A safety net for the workforce

In a buoyant economy, employee turnover is usually high as jobs are more easily available. Depending on the country, the cost of replacing a mid-level executive is about 20% of their annual salary while replacing a senior level executive can range from 213% to 400% of annual salary*.

Investing in policies that support employee retention has become essential as companies recognize the high cost of rehiring and training. Policies such as paid sick leave, childcare leave, health and personal accident insurance also demonstrate an employer’s commitment to their Duty of Care obligations and the general well-being of their employees. Let’s see how a simple Group Personal Accident insurance plan provides a strong safety net for employees and employers in the following scenarios. Cover was utilized under their Group insurance coverage provided by Chubb.

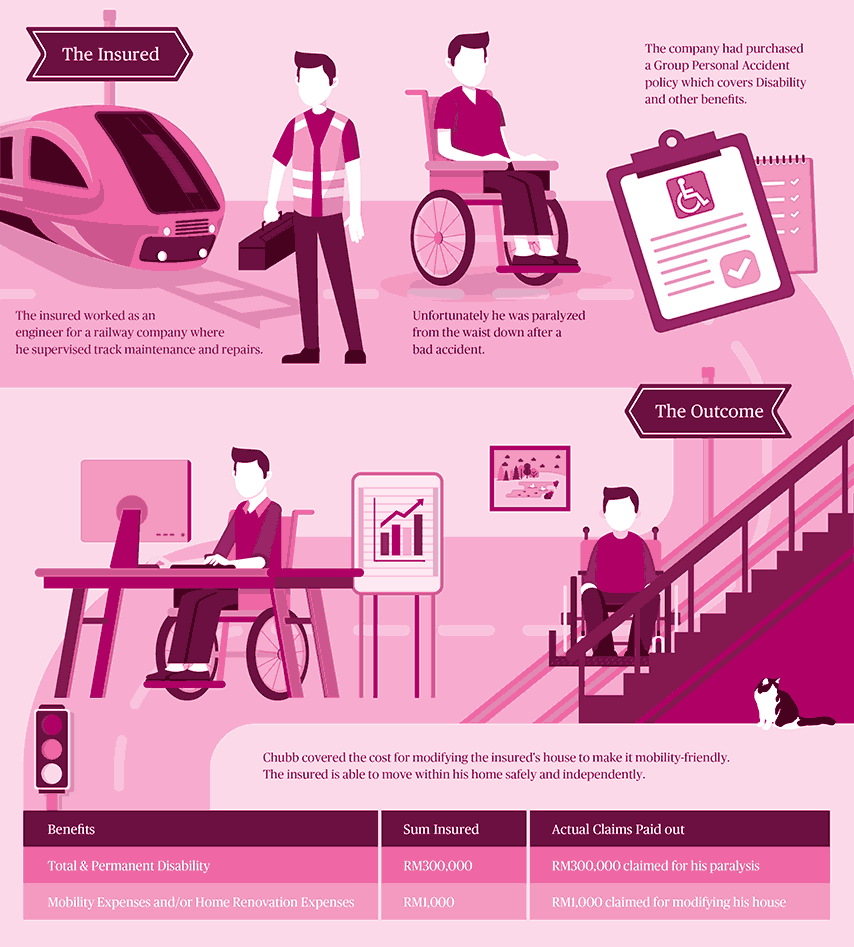

Scenario 1

The insured received a lump sum payment when he was paralyzed from the waist as his company’s Group Personal Accident Policy covers Total & Permanent Disability. In addition, he was also able to claim for his home modification.

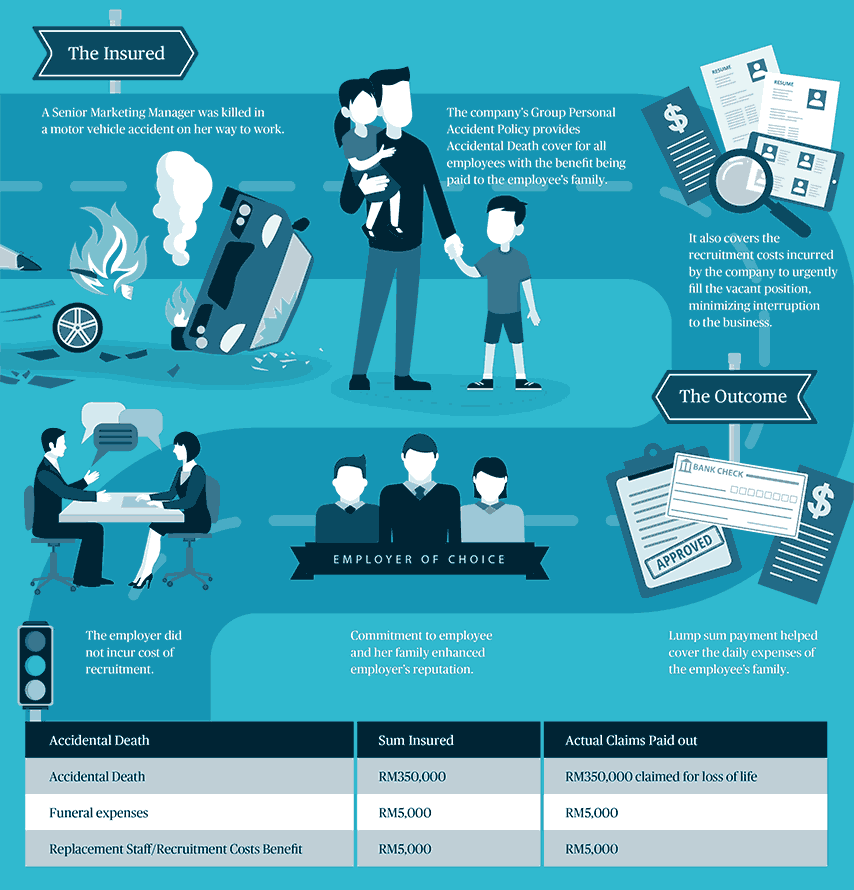

Scenario 2

In this unfortunate case, the insured died from a road accident but his family received a lump sum payment from her company’s Group Personal Accident Policy.

*Source: https://www.quill.com/blog/careers-advice/turning-the-tables-the-cost-of-employee-turnover.html?cm_mmc=NEW_Infographic

Disclaimer: The scenarios and all details therein are for illustration purposes only

This content is brought to you by Chubb Insurance Malaysia Berhad, Registration No. 197001000564 (9827-A) (“Chubb”) as a convenience to readers and is not intended to constitute advice or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/my, through your broker or by contacting any of the Chubb offices or Chubb agents. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of this content. It is the responsibility of the reader to evaluate the quality and accuracy of material herein.

© 2023 Chubb. Not all coverages available in all jurisdictions. Chubb® and its respective logos, and Chubb. Insured.SM are protected trademarks of Chubb.

Have a question or need more information?

Contact us to find out how we can help you get covered against potential risks