Quick guide on liberalisation of motor insurance

Before 1 July 2017, motor insurance premium is fixed and controlled by Bank Negara Malaysia.

Hence, the motor insurance offered by all the insurance and takaful operators are similar.

The premium is calculated based on:

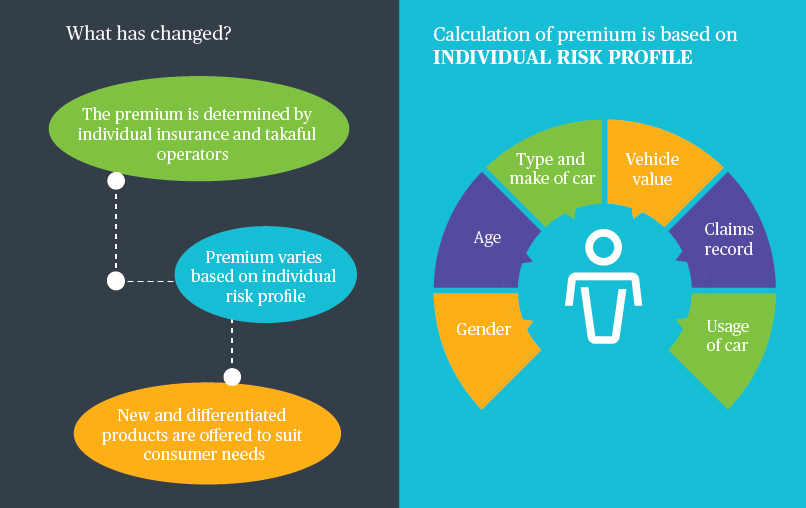

Effective 1 July 2017, the tariff rates for comprehensive and third party fire & theft coverage are liberalised.

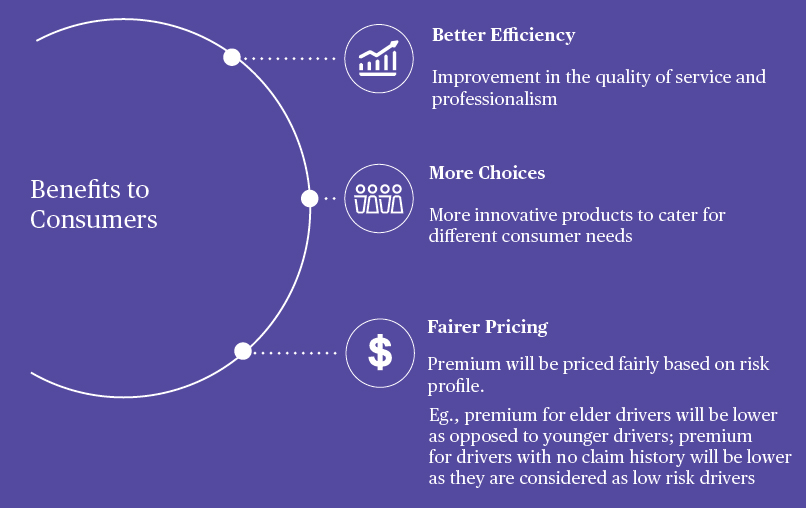

What are the benefits?

What should consumers do to enjoy lower insurance premium?

This content is brought to you by Chubb Insurance Malaysia Berhad, Registration No. 197001000564 (9827-A) (“Chubb”) as a convenience to readers and is not intended to constitute advice or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/my, through your broker or by contacting any of the Chubb offices or Chubb agents. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of this content. It is the responsibility of the reader to evaluate the quality and accuracy of material herein.

© 2022 Chubb. Not all coverages available in all jurisdictions. Chubb® and its respective logos, and Chubb. Insured.SM are protected trademarks of Chubb.

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks