly growing business with 4.7 million clients and a goal of reaching 5.5 million by the end of the end of the year.

How Chubb helped

The Ultim travel insurance, introduced in January 2023, is the outcome of Boursorama’s collaboration with Chubb, the world’s largest publicly traded property & casualty insurance company.

The digital travel solution was built from scratch over four months, with up to 50 people from Chubb involved in creating the insurance service. Thanks to its consumer lines expertise, Chubb was able to streamline processes and leverage the strengths of both organizations to create a ready-to-plug-in solution that will benefit customers for years to come.

Activated at purchase

The travel insurance, provided at no additional cost to consumers, is activated when a card holder makes a travel related purchase, such as buying a plane ticket or booking a hotel.

The premium card holders are automatically covered for many types of mishaps that may happen during travel, including flight cancellations, an accident abroad, rental car troubles, or medical expenses. Overall, there are 32 different benefits offered under this travel insurance.

While disrupting the market with the lowest card fees, Boursorama competes with other premium cards by offering travel insurance coverage.

Building Trust

Top Benefits of Embedded Insurance

Helps us build trust with our customers

Improves customer satisfaction

Helps us attract new customers

Leads to new revenue streams

Helps us retain current customers

Summary

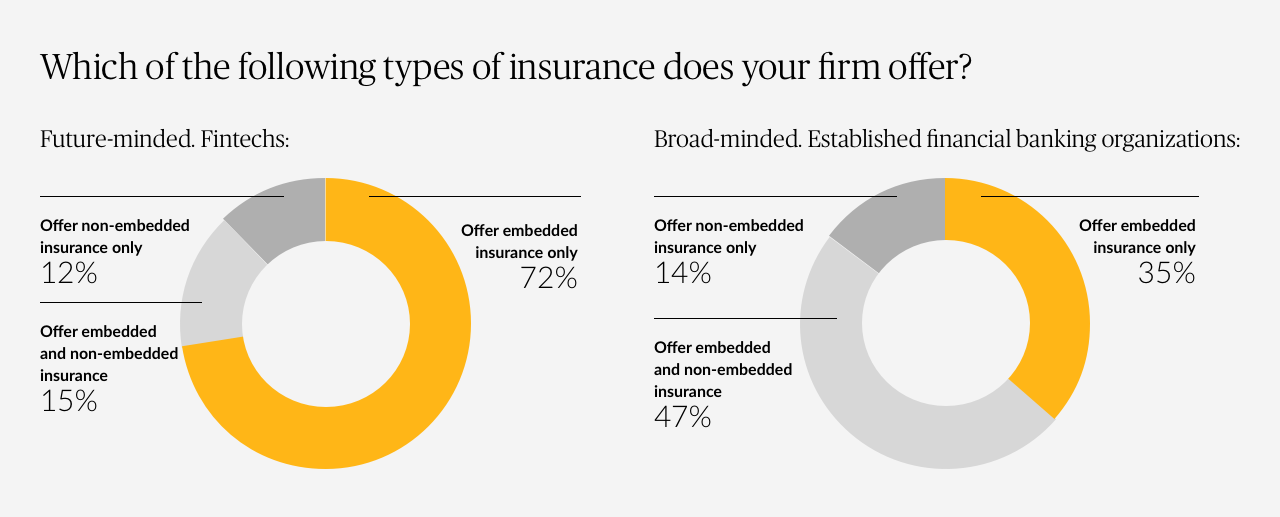

1.1 Embedded Leaders

Digitally native fintechs lead the curve in terms of insurance. Isabella Carvalho, Head of Digital, Asia Pacific, Chubb, is not surprised.

Leadership voices

Isabella Carvalho | Head of Digital, Asia Pacific, Chubb

“Fintechs want to offer tailored insurance propositions, relevant to their specific user base and to the context in which they experience the fintech’s core services. This increases user stickiness and monetization.”

Unlike fintechs established banking organizations have to deal with widespread legacy technologies in all of their lines of business, as they are moving to an omnichannel, “phygital” customer experience. However, established financial organizations still have advantages, points out Israel Rayan, Senior Vice President, Consumer Distribution EMEA. "Firstly, established banks do not need to focus so much on growing their customer base because they have built it over the years. Secondly, their processes make them more operationally stable. Thirdly, they typically have more financial resources and do not depend on external sources for funding as much as startup companies."

It is not the origins of a company that needs to define its future.

When Is the Right Time for Fintechs to offer Embedded Insurance?

Rodrigo Valiente | Vice President of Digital, Latin America, Chubb

“Fintechs tend to have a real focus on the customer experience and technology, which is the foundation of a great embedded insurance experience. They don’t divide technology from customer experience.”

Fintechs start out of the gate with an advantage over traditional banking organizations when it comes to embedded insurance, believes Rodrigo Valiente, Chubb’s Vice President of Digital, Latin America.

But that does not mean that any fintech offering financial services is ready to add on insurance. What’s the right time? While he admits there is no formula, Valiente points to several milestones that should be met before considering embedded insurance:

- A customer base of active users that are engaging with the platform regularly, at least once a month. “Insurance may not be something you think about every morning when you wake up. But digital platforms offer endless opportunities to create contextual insurance experiences to remind customers about the importance of insurance and deliver personalized solutions,” says Valiente.

- Financial products that lend themselves to embedding insurance, such as car loans, money transfers, or mortgage loans.

- A payment mechanism in place with the capability of collecting recurring premiums.

