Why is it important to include Association Liability insurance in the corporate governance framework of associations?

Corporate governance for associations, charitable and non-profit organisations often entails placing strong emphasis on auditing standards and financial management controls. However, the inclusion of insurance as part of these organisations’ corporate governance framework is seldom considered.

As at 31 December 2018, there were 2,277 registered charitable organisations in Singapore. In 2017, the charity sector received $20.5 billion in annual receipts, which include government grants, donations as well as fees and charges.1

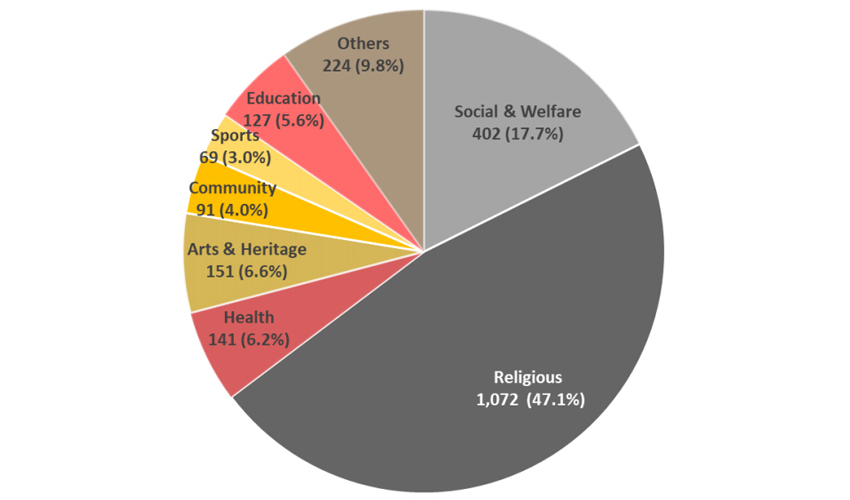

Distribution of Charities by Sector (as at 31 December 2018) 1

Under the Code of Governance of Charities and Institutions of a Public Character issued in 2017, the Charity Council advised that there should be appropriate insurance coverage for board members, staff and volunteers. Insurance however, is not mandatory.2

Nevertheless, in the course of providing services to members or to the public, organisations face a risk of exposure to civil liability leading to expensive litigation.

What are some examples of Civil Liability?

Civil Liability may arise from wrongful acts in the:

- Management of the organisation including the discharge of directorial duties and the misuse of funds;

- Breach of duty in providing professional services; or

- Employment practices liability.

The risks for associations, charitable and non-profit organisations remains relevant. Below are some scenarios* to highlight the importance of Association Liability insurance in the corporate governance framework of associations.

-

Mismanagement of funds

Charity X remunerated its management staff with an unusually generous bonus. Charity X also used donated funds for private or non-work related purposes.

- Protect against litigation for breach of trust, authority and fiduciary duties.

-

Improper use of donation

Trustee of a charitable organisation persuaded donor to contribute sizeable sum for a specific cause. However, that donation was used for general work instead. Donor sues the Trustee.

- Protect against the inappropriate use (intended or unintended) of donated funds for non-intended cause

-

Defamation

Charity A (Insured) alleged that statements made on Charity B’s website was false. Charity A’s monthly publication also insinuated that other charities in the same sector had poor corporate governance.

- Protect against defamation lawsuits against the Insured

-

Intellectual Property (IP) infringement

In a bid to raise more donations, Charity A displayed a well-known logo whose copyright belongs to Charity B. Charity B sues Charity A.

- Protect against litigation arising from unintended IP infringement

-

Employment practices liability

An employee of Charity Z was unfairly terminated without substantive justification. Employee sues Charity Z for compensation.

- Protect against lawsuits filed by employees against their employers

-

Breach of professional duty and trust

An employee of a social welfare organisation entered into a relationship with a patient he was counselling. It was alleged that the employee took advantage of the patient’s vulnerability and trust.

- Protect against alleged breach of professional duty and trust

-

Failure to supervise staff

Audit Committee failed to conduct audit checks on Treasurer’s misappropriation of fund. Treasurer engaged an unskilled volunteer to perform services that required proper qualification and expertise.

- Protect against negligence in engaging an unskilled individual

-

Discrimination against association member

Committee of a Trade Association decided to revoke a membership because that member company’s business was not doing well financially. Member sues company for discrimination.

- Protect against discrimination lawsuits

*The above scenarios are intended to serve as a guide for the possible circumstances under which an insured may be eligible for claim under the Association Liability insurance. This is not intended to be an exhaustive list. Coverage will be evaluated on a case-by-case basis and in accordance with the policy terms and conditions.

Smaller organisations are usually funded through donations, grants and membership fees, and often operate on a tight budget. What can the organisations do to ensure that funds are channelled towards its intended cause, and not to settle civil or negligence claims.

Association Liability Insurance

Association Liability insurance is a valuable tool of risk management, offering financial protection to these meaningful organisations that have been contributing tremendously to our society. Chubb’s Association Liability insurance provides protection to the organisation itself, its directors, office bearers and employees against potential civil liability they may face in the daily conduct of activities.

Sources:

1 https://www.charities.gov.sg/Publications/Documents/Commissioner%20of%20Charities%20Annual%20Report%202018.pdf

2 https://www.charities.gov.sg/manage-your-charity/Day-to-Day-Operations-of-Charity-IPC/Pages/Code%20of%20Governance%20for%20Charities%20and%20IPCs.aspx

No part of this article may be reproduced in any written, electronic, recording, or printed form without written permission of Chubb.

Disclaimer - The content of the above article is not intended to constitute professional advice. Although all content is believed to be accurate, Chubb Insurance Singapore Limited (Chubb) makes no warranty or guarantee about the accuracy, completeness, or adequacy of the content of this article. Users relying on any content do so at their own risk.

Have a question or need more information?

Leave your contact details and our representatives will get in touch with you.