Is your home underinsured?

Why it’s so easy to be underinsured in today’s housing market

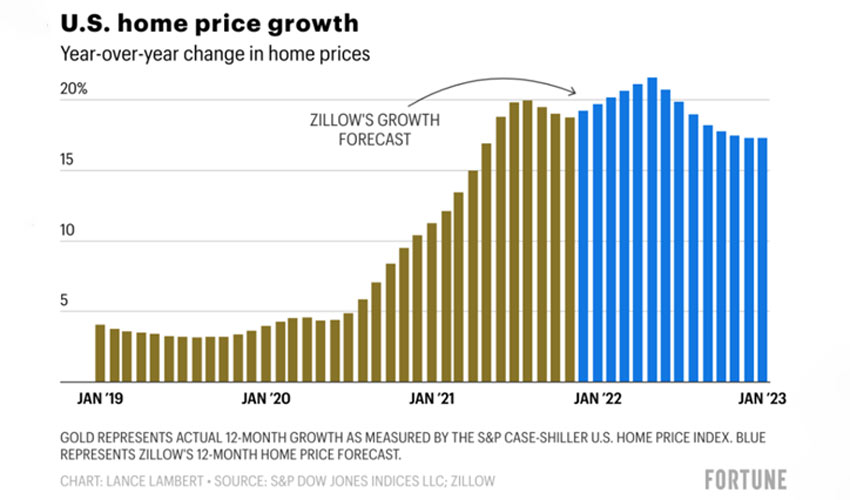

With mortgage rates continuing to rise over the past few months, you’d think that the real estate market would cool off a bit. However, the first quarter of 2022 continued the trend from 2021, with many homes selling almost instantly - often over asking price, inventory levels at all-time lows, and homes significantly appreciating in value. Add to that, the increasing cost of labor and materials for home building and renovations, and we’re looking at a perfect storm for home prices.

Source: Fortune.com

Your home’s value should be reflected in your insurance

If something happens to your home, you’ll want to know that you have insurance to cover the cost to replace it. If you don’t have enough insurance to pay for your home to be repaired or rebuild in the event of a covered loss, you are underinsured. And, with the rising cost of homes, many homeowners are realizing too late that they are underinsured and may have to pay a significant amount out of pocket to replace the home they lost.

Let’s say, for example, that your home is insured for $700,000, and is destroyed by a fire. With the rising cost of homes, it might now cost $850,000 to buy a new one just like the one you had before. When your policy limits the claims payment to $700,000, you’ll likely have to foot the additional bill of $150,000 to purchase a comparable home, or settle for a home with fewer amenities or in a less attractive neighborhood. This highlights the importance of ensuring that your insurance policy is periodically updated to reflect appropriate values.

Other factors that affect the amount of insurance you should have

It’s not only the rising cost of homes themselves that should lead you to increase the amount of insurance you carry. These days, the cost of construction materials, skilled labor, engineering, and appliances — really everything you’d need to build a new home or repair an existing one —is also rising substantially. In addition, building codes are becoming stricter, causing homeowners to add better insulation, more efficient windows, wind resistant siding and energy efficient systems, and all this comes with a higher cost.

Figuring out how much insurance you really need

To make sure your home is adequately insured, notify your agent if you have made any updates or renovations to your home since it was last inspected by your insurance carrier. Then, discuss that information with your insurance agent to potentially increase the limits on your insurance so that you are appropriately covered if something were to happen to your home.

This document is advisory in nature and is offered as a resource to be used together with your professional insurance advisors in maintaining a loss prevention program. It is an overview only, and is not intended as a substitute for consultation with your insurance broker, or for legal, engineering or other professional advice.

Chubb is the marketing name used to refer to subsidiaries of Chubb Limited providing insurance and related services. For a list of these subsidiaries, please visit our website at www.chubb.com. Insurance provided by ACE American Insurance Company and its U.S. based Chubb underwriting company affiliates. All products may not be available in all states. This communication contains product summaries only. Coverage is subject to the language of the policies as actually issued. Surplus lines insurance sold only through licensed surplus lines producers. Chubb, 202 Hall's Mill Road, Whitehouse Station, NJ 08889-1600.

Find an Agent

Speak to an independent agent about your insurance needs.