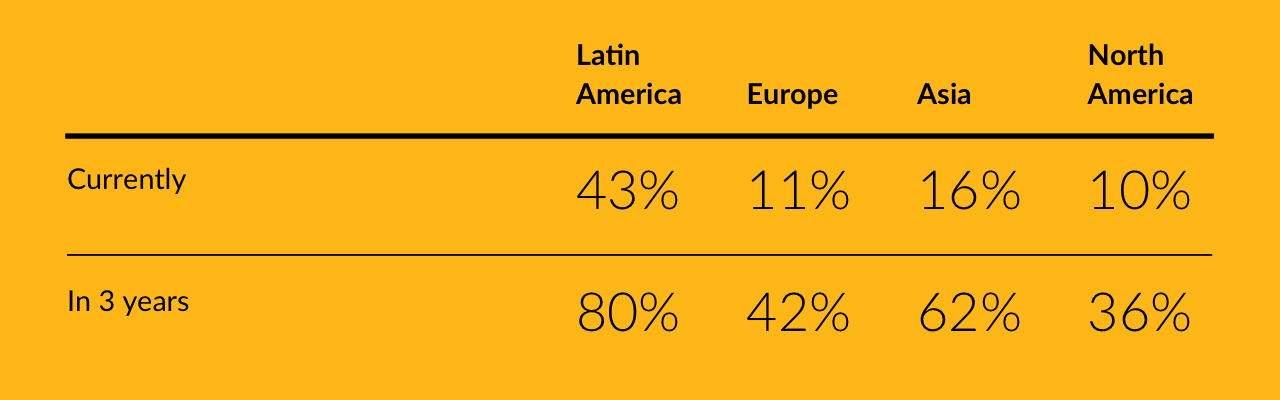

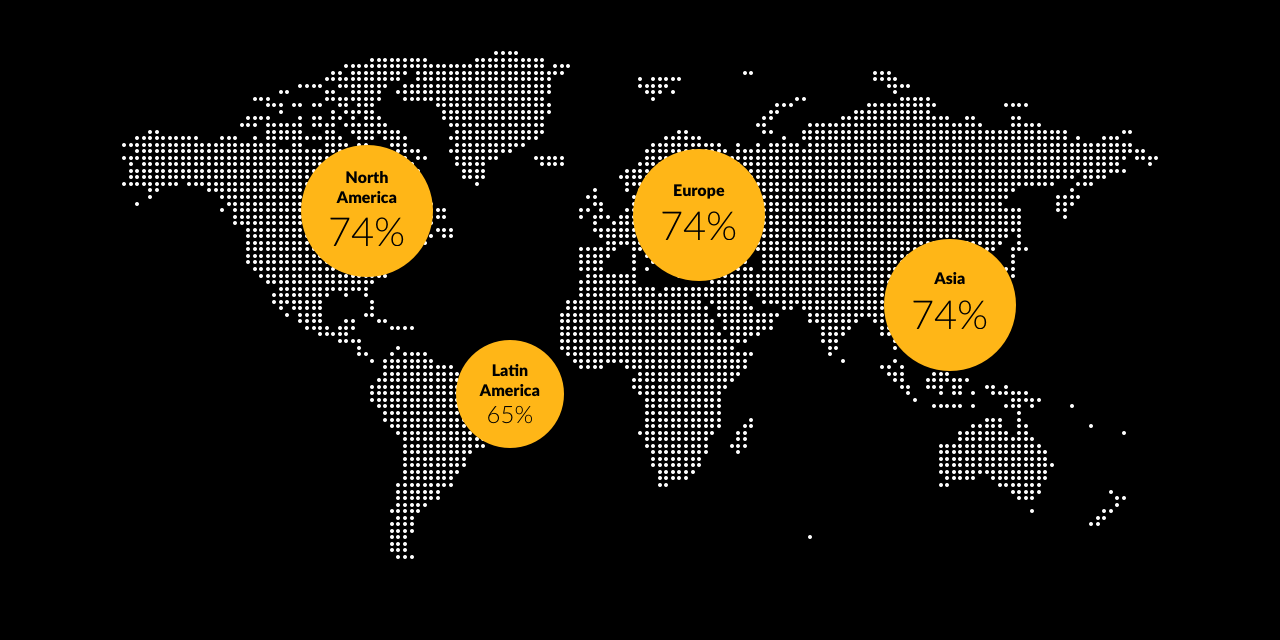

1.2 Global View: A Tale of Two Worlds, Converging

The adoption of embedded insurance follows the global arc of the adoption of mobile phones. Emerging markets, lacking adequate traditional communications infrastructures, and facing a scarcity of landlines, were quicker to adopt mobile phones than the developed economies.

For many people in the emerging markets, mobile phones were the only way to get a phone, so they were eager to embrace them. They leapfrogged from not having a phone at all directly to having a mobile phone, skipping the landline stage. The unbanked and underinsured in emerging markets are often leapfrogging the traditional banking stage to embrace digital banking and insurance. In those parts of the world where the traditional financial and insurance infrastructure is less mature, such as Latin America or Southeast Asia, financial executives and consumers are more excited about embedded insurance than their counterparts in more developed markets such as Europe and North America.

The Leapfrog Effect in Embedded Insurance

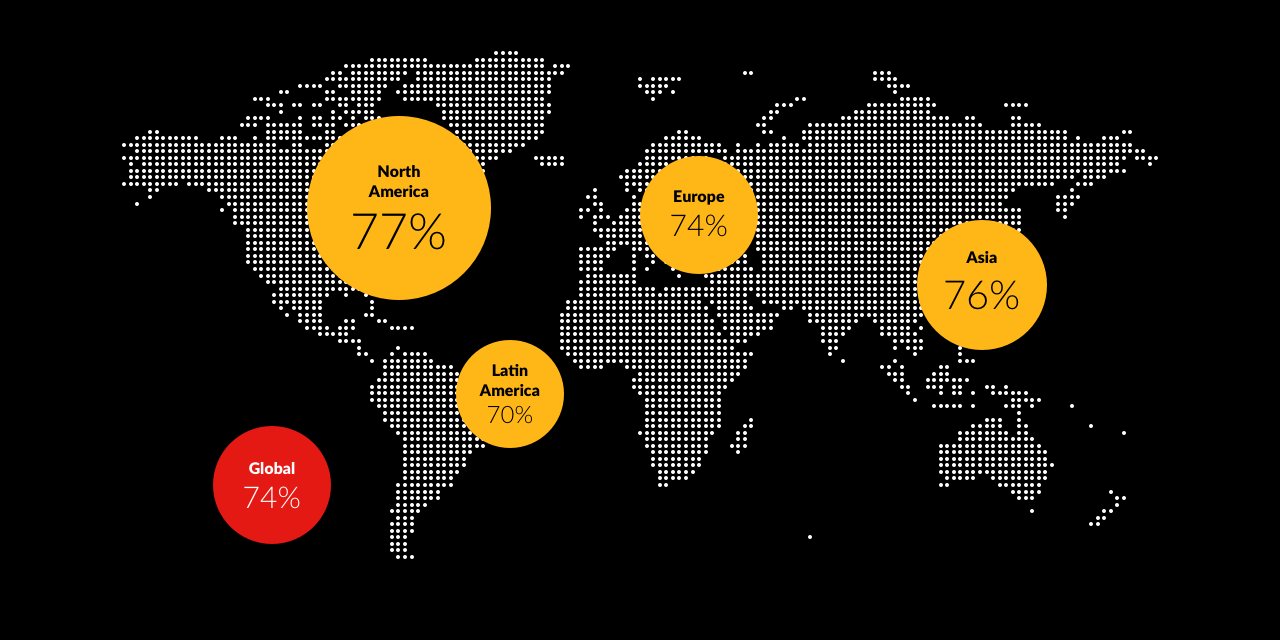

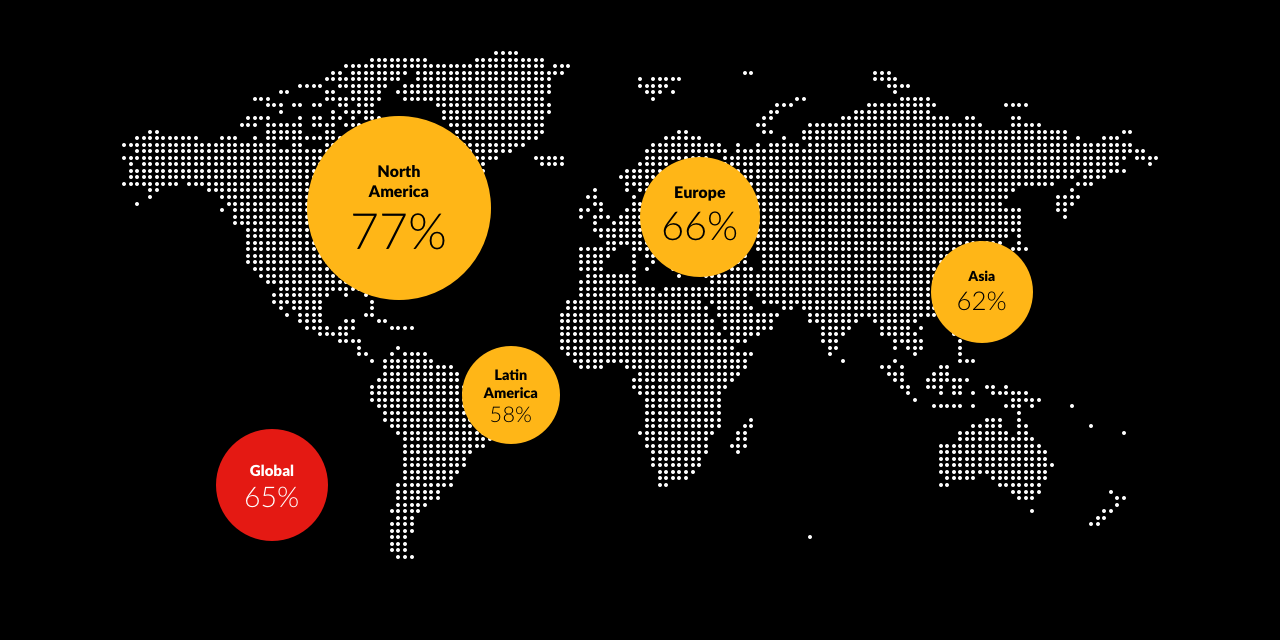

What percent of your revenues are currently generated by embedded insurance — what percent of your revenues do you aim to generate from embedded insurance in the next 3 years? (Percent of financial organizations that generate at least 10% of their revenue from insurance)

There is a fundamental difference in what digitization of financial services, including insurance, means in different regions. Before digitization, much of Latin America and Southeast Asia were cash-driven societies. Being underbanked translated into being underinsured. In Latin America, for example, the insurance penetration index (the ratio of underwritten premiums to GDP) of around 2% is less than half of that in developed countries. In some Southeast Asian countries, such as the Philippines, the index also hovers around 2%.

For example, GCash, a leading super app in the Philippines recognized that many customers would benefit from a backstop in the event they were temporarily unable to pay their bills.

GCash Boosts Confidence in App-Based Transactions

GCash is a cashless ecosystem in the Philippines with millions of users which empowers partner merchants towards digitalization.

As a leading e-wallet provider in the Philippines, it recognized that many customers would benefit if insurance protection was included in their app-based transactions, offering coverage of bill payments and purchase expenses in the event of injury or death.

The challenge

GCash wanted to provide assurance to customers transacting through its service, many of whom are either underinsured or not insured at all, creating many potential challenges if they were unable to work and earn an income. The goal was to provide protection for transactions conducted through its mobile app.

How Chubb helped

Chubb offers embedded symbiotic insurance through partners, offering personal and meaningful protection through an easy-to-use experience for the customers of our partner companies, like GCash. Through its partnership with Chubb, GCash was able to seamlessly offer relevant, simple, and affordable insurance to its customers. The policies are not only easily accessible through mobile or online channels but are also low-cost, enabling Filipinos to benefit from insurance without paying high premiums.

Products now offered through the GCash app include GInsure Bill Protect, which provides insurance for customers where they suffer accidental death and permanent disablement caused by bodily injury for a period of 30 days from date of payment of transaction. A lump sum benefit equivalent to thirty-six times the total amount of enrolled GCash bill payments can be claimed in the event of an accident. The premium is less than one percent of the GCash bill payment amount. Users are offered this insurance at the time they settle their bill on the app.

Through Chubb, GCash also offers purchase protection and buyer’s protection for items bought using its app. Online Shopping Protect Insurance provides reimbursement for up to 20,000 Philippine pesos (approximately $360 US dollars) in the event the item did not arrive, arrived damaged, was stolen, or was a counterfeit product, for a coverage period of 60 days from the date of initial purchase. The policy premium is a little more than one peso per day of coverage.

Expanding protection

The Chubb partnership is an integral part of GCash Insurance, an all-around insurance solution that provides access to personal accident and daily hospital income.

In Brazil, Nubank, one of the largest digital platforms in the world, sought to add insurance services to its growing customer base, many of whom were unbanked or underserved customers buying insurance for the first time.

Closing the Protection Gap Across Latin America

A major digital banker sought to add insurance services to its growing customer base, many of whom were unbanked or underserved customers buying insurance for the first time.

Nubank, founded in Brazil in 2013, is one of the largest digital financial services platforms in the world, serving about 75 million users across Latin America, offering a variety of services including personal accounts, credit cards, business accounts, investing, loans, cryptocurrency, and now, insurance.

The challenge

For many in the region Nubank serves, having the protection of life insurance is a distant dream due to the cost and complexity of available options in the market, as well as a general lack of understanding about the real benefits of coverage. The bank sought to offer a seamless way to acquaint customers with insurance benefits and make it easy to sign up.

How Chubb helped

Chubb partnered with Nubank to create offerings that could be easily acquired by millions who may not have known how or why to buy insurance. The policies provide protections for life events such as hospitalization or accidents, mobile device protection, and more. All these coverages help address the growing protection gap in Latin America.

Expanding protection

The first offering out of the alliance, Nubank Vida, represents a first step towards equalizing access to insurance, as well as help to create a new generation of financial services in Latin America. The product already has more than 560,000 active policies.

A second offering, Nubank Celular Seguro, offers insurance coverage for mobile phones. Both products were designed by Nubank using Chubb Studio, Chubb’s global digital product distribution platform.

In a survey of policyholders conducted by Nubank, over 50% of clients reported that Nubank Vida was their first life insurance policy and Nubank Celular Seguro was their first phone insurance policy.

Most recently, Nubank announced two new products on its insurance portfolio in partnership with Chubb — Nu Vidas Juntas (Lives Together), and Nubank Parcela Segura (Nubank Safe Installment). Nu Vidas Juntas brings a groundbreaking element to the market by allowing customers to acquire a policy for themselves and gift another Nubank customer with a policy as well, whether or not they are related. Nubank Parcela Segura allows customers who take out a personal loan in the company's app to have access to insurance protection against unexpected events to help keep their loan payments up to date, and it will be gradually offered to all eligible Nubank users who obtain credit through new personal loans.

In developed markets, the digitization has been accelerated by the pandemic, and the focus is on transforming the traditional bank branch experience and the portfolio of products to better fit the digitally driven modern age. It’s not about first-time customers but about adjusting to the new habits of existing customers and the new ways of the younger generations.

While the current needs and maturity of financial and insurance markets vary by region, global markets are being influenced by technology-driven lifestyles and social trends that are worldwide. For instance, the fragmentation of experiences requires insurance in small chunks, like for a specific purpose, e.g., taking a rideshare trip. Changing work life, with a freelance workforce depending on short-term assignments, erodes long-term financial security and creates a need for paycheck protection. And the speed of life lends itself to a yes-or-no, split-second decision about insuring a single transaction. Thus, insurance purchased as part of another transaction is gaining traction, with more than half of Latin American consumers (55%) purchasing insurance in this way, which is more than in any other region.

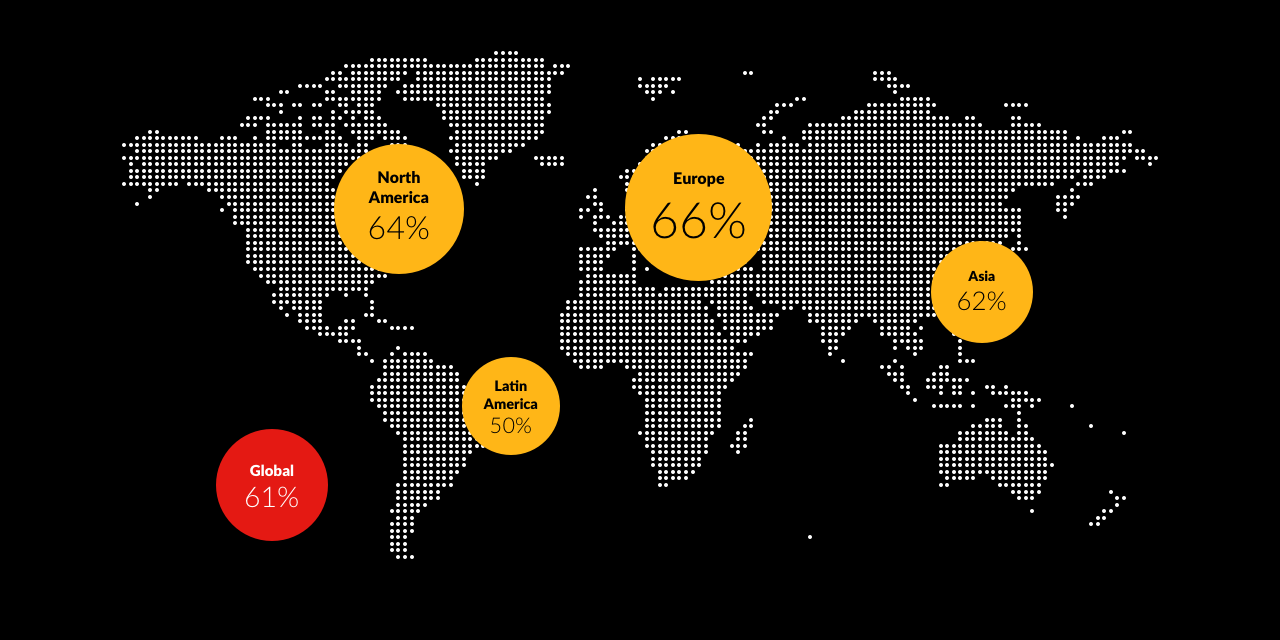

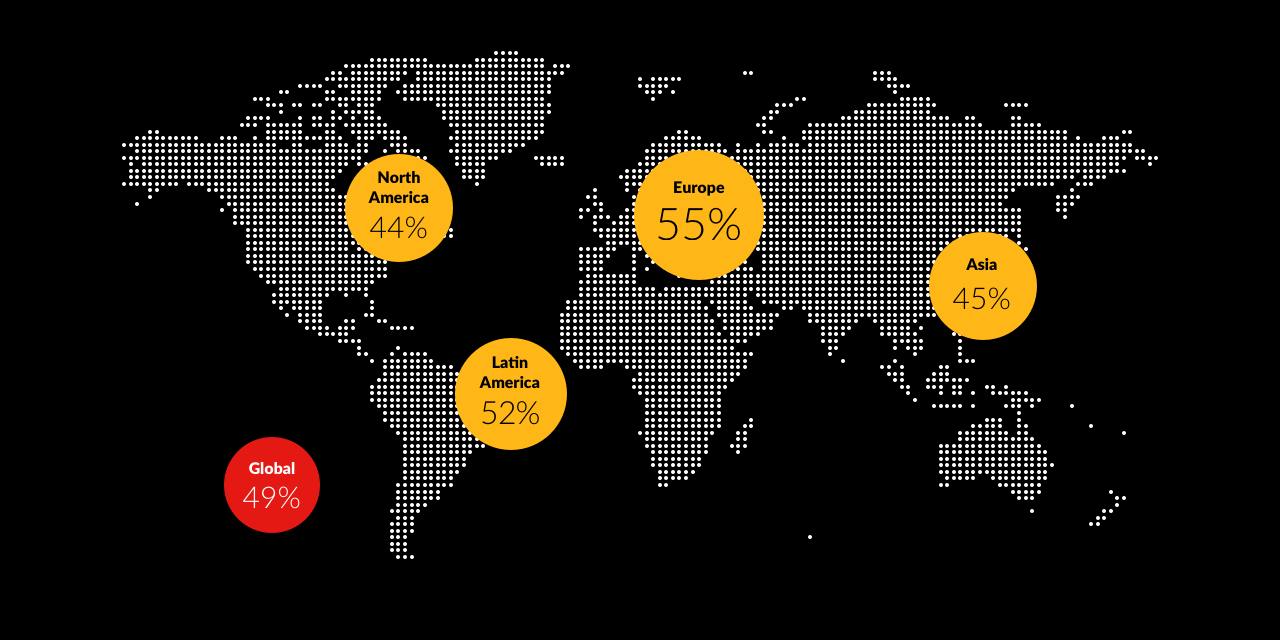

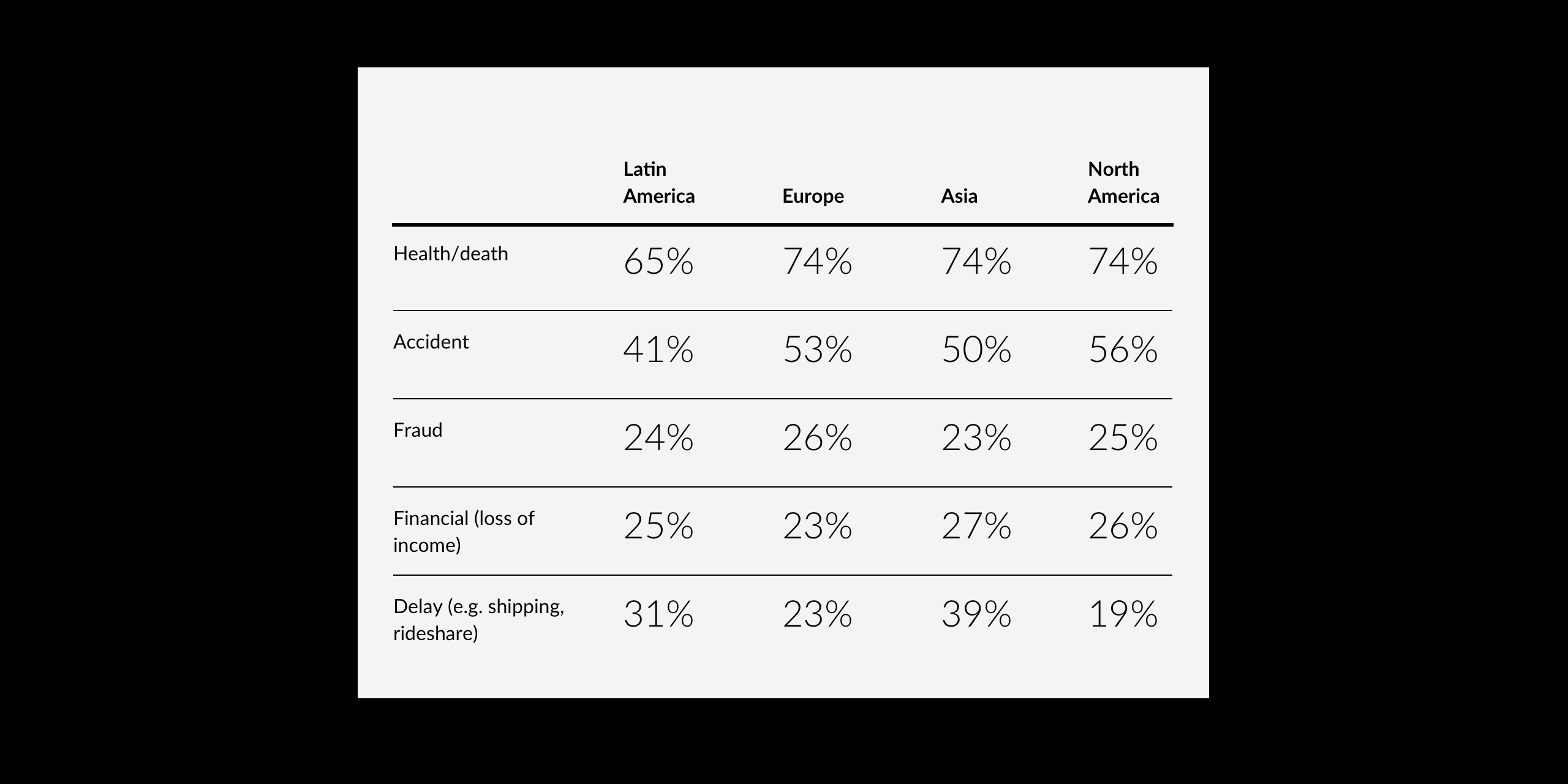

And while the insurance protection gap is not equal worldwide, more than half of consumers globally, irrespective of whether they are in emerging or developed markets, believe that they need more insurance. They feel especially underinsured in the risks common to modern-day life — such as financial security, travel delay, or fraud. All of these modern risks can be insured using digital embedded insurance.

Consumers’ needs will continue to drive the swelling wave of embedded insurance, making the industry increasingly flexible and responsive, making more transactions nearly frictionless, and providing customers with the protection they seek.

Feeling Exposed to Modern-Day Risks

In terms of insurance, how well protected are you against these risks? (Percentage of consumer participants who feel protected or very well protected)

Health/death

Accident

Fraud

Financial (loss of income)

Delay (e.g. shipping, rideshare)

Summary

Section 2: What do Customers Want — and Need?

What types of insurance do consumers prefer to purchase digitally?

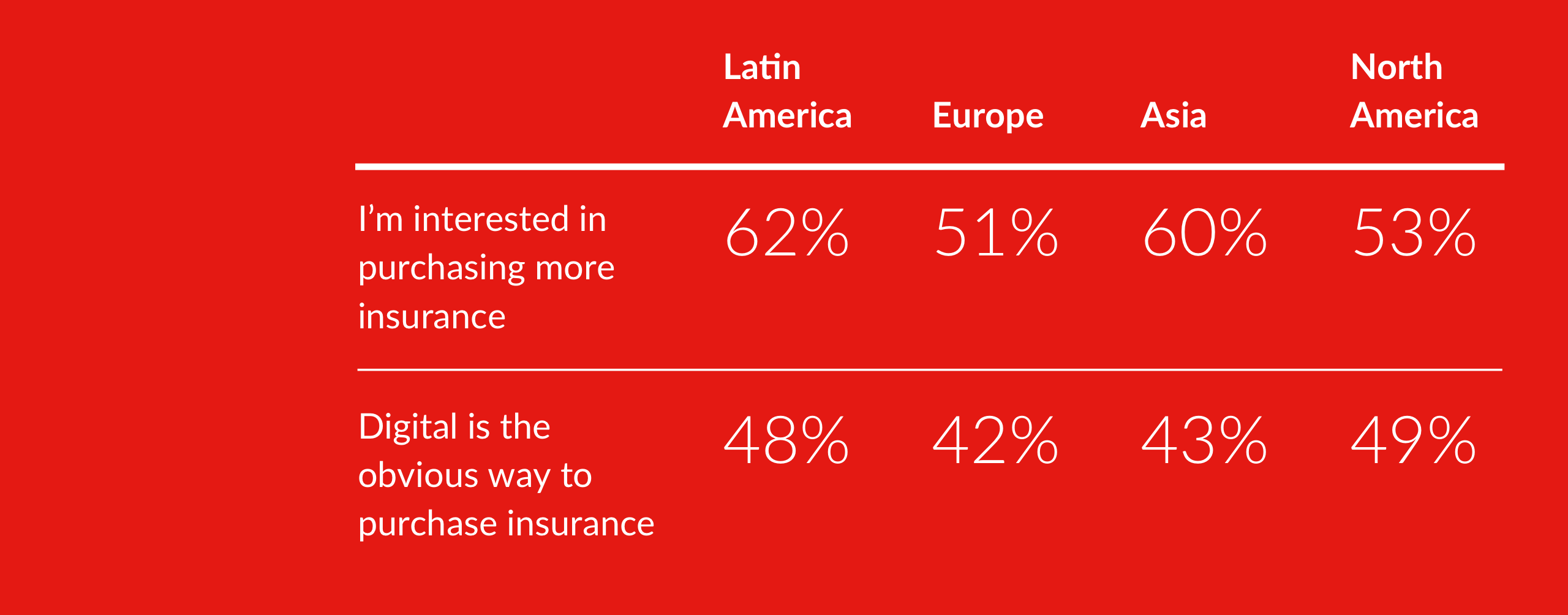

Almost half (46%) believe that digital is an obvious way to buy insurance, and more than half of all consumers (56%) believe they need more insurance. Reflecting lower levels of insurance penetration in emerging markets, the interest in purchasing more insurance is higher in Latin America and Asia than in Europe and North America.

of consumers globally believe they need more insurance.

believe that digital is the obvious way to buy insurance.

However, the differences in the levels of interest are not on par with the differences in insurance gaps among the regions.

This points to the shortage of awareness about the need for insurance in emerging markets. It also shows that even consumers in mature markets realize they need more insurance.

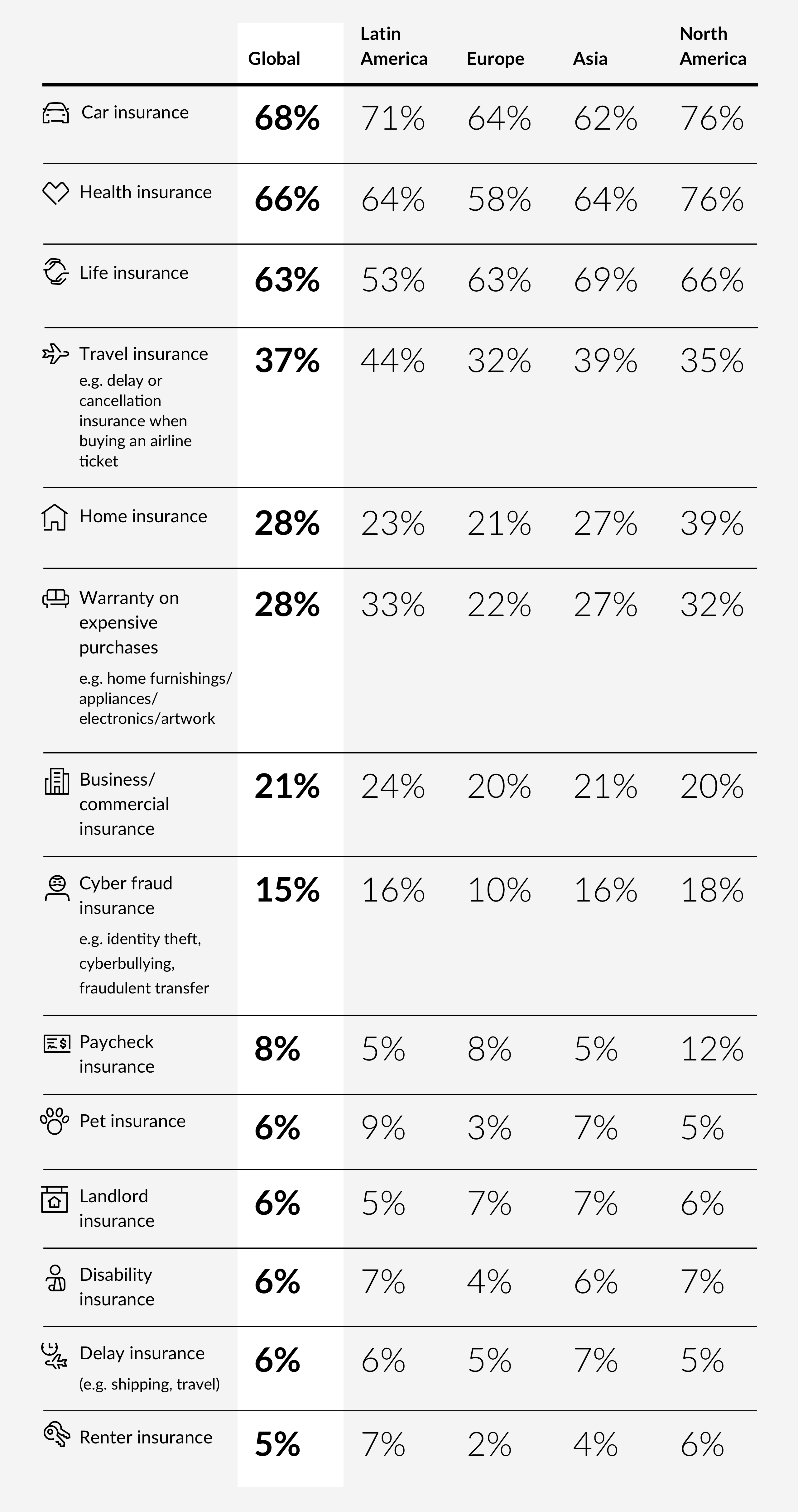

The survey finds that consumers tend to have traditional insurance coverage such as car, health, and life insurance. There is a high degree of underinsurance in areas such as paycheck protection, pet insurance, and shipping or travel delay insurance, with each of these categories seeing adoption at less than 10% at this point. These underinsurance patterns are similar across the globe.

The types of insurance that consumers globally lack often relate to modern-day risks, which come with the increase in all kinds of travel, shifting work models from full-time to freelance or nomadic, introduction of new platform-based business models for workers to look for jobs, and customers to shop, to name just a few advances in how we live and work.

Several financial organizations have taken note of the needs of a modern consumer, including SoFi, an American digital personal finance company. The company’s insurance agency has teamed up with Blink by Chubb to provide simple, easy-to-understand and affordable personal cyber insurance. Chilean fintech Tenpo provides coverage for theft of personal belongings from a vehicle.

Getting It Right

SoFi is a digital personal finance company that helps people achieve financial independence to realize their ambitions.

SoFi provides its over six million members with fast access to tools to get their money right, including products for borrowing, saving, spending, investing, and protecting. SoFi also provides its members with the key essentials for getting ahead, including career advisors and connection to a thriving community of ambitious people.

SoFi and Blink by Chubb have shared ambitions to provide simple, easy-to-understand and affordable personal cyber insurance to safeguard consumers in a world that is increasingly connected through digital means.

Blink Cyber

Whether you use social media accounts daily or own smart home devices to control your personal climate, our expanding digital world provides increased access points for bad actors to seize control, and Blink Cyber is an easy way to provide the right coverage at the right time.

Here is how Blink by Chubb personal cyber insurance helps protect you: For about $5.00/month, an in-app solution, Blink Cyber provides up to $10,000 in protection for covered cyber events. Increased coverage limits can be purchased for extended protection for up to five additional households to protect consumers' shared digital worlds.

Coverage

Blink Cyber is a stand-alone insurance policy that addresses the needs of customers facing the increasingly growing risk of cyber-attacks. The policy responds to expenses related to a personal cyber event, including cyber bullying, phishing scams, ransomware extortion, and cyber financial fraud.*

Chilean Fintech Employs AI to Embed Insurance Offerings

Focused on promoting digital and financial inclusion, Tenpo seeks to provide tailor-made insurance products through an intuitive, user-friendly experience, in which premium quotes, bill payments, and account management are transacted digitally.

Tenpo, a fintech based in Chile, was launched in 2020 within the portfolio of Krealo, the corporate venture capital of Peruvian Grupo Credicorp, Tenpo has more than two million customers, offering bank accounts, prepaid cards, money transfer services, and bill payments. The company’s app offers a digital account and a Mastercard prepaid card, as well as AI-based personal finance management, investments, and international transfers.

The challenge

Tenpo collaborates with Chubb to disrupt the region’s developing insurance industry, providing a new channel to reach consumers who lack adequate coverage. Many customers across the region already have access to mobile and digital technologies, and Tenpo’s goal is to make insurance easily attainable through these channels.

How Chubb helped

Chubb teamed with Tenpo to create a regional alliance to co-create customized digital insurance offerings for the app’s millions of customers in Chile and future users across Latin America. The first product, launched in Chile, provides coverage for theft of personal belongings from a vehicle. The product, called “Auto Content Plus," forms a customizable platform to add complementary coverage such as Purchase Protected, Digital Wallet, and Accidental Death.

To contract the insurance, customers are required to have a balance in their Tenpo accounts to pay the first installment. The product is sold by a local broker and the coverage details are provided to the customer in the app and, once purchased, confirmed in a follow-up email.

AI-supported growth

Tenpo is also moving forward with AI-powered data analytics, which, combined with their digital-first approach to claims management will boost customer service. This will be key as Tenpo continues to expand beyond Chile into other South American markets.

Exposed and Underinsured Consumers

What insurance do you have or regularly buy